China turns inward as U.S. tariffs upend export-driven retail models

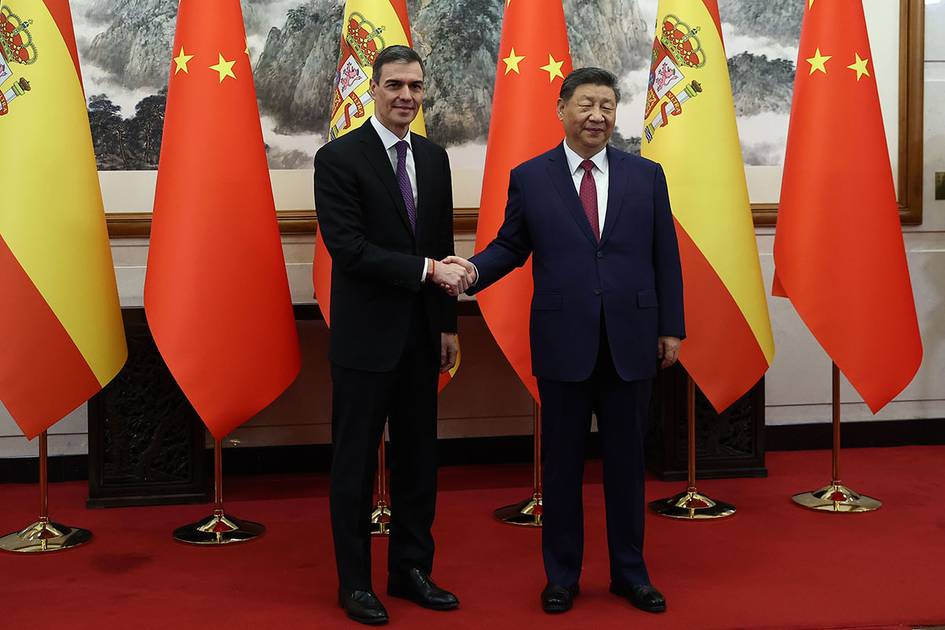

The President of the Government of Spain, Pedro Sánchez, and the President of the People's Republic of China, Xi Jinping, on April 11, 2025, in Beijing (China). Credits: Pool Moncloa, Fernando Calvo. As escalating U.S. tariffs reshape the global trade landscape, Beijing is pivoting towards domestic consumption to shore up its export-reliant industries. The move, which carries significant implications for the international fashion supply chain, signals a critical rebalancing of China’s manufacturing-led growth model. In a joint statement issued this week, the China General Chamber of Commerce and seven affiliated trade associations warned that Washington’s latest tariff hikes have created “an urgent priority to expand the domestic market, promote integration between domestic and foreign trade, and facilitate the transition of export goods for local consumption,” Bloomberg said. The announcement follows the Biden administration’s continuation of former President Trump’s protectionist measures—most notably, the reimposition of steep tariffs on Chinese-made goods and the removal of the longstanding 800 dollars duty-free import threshold for e-commerce purchases. For Chinese ultra-fast fashion players like Shein and Temu, this double blow is forcing a strategic recalibration. Both platforms have confirmed plans to raise prices for U.S. consumers in response to the new 145 percent tariffs, according to the Associated Press. In parallel, major Chinese e-commerce platforms including JD.com, Alibaba Group, and Tencent Holdings are launching initiatives to redirect exporters towards the domestic market. Bloomberg reports that JD.com, for example, has pledged to purchase at least 200 billion yuan (27.4 billion dollars) worth of goods from Chinese exporters over the next year to support their transition into local retail channels. The effort underscores a broader government-backed campaign to reduce the country’s dependence on volatile overseas markets. For global fashion professionals, the shift suggests that supply dynamics may begin to evolve—not only in terms of pricing and availability but also in how Chinese fashion suppliers position themselves. In the short term, these measures may provide temporary relief for China’s export-heavy manufacturing sector. In the longer term, they could catalyse a more profound transformation, turning China’s vast consumer base into a primary growth engine for local producers. For international brands sourcing from China, the implications are twofold: expect continued price pressures on exports and watch closely as domestic competition within China intensifies. As the world’s second-largest economy rewires its trade priorities, the ripple effects are likely to reshape sourcing strategies, price models, and competitive dynamics across the fashion industry.

As escalating U.S. tariffs reshape the global trade landscape, Beijing is pivoting towards domestic consumption to shore up its export-reliant industries. The move, which carries significant implications for the international fashion supply chain, signals a critical rebalancing of China’s manufacturing-led growth model.

In a joint statement issued this week, the China General Chamber of Commerce and seven affiliated trade associations warned that Washington’s latest tariff hikes have created “an urgent priority to expand the domestic market, promote integration between domestic and foreign trade, and facilitate the transition of export goods for local consumption,” Bloomberg said.

The announcement follows the Biden administration’s continuation of former President Trump’s protectionist measures—most notably, the reimposition of steep tariffs on Chinese-made goods and the removal of the longstanding 800 dollars duty-free import threshold for e-commerce purchases. For Chinese ultra-fast fashion players like Shein and Temu, this double blow is forcing a strategic recalibration. Both platforms have confirmed plans to raise prices for U.S. consumers in response to the new 145 percent tariffs, according to the Associated Press.

In parallel, major Chinese e-commerce platforms including JD.com, Alibaba Group, and Tencent Holdings are launching initiatives to redirect exporters towards the domestic market. Bloomberg reports that JD.com, for example, has pledged to purchase at least 200 billion yuan (27.4 billion dollars) worth of goods from Chinese exporters over the next year to support their transition into local retail channels.

The effort underscores a broader government-backed campaign to reduce the country’s dependence on volatile overseas markets. For global fashion professionals, the shift suggests that supply dynamics may begin to evolve—not only in terms of pricing and availability but also in how Chinese fashion suppliers position themselves.

In the short term, these measures may provide temporary relief for China’s export-heavy manufacturing sector. In the longer term, they could catalyse a more profound transformation, turning China’s vast consumer base into a primary growth engine for local producers.

For international brands sourcing from China, the implications are twofold: expect continued price pressures on exports and watch closely as domestic competition within China intensifies. As the world’s second-largest economy rewires its trade priorities, the ripple effects are likely to reshape sourcing strategies, price models, and competitive dynamics across the fashion industry.

.jpg)

.jpg)

.jpg)