Q1 forecast: Truckload rates likely to rise but not skyrocket

Recent data released by RXO shows continued signs of rate inflation as 2025 gets underway, with spot rates rising and capacity continuing to exit the market. The post Q1 forecast: Truckload rates likely to rise but not skyrocket appeared first on FreightWaves.

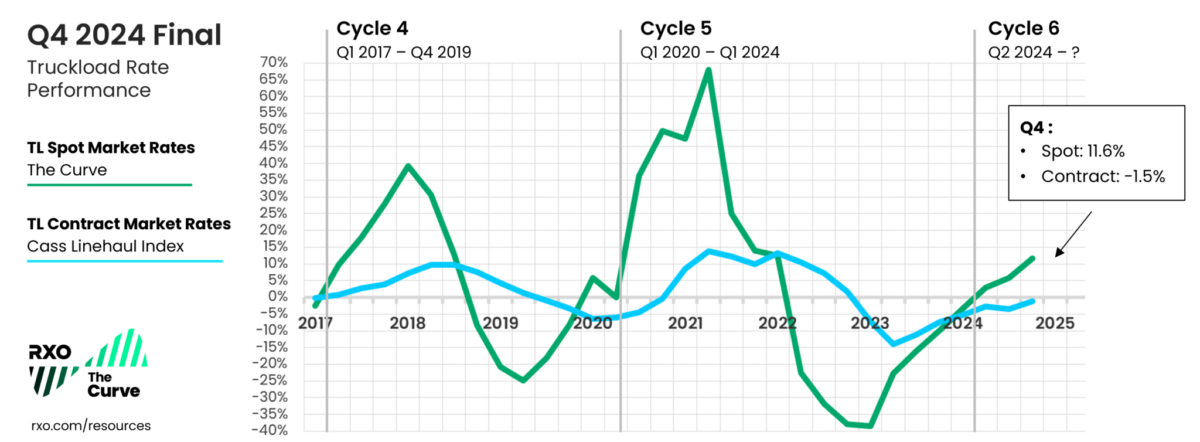

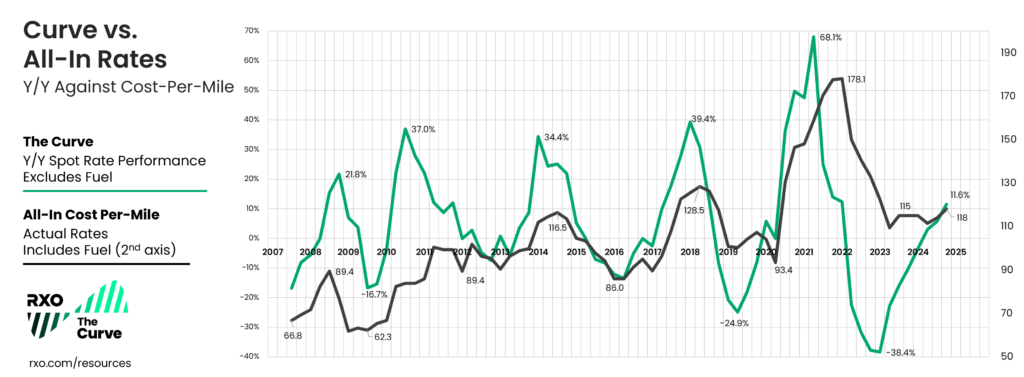

On Monday, RXO recently released its Q1 2025 Truckload Market Forecast, with its Curve Index showing a continuation of rate inflation first observed in Q4 2024. The Curve, formerly the Coyote Curve, is a proprietary index measuring year-over-year changes in truckload linehaul spot rates (excluding fuel). It has climbed steadily higher for seven consecutive quarters. After purchasing Coyote Logistics in September 2024, RXO acquired the data and combined it into a larger dataset.

“The Curve has been a leading index for years — now, as a combined organization, it’s going to become even more robust,” said Jared Weisfeld, chief strategy officer at RXO. “As the third-largest freight brokerage in North America, we have an immense set of data spanning industries, geographies and business sizes.”

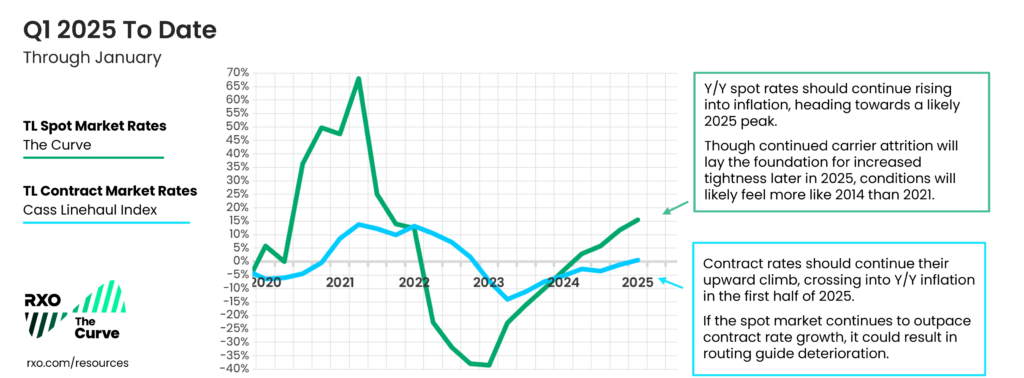

The forecast highlighted how rising spot rates and capacity exiting the market are driving the upswing, though the authors caution that the extreme conditions experienced in the last inflationary market in 2020 and 2021 are not anticipated. While shippers may not feel dramatic changes yet, RXO warns that conditions are shifting in ways that could lead to tightening later this year.

Q4 2024 recap: Rates trending upward

The Q4 2024 Curve Index showed spot rates up 11.6% year over year, a jump from the 5.8% increase seen in Q3. This rise was driven by continued carrier exits, impacts from hurricanes Helene and Milton, and typical holiday shipping seasonality.

Contract rates, while still showing a slight year-over-year decline of 1.5% in Q4, moderated from the 3.4% y/y drop seen in Q3. This aligns with typical market behavior, as contract rates tend to lag spot rates by two to three quarters.

“Over the holidays, we saw market rate and coverage KPIs reach levels we haven’t hit since Christmas 2022. While we have seen some of those gains moderate through the first quarter to date, the baseline has reset higher,” said Corey Klujsza, vice president of pricing and procurement at RXO. “Though the rest of 2025 may not look like the peak in the COVID-era truckload market, we’re seeing continued signs that we’re past the bottom of the cycle.”

Macroeconomic factors at play

The broader U.S. economy remains relatively healthy, with low unemployment and several key indicators moving higher. However, uncertainties loom, particularly around inflation, interest rates and trade policies.

Core inflation, excluding volatile food and energy costs, increased by 3.3% year over year in the latest update, exceeding both market expectations and the Federal Reserve’s 2% target rate. This persistent inflation, coupled with potential impacts from recent changes in U.S. trade policy, has driven consumer confidence to a seven-month low.

On a positive note, the industrial sector is showing signs of improvement. The Manufacturing Purchasing Managers’ Index entered expansionary territory for the first time since October 2022, with the New Orders component improving for five consecutive months.

Key trends shaping the market

Several trends are converging to shape the current truckload market landscape:

Spot and contract rate convergence: After more than two years of discounted spot rates compared to contract rates, the market is shifting. Holiday shipping season saw spot rates hold a premium over contract rates, creating tension in routing guides as carriers sought more lucrative opportunities. The forecast adds, “Those rates and routing guides set in the softer market of 2024 may not survive a tighter market later in 2025, when the spot market will (likely) become more lucrative than the contract market.”

Private fleet impact: Excess capacity in private fleets, built up during the volatility of 2020 and 2021, continues to absorb freight that would typically hit the for-hire spot market. “This added a lot of resilience in the form of guaranteed capacity and predictable rates, but with the overall downturn in freight volumes, there has been a lot of slack in the line,” notes the report. This has prolonged the down cycle but may change as shipping volumes increase or the for-hire market further contracts.

Declining truck purchases: U.S. Class 8 tractor sales were down 12% year over year in Q4 2024, reflecting financial strain on carriers and hesitancy to expand fleets amid market uncertainty.

Carrier attrition: Employment data from the Bureau of Labor Statistics shows consistent year-over-year declines in truck transportation employment throughout 2024. The Federal Motor Carrier Safety Administration reported a net decrease of over 3,000 operating authorities in Q4 alone, continuing a trend that has seen more than 50,000 authorities exit the market since 2022.

Q1 2025 forecast: Inflationary pressure builds

Looking ahead from Q1 2025, the Curve is expected to continue its inflationary trajectory. While the market may feel relatively stable to shippers in the short term, underlying dynamics suggest more significant changes ahead.

“Though we are in an inflationary rate environment, we don’t anticipate the sort of extreme conditions we experienced in the last inflationary market in 2020 and 2021,” the RXO report states. “Based on recent history and current market dynamics, it’s quite possible we’ll see a lower potential market peak; for guidance, a look back to 2014 would likely be a better comparison.”

The report advises shippers to be cautious about aggressive rate cutting in the current environment. Short-term gains achieved now could lead to higher spot market costs later in the year as capacity tightens. Additionally, maintaining relationships with core freight providers, even at reduced volumes, may prove crucial when market conditions shift more dramatically.

“We are in an inflationary spot market as carrier attrition continues and spot rates overtake contract rates. This dynamic will create pressure for shippers in the coming months,” the forecast concludes. “Q1 will not likely feel like a dramatically different operating environment, which is typical given seasonality, but we are in a changing marketplace that is setting us up for a more meaningful flip later in the year.”

The post Q1 forecast: Truckload rates likely to rise but not skyrocket appeared first on FreightWaves.