Americans Are Using This Strategy To Save Money on Home Insurance. Is It a Good Idea?

With the average home-insurance premium hitting a record high of $2,290, homeowners are looking for ways to cut costs.

Getty Images

Homeowners frustrated with rising home-insurance premiums are switching plans and opting for higher deductibles to manage their costs, a new report says, but these might not be the best strategies for everyone.

Homeowners who took on a mortgage last year had deductibles that were 19% higher than those of the average mortgage holder, and ended up with premiums 12% lower, according to data from Intercontinental Exchange.

Meanwhile, about 11.4% of homeowners with a mortgage switched insurance providers in 2024, ICE found, up from 9.4% the previous year.

While homeowners are finding ways to make their monthly housing costs cheaper, is it a good idea to change plans or pay a higher deductible? Here’s what experts and data say.

Why homeowners-insurance premiums are so high

Homeowners in many parts of the U.S. are dealing with sharp increases in property-insurance premiums.

As natural disasters such as hurricanes and wildfires more frequently damage or destroy properties, insurance companies are paying out more claims—and they’re passing on their higher losses to homeowners in the form of higher premiums.

Between 2018 and 2022, the average homeowners-insurance premium per policy rose 8.7% faster than the rate of inflation, according to a Treasury Department report released in January. The government looked at more than 33,000 ZIP codes and 45 million insurance policies each year nationwide.

Some consumers in the top 20% of ZIP codes facing the highest risk of losses from natural disasters saw premiums per policy increase nearly 15% faster than the rate of inflation, the report said. Those homeowners paid an average inflation-adjusted premium per policy of $2,321 over the four-year span.

Premiums have remained elevated: In 2024, the average homeowners-insurance premium for single-family homes was a record high of $2,290, according to the Intercontinental Exchange report. That figure was up 14% from a year earlier, and the largest yearly increase on record since ICE began tracking the data in 2013.

Property-insurance costs are the fastest-growing component within a homeowner’s overall housing costs, the company said, which also include principal and interest payments on the mortgage as well as property taxes. Interest payments rose 8% over the past year and property taxes rose 5%, while property-insurance costs rose 14% over that period.

Homeowners in states where natural disasters are more prevalent, such as Florida, have dealt with significantly higher insurance costs over the years.

Homeowners in Miami bore the highest average insurance premium for single-family homes with a mortgage in 2024, at $6,200 per year. New Orleans homeowners were next on the list, paying $5,700 a year on average in insurance premiums, ICE said.

Switching homeowners-insurance carriers

To reduce the high cost of insurance, homeowners have used two strategies. The first is to switch carriers.

Some homeowners may have switched insurance companies because they had been dropped by their provider, but others did so to lower their costs, ICE said.

Homeowners in Miami were the most likely to switch insurance providers in 2024. Nearly a quarter of Miami homeowners with an outstanding mortgage switched providers, the highest share in the nation, followed by 23% of homeowners in New Orleans and Orlando, Fla.

And the effort paid off for some: For instance, the average borrower switching policies in cities like Jacksonville, Fla.; Dallas and San Antonio, Texas; and Denver, Colo., paid “at least 10% less” on average than borrowers who stuck with their carrier, ICE said.

To be sure, the seemingly straightforward strategy doesn’t work for everyone.

Homeowners who switched policies in Miami actually paid 2% more on average with their new plans, and in multiple cities in California—including San Diego, San Jose and Los Angeles—borrowers paid at least 15% more on average when switching, compared with those who stayed put.

The jump in premiums in California is partly explained by borrowers being forced to switch carriers as some insurance companies pulled back on writing or even renewing policies in that state.

Paying a higher deductible for homeowners insurance

The second strategy some homeowners are choosing is to take on a higher deductible to reduce their insurance costs.

On average, homeowners increased their deductible by 19%, or $390, in 2024 from the previous year, according to ICE. Homeowners can negotiate the price of insurance by adjusting how much coverage they need and choosing a higher or lower deductible, the company said.

A home-insurance deductible refers to the amount of money that a homeowner pays before the insurance company steps in and pays for a claim. Typically, higher deductibles result in lower premiums.

Unlike with health-insurance deductibles, which apply to all medical expenses, there is no maximum amount that a homeowners-insurance policy holder will pay out of pocket in one year. The deductible that a homeowner will pay depends on the amount of each claim.

In other words, if a roof caves in, a homeowners-insurance company will only pay the repair costs after subtracting the deductible. The homeowner usually pays the deductible amount to the contractor, and once it hits a certain limit, the insurance company steps in.

If the home later floods, the same process is repeated. The homeowner pays the contractor the deductible, and the insurance company covers the rest of the amount.

If the cost to repair the damage is within the homeowner’s deductible, they are responsible for the entire sum, which can be a big expense for some people. If an owner sets their deductible at $300, and the repairs only cost that much, the insurance company won’t pay anything.

There are two types of deductibles: standard and percentage. The standard deductible amount is a fixed amount, usually between $500 and $2,000, according to Rocket Mortgage.

A percentage deductible, which refers to wind-, hail- or hurricane-related claims, is a share of the home’s insured value, Rocket said. If a home is insured for $500,000 and the deductible is 1%, the homeowner would pay $5,000 out of pocket. So if a claim is for $10,000, the insurance company would only cover $5,000.

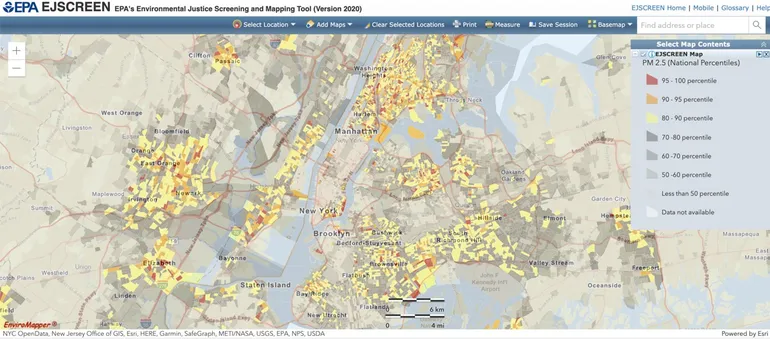

Among homeowners with new mortgages in 2024, there was a surge in the share of those opting to take percentage deductibles, as seen in the chart below from ICE.

Why it’s risky to opt for a higher home-insurance deductible

Opting for a higher-deductible plan may be a smart strategy for some savvy homeowners, but proceed with caution, experts advised.

More homeowners are increasing their standard deductibles, and, on the Atlantic and Gulf coasts, their wind- or hail-damage deductibles, Mark Friedlander, director of corporate communications at the Insurance Information Institute, an industry trade group, told MarketWatch.

But the key risk involved in a higher-deductible plan is that a homeowner has to pay much more out of pocket if disaster strikes, he said. During the hurricane season in 2024, many Florida homeowners struggled with high windstorm deductibles when filing claims for losses caused by the storm, Friedlander said.

As the Florida local news outlet WPTV reported in October, one 71-year-old homeowner whose house was damaged by a tornado was asked to pay a $14,000 hurricane deductible before her insurance would kick in. The homeowner had a 5% deductible, meaning that the homeowner had to pay $14,000 out of pocket for the home’s insured value of roughly $280,000.

Therefore, even though a homeowner saves hundreds of dollars on their homeowners insurance, a surprise bill could cost far more. And that could bite many people: The median savings-account balance held by people in the U.S. was $8,000 in 2022, according to the Federal Reserve’s most recent Survey of Consumer Finances.

Matthew Chancey, a certified financial planner and the founder of Tax Alpha Companies, suggested homeowners try other measures to reduce their premiums before opting for high deductibles.

For instance, some people with older homes could benefit from upgrading them to be more up to date with current building standards. By making some home improvements, such as reinforcing older parts of the property and strengthening the structure, a homeowner can potentially reduce their home-insurance premium, he said.

To be sure, a renovation can be a costly undertaking, especially if the effort doesn’t result in a lower premium. So “call around and find carriers that tell you in advance that these projects would qualify for discounts with their company,” Chancey said.

Insurance companies also offer discounts if a homeowner chooses to take out their home, auto and life-insurance policies with them, he added.

Finally, some homeowners may get a better rate if they improve their credit score, Chancey said. “Many insurance companies check your credit before offering you a policy. If you can improve your credit score … it might just save you on your homeowners insurance.”