Who is Hunkemöller's new owner, Redwood Capital Management?

The new store concept in the pilot store. Credits: Hunkemöller After three years, Dutch lingerie retailer Hunkemöller is changing hands once again. Investment firm Redwood Capital Management is taking over ownership from Parcom and Opportunity Partners at a time when Hunkemöller is in the midst of a transformation program. Who is Redwood Capital Management, Hunkemöller's new owner? Redwood Capital Management, LLC, was founded in 2000 by Jonathan Kolatch. The US-based firm is currently led by Chief Executive Officer and Chief Investment Officer Ruben Klikberg, who joined Redwood Capital Management in 2005 as an analyst and worked his way up to CEO and CIO. Redwood Capital Management describes itself as "an alternative investment firm." The firm manages approximately ten billion dollars in assets and invests across various sectors and geographies through diverse strategies and funds. The investment firm has experience with consumer brands and supports them through strategic investments and operational improvements. Redwood Capital Management often seeks investment opportunities in companies experiencing market dislocations, company-specific challenges, or complex situations that have the potential to generate significant returns. The investment firm focuses on distressed debt – referring to debt of companies facing financial difficulties and a high risk of default. These companies are therefore sold for a much lower price than originally agreed upon, as there is a risk that the company will not repay the full amount. Redwood Capital Management: This is Hunkemöller's new owner Hunkemöller is currently undergoing a transition, making the lingerie retailer an attractive prospect for the American investment firm. In the press release announcing the acquisition, Redwood Capital Management states its commitment to Hunkemöller's long-term growth. The firm will work with the management team to invest in the Dutch brand's strategic vision. This includes strengthening its brand positioning as a top priority, encompassing improvements to its omnichannel strategy, optimizing the brick-and-mortar retail experience, expanding into new markets, and bolstering its wholesale operations. Redwood Capital Management likely acquired Hunkemöller at a reduced price with the aim of restructuring the company and subsequently exiting their investment profitably. Prior to acquiring full ownership, Redwood Capital Management was involved in an uptiering transaction with Hunkemöller in June 2024, according to PitchBook. This transaction involved providing new financing in exchange for a higher position in the company's debt structure. This is often done in anticipation of a larger investment or acquisition. In addition to Hunkemöller, the US investment firm has also owned the workwear division of VF Corporation, including the brands Red Kap, Bulwark, Workrite, and Walls, since April 2021, according to a press release from that time. VF Corporation divested its workwear division to focus on consumer and retail-oriented brands. Redwood Capital Management leveraged its expertise to guide the brands into their next phase of growth. This article was translated to English using an AI tool. FashionUnited uses AI language tools to speed up translating (news) articles and proofread the translations to improve the end result. This saves our human journalists time they can spend doing research and writing original articles. Articles translated with the help of AI are checked and edited by a human desk editor prior to going online. If you have questions or comments about this process email us at info@fashionunited.com

After three years, Dutch lingerie retailer Hunkemöller is changing hands once again. Investment firm Redwood Capital Management is taking over ownership from Parcom and Opportunity Partners at a time when Hunkemöller is in the midst of a transformation program. Who is Redwood Capital Management, Hunkemöller's new owner?

Redwood Capital Management, LLC, was founded in 2000 by Jonathan Kolatch. The US-based firm is currently led by Chief Executive Officer and Chief Investment Officer Ruben Klikberg, who joined Redwood Capital Management in 2005 as an analyst and worked his way up to CEO and CIO. Redwood Capital Management describes itself as "an alternative investment firm." The firm manages approximately ten billion dollars in assets and invests across various sectors and geographies through diverse strategies and funds. The investment firm has experience with consumer brands and supports them through strategic investments and operational improvements.

Redwood Capital Management often seeks investment opportunities in companies experiencing market dislocations, company-specific challenges, or complex situations that have the potential to generate significant returns. The investment firm focuses on distressed debt – referring to debt of companies facing financial difficulties and a high risk of default. These companies are therefore sold for a much lower price than originally agreed upon, as there is a risk that the company will not repay the full amount.

Redwood Capital Management: This is Hunkemöller's new owner

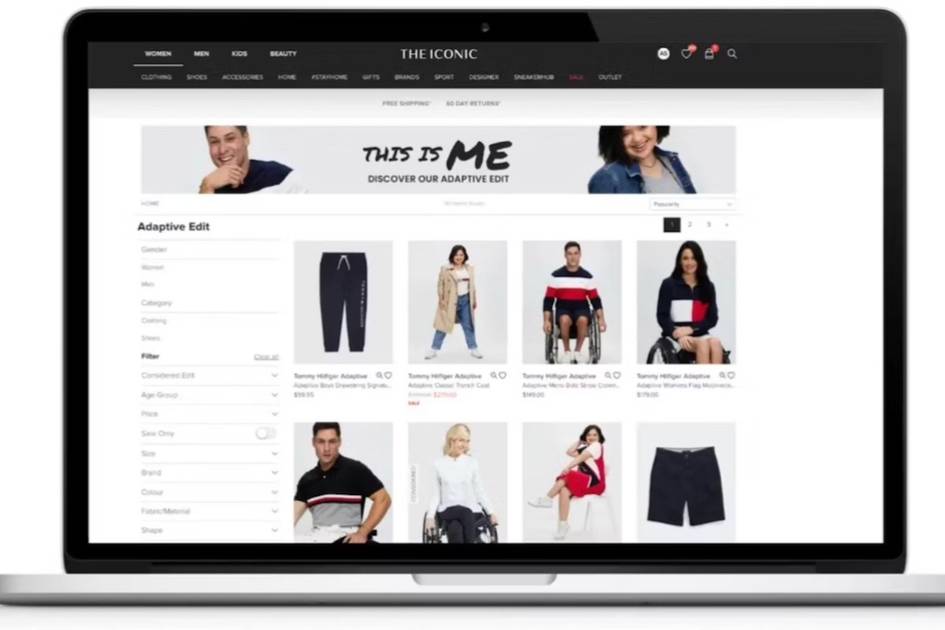

Hunkemöller is currently undergoing a transition, making the lingerie retailer an attractive prospect for the American investment firm. In the press release announcing the acquisition, Redwood Capital Management states its commitment to Hunkemöller's long-term growth. The firm will work with the management team to invest in the Dutch brand's strategic vision. This includes strengthening its brand positioning as a top priority, encompassing improvements to its omnichannel strategy, optimizing the brick-and-mortar retail experience, expanding into new markets, and bolstering its wholesale operations. Redwood Capital Management likely acquired Hunkemöller at a reduced price with the aim of restructuring the company and subsequently exiting their investment profitably.

Prior to acquiring full ownership, Redwood Capital Management was involved in an uptiering transaction with Hunkemöller in June 2024, according to PitchBook. This transaction involved providing new financing in exchange for a higher position in the company's debt structure. This is often done in anticipation of a larger investment or acquisition.

In addition to Hunkemöller, the US investment firm has also owned the workwear division of VF Corporation, including the brands Red Kap, Bulwark, Workrite, and Walls, since April 2021, according to a press release from that time. VF Corporation divested its workwear division to focus on consumer and retail-oriented brands. Redwood Capital Management leveraged its expertise to guide the brands into their next phase of growth.

FashionUnited uses AI language tools to speed up translating (news) articles and proofread the translations to improve the end result. This saves our human journalists time they can spend doing research and writing original articles. Articles translated with the help of AI are checked and edited by a human desk editor prior to going online. If you have questions or comments about this process email us at info@fashionunited.com

This article was translated to English using an AI tool.