SEC Staff Reinstates Traditional Approach to Interpreting the Shareholder Proposal Rule

On February 12, 2025, the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) published Staff Legal Bulletin No. 14M (“SLB 14M”), which sets forth Staff guidance on shareholder proposals submitted to publicly traded companies under Exchange Act Rule 14a-8. SLB 14M rescinds Staff Legal Bulletin No. 14L (“SLB 14L”) (which was issued in […]

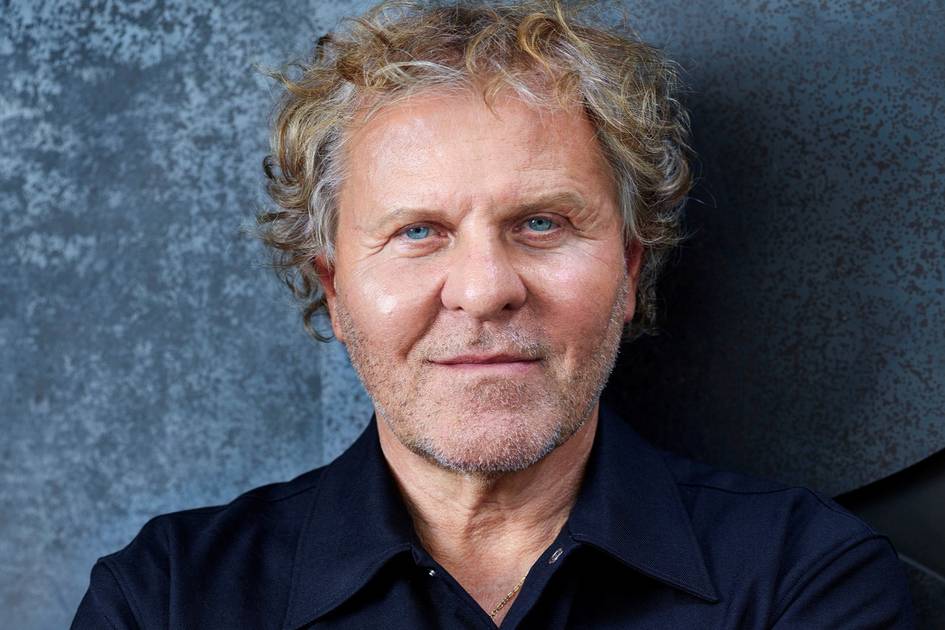

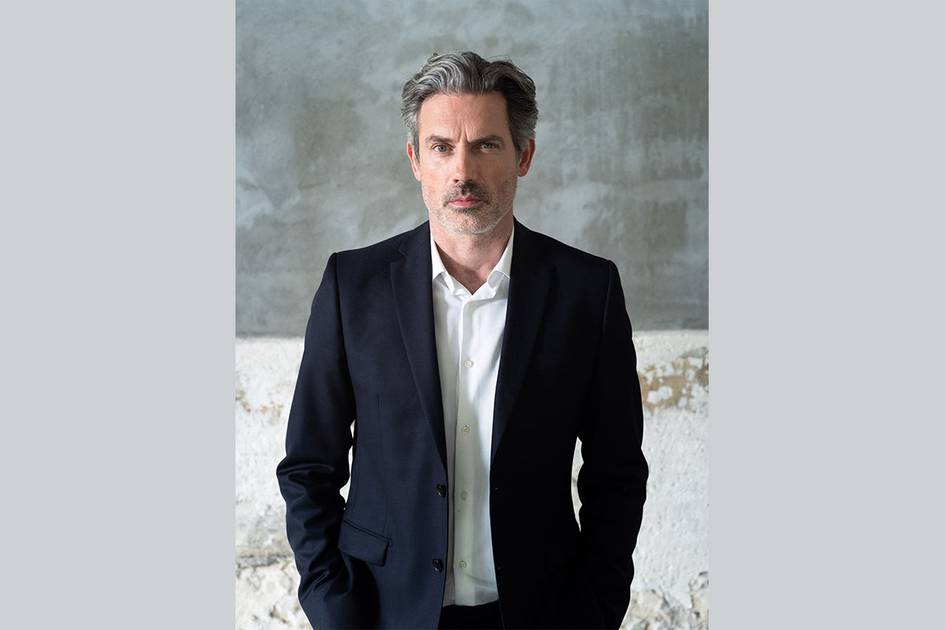

Ronald O. Mueller, Elizabeth A. Ising, and Thomas J. Kim are Partners at Gibson, Dunn & Crutcher LLP. This post is based on a Gibson Dunn memorandum by Mr. Mueller, Ms. Ising, Mr. KIm, Lori Zyskowski, Julia Lapitskaya, and Geoffrey Walter.

On February 12, 2025, the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) published Staff Legal Bulletin No. 14M (“SLB 14M”), which sets forth Staff guidance on shareholder proposals submitted to publicly traded companies under Exchange Act Rule 14a-8. SLB 14M rescinds Staff Legal Bulletin No. 14L (“SLB 14L”) (which was issued in November 2021) and addresses a number of interpretive issues in a manner that draws heavily from prior statements by the Commission interpreting Rule 14a-8.

SLB 14L was widely viewed as creating an “open season” for shareholder proposals.[1] During the 2022 proxy season following the issuance of SLB 14L, the number of shareholder proposals submitted to companies surged, with those addressing environmental topics up over 50% and proposals addressing social policy issues increasing by 20%. At the same time, the overall success rate for no-action requests plummeted to an all-time low of 38%, a drastic decline from success rates of 71% in 2021 and 70% in 2020. As a result, many institutional shareholders, who typically do not submit Rule 14a-8 proposals but must devote time and resources to review and vote on shareholder proposals submitted by others to companies in which they have invested, have commented that the quality and utility of shareholder proposals have declined.

SLB 14M heralds a return to a more traditional administration of the shareholder proposal rule, particularly as it relates to interpreting the “ordinary business” exception under Rule 14a-8(i)(7), reinvigorates the economic relevance exclusion under Rule 14a-8(i)(5), and reinstates in part interpretive positions discussed in Staff Legal Bulletins issued by the Staff during the tenure of Commission Chair Jay Clayton. SLB 14M states that companies may supplement previously filed no-action requests to exclude shareholder proposals, or submit new no-action requests, based on the standards set forth in SLB 14M, and that the Staff will apply the standards outlined in SLB 14M when responding to pending or subsequently filed no-action requests.