JD Sports posts steady Q4, announces medium-term growth strategy

JD Sports store Credits: Daniel Gual/URW Sports fashion retailer JD Sports has provided its fourth-quarter trading update and initial outlook for the new financial year, highlighting a resilient performance in a challenging market. The Group reported LFL revenue growth of 0.3 percent and organic revenue growth of 5.8 percent for FY25, with adjusted pre-tax profit landing within the previously guided range of 915 to 935 million pounds (1.17 to 1.19 billion dollars). JD Sports forecasts challenging trading conditions ahead Looking ahead to FY26, while the company started the year in line with expectations, it anticipates the trading environment in key markets to be volatile throughout the year. JD forecasts a 10 percent contribution to total revenue from the acquisitions made during FY25, and 4 percent through the contribution from new space. However, LFL revenue is expected to remain below FY25 levels. A key area of uncertainty lies in recently proposed tariff changes. The potential impact of these changes is not yet factored into the FY26 guidance, as discussions with brand partners are ongoing and the outcome remains unclear. “JD operates within an attractive, long-term growth market and we are well positioned to continue growing market share. We have strong brand partner relationships and an agile, multi-brand model which allows us to drive, and respond quickly to, market trends,” said Régis Schultz, CEO of JD Sports Fashion Plc. JD Sports announces medium term strategy update Strategically, JD Sports is recalibrating its medium-term plans to focus on unlocking organic growth opportunities—particularly in North America and Europe—while driving efficiency and productivity gains from recent infrastructure investments. This evolution includes leveraging its multi-fascia customer proposition in North America, optimizing supply chains to boost profitability in Europe, and stabilizing its performance in the UK market. Commenting on the strategy update, Schultz said, “Reflecting slower market growth and the investments we have made in our supply chain and infrastructure, we are updating our medium-term plans to capitalise on our organic growth opportunities in North America and Europe, deliver productivity and efficiency benefits from the investments and utilise our strong cash generation to deliver improved returns for our shareholders.” The company has also refined its capital allocation priorities, and by deferring the planned buyout of the remaining stake in their North American business, Genesis, JD has freed up capital to launch an initial 100 million pounds share buyback program.

Sports fashion retailer JD Sports has provided its fourth-quarter trading update and initial outlook for the new financial year, highlighting a resilient performance in a challenging market.

The Group reported LFL revenue growth of 0.3 percent and organic revenue growth of 5.8 percent for FY25, with adjusted pre-tax profit landing within the previously guided range of 915 to 935 million pounds (1.17 to 1.19 billion dollars).

JD Sports forecasts challenging trading conditions ahead

Looking ahead to FY26, while the company started the year in line with expectations, it anticipates the trading environment in key markets to be volatile throughout the year. JD forecasts a 10 percent contribution to total revenue from the acquisitions made during FY25, and 4 percent through the contribution from new space. However, LFL revenue is expected to remain below FY25 levels.

A key area of uncertainty lies in recently proposed tariff changes. The potential impact of these changes is not yet factored into the FY26 guidance, as discussions with brand partners are ongoing and the outcome remains unclear.

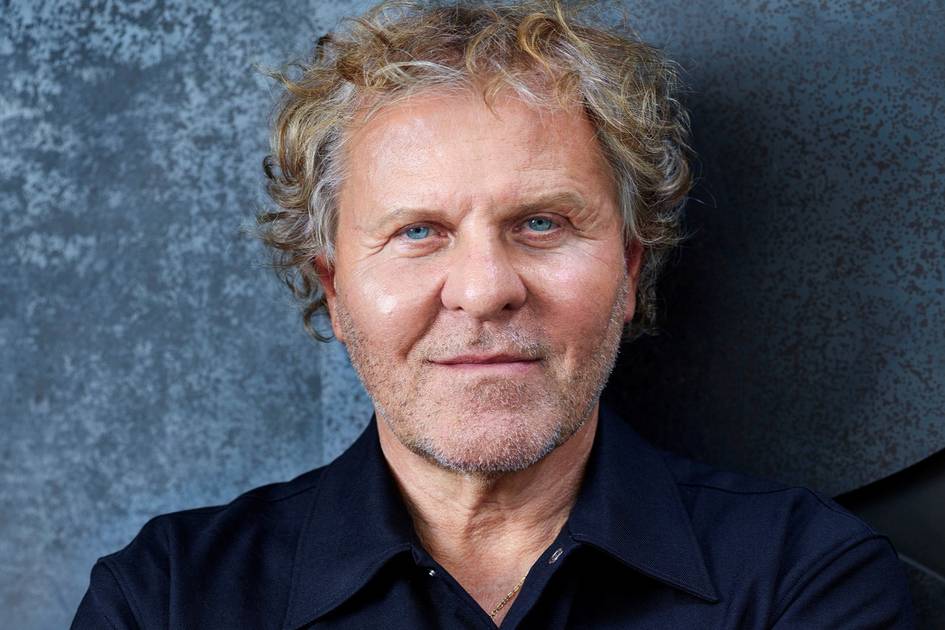

“JD operates within an attractive, long-term growth market and we are well positioned to continue growing market share. We have strong brand partner relationships and an agile, multi-brand model which allows us to drive, and respond quickly to, market trends,” said Régis Schultz, CEO of JD Sports Fashion Plc.

JD Sports announces medium term strategy update

Strategically, JD Sports is recalibrating its medium-term plans to focus on unlocking organic growth opportunities—particularly in North America and Europe—while driving efficiency and productivity gains from recent infrastructure investments. This evolution includes leveraging its multi-fascia customer proposition in North America, optimizing supply chains to boost profitability in Europe, and stabilizing its performance in the UK market.

Commenting on the strategy update, Schultz said, “Reflecting slower market growth and the investments we have made in our supply chain and infrastructure, we are updating our medium-term plans to capitalise on our organic growth opportunities in North America and Europe, deliver productivity and efficiency benefits from the investments and utilise our strong cash generation to deliver improved returns for our shareholders.”

The company has also refined its capital allocation priorities, and by deferring the planned buyout of the remaining stake in their North American business, Genesis, JD has freed up capital to launch an initial 100 million pounds share buyback program.