Japan’s big missile plans face hurdles at home and in the US

The US role in Tokyo’s missile ambitions has been underscored by major purchase decisions this year – and politics threatens to interfere.

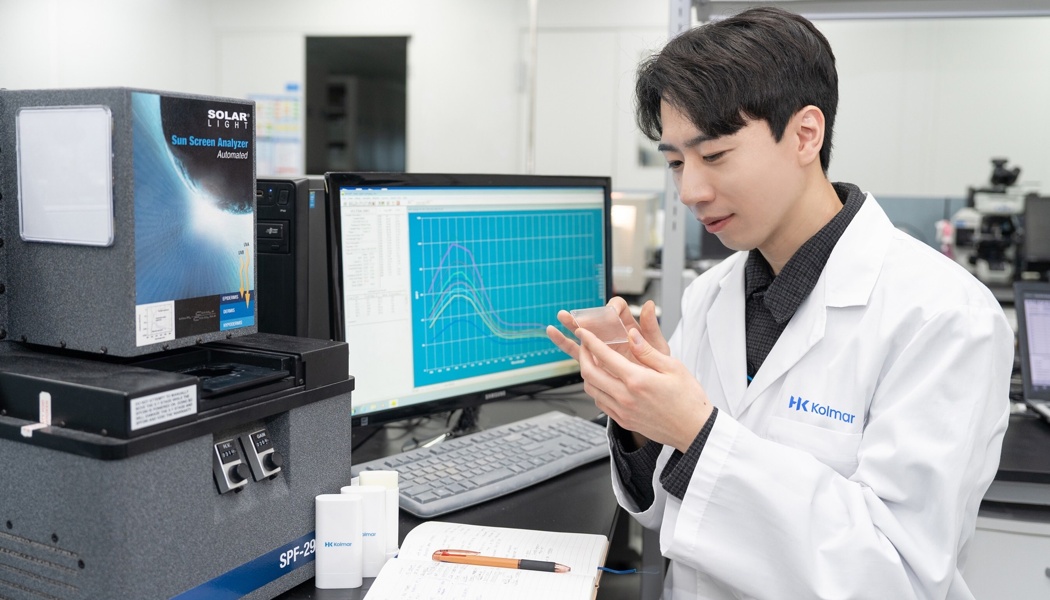

An SM-3 (Block 1A) missile is launched from the Japan Maritime Self-Defense Force destroyer JS Kirishima (DD 174), successfully intercepting a ballistic missile target launched from the Pacific Missile Range Facility at Barking Sands, Kauai, Hawaii. (US Navy via DVIDS)

BANGKOK — Japan is accelerating its acquisition of long-range missiles as part of a broader effort to improve its military capabilities in response to growing threats, particularly from China.

But while Tokyo continues to buy US weaponry and train closely with US forces, its defense investment plans face political and economic challenges at home, and the Trump administration’s approach to foreign policy and alliances has raised concerns in Tokyo about stability of the relationship on which those plans are based.

An expansion of Japan’s military capabilities “has been debated for quite some time,” but “this is the first time that we have proactively pursued on this scale” the kinds of missiles that will arrive in the coming years, Ken Jimbo, a professor at Japan’s Keio University, told Breaking Defense in Bangkok on March 13.

The national security strategy Japan published in late 2022 said missile attacks had become “a palpable threat” and that a counterstrike capability was “a minimum necessary measure for self-defense” against missile launchers and invasion forces “as early and as far away as possible.” Long-range, or “standoff,” missiles are central to that capability, and during 2023, Japan sped up plans to acquire them, changing its order for US-made Tomahawk cruise missiles to include older versions that could be delivered sooner while accelerating deployment of upgraded versions of its own Type 12 anti-ship missile.

Japanese troops began training on the Tomahawk last spring, and Japan’s Defense Ministry said in February that “positive results” in research and development meant mass production of the upgraded Type 12 could begin earlier than planned.

The US role in Tokyo’s missile ambitions has been underscored by major purchase decisions this year. In January, the US State Department said it had approved more than $4.5 billion in sales of AIM-120 air-to-air missiles, SM-6 anti-air and anti-ship missiles, and Joint Air-to-Surface Standoff Missiles-Extended Range cruise missiles. The department said on March 10 that it had approved a $200 million sale of equipment and services to support Japan’s Hyper Velocity Gliding Projectile, on which Tokyo has accelerated testing over the past year.

Japan is now poised to start receiving this year new ground-launched Type 12s with a range of more than 560 miles — bringing much of North Korea and China’s east coast into range from Kyushu and new bases on Japan’s Southwest Islands — and ship-launched Tomahawks with a range of nearly 1,000 miles, according to the International Institute of Strategic Studies’ 2025 Military Balance report. Tomahawk deliveries in 2025 and 2026 will be followed deliveries of ship- and air-launched Type 12s in 2027 and 2029, respectively, and by JASSM-ER deliveries in 2027, with Hyper Velocity Gliding Projectiles and Hypersonic Guided Missiles arriving from the late 2020s to early 2030s, the report says.

China’s military activity near Japan has increased over the past two decades, and its recent operations in the region have made its quantitative and qualitative advances clear. In addition to a growing missile arsenal, China now has “general air and naval superiority vis à vis Japan,” Jimbo said, adding that “we definitely need to have a penetrating concept to offset” those capabilities, and anti-ship and land-attack missiles “will really deliver well in terms of having an early engagement toward adversaries to buy time in how to maintain the escalation-control ladder for us.”

‘They will have to rely on the US’

Despite the attention and resources focused on improving Japan’s missile capabilities, there are still political and economic factors that could affect how Tokyo and Washington pursue those plans.

Japan’s defense budget has risen consistently over the past decade, and in 2022, Prime Minister Fumio Kishida pledged to increase total national security-related spending to 2 percent of GDP as part of the 2023-2027 defense buildup plan, but plans to raise tax rates to secure that increase are incomplete. Kishida’s successor, Shigeru Ishiba, leads a minority government and faced doubts he could advance legislation even before he and his party were tarnished by recent scandals.

“You have to do the legislation processes in order to have those kind of mobilizations of the spending, which has been avoided by the subsequent administration,” Jimbo said, “which means that we are still incapable even to try to secure the five-year budget which was decided by the Kishida administration.”

Public sentiment poses another hurdle. Jimbo said the Japanese public generally supports increased defense spending but was “quite shaky” about actually taking on a higher tax burden to fund it. There is also a “Not-In-My-Backyard” issue: Putting several thousand anti-ship missiles in Kyushu, Japan’s southernmost main island, “is very important for the deterrence,” but “China may want to target those, so [that] entails a lot of subsequent risk.” Addressing such concerns may require “a lot of political transactions, which haven’t been attempted by the politicians,” Jimbo said.

The yen’s recent fall against the US dollar has also made it costlier to maintain and acquire weapons and equipment. It’s unclear how that will affect defense acquisitions, but Japanese officials have said they will acquire hardware based on priority, and standoff capabilities were the first of seven priority areas in the defense-buildup plan.

There are also questions about the Japan Self-Defense Force’s ability to employ its new missiles effectively. The plans for a standoff capability include enhancing command and control and target-data collection, but there are still gaps in the SDF’s “kill chain” — its ability to detect and track targets in particular is “inadequate,” the IISS said in a report last year.

Plans to improve the alliance’s command-and-control structure could help bridge those gaps, but the SDF will still depend on the US. “I don’t think [Japanese forces] have the know-how or the infrastructure” to do that targeting process on their own, Jeffrey Hornung, an expert on Japanese security at the Rand Corporation, said in an email on March 8. “They will have to rely on the US for all parts of the kill chain, at least for the foreseeable future.”

There have been questions about what those command-and-control improvements will entail — and there are now also doubts they will survive the Pentagon’s current cost-cutting — but kill-chain-related cooperation is “an operational issue” and is not likely to be affected by politics, Hornung said. “The US and SDF have been pretty good at advancing various types of cooperation regardless of who is in office; I don’t think that will change.”

‘Transactional’ Alliances

But after the first weeks of Trump’s second term, there may be more concern about the alliance itself, especially in Tokyo. Ishiba’s White House visit — only the second by a foreign leader — in early February was largely successful, with both sides restating their commitment to the alliance and the US re-pledging to defend Japan “using its full range of capabilities.” Less than a month later, however, Trump and other officials indicated they will have greater expectations for Japan.

Elbridge Colby, the nominee for undersecretary of defense for policy, said at his confirmation hearing on March 4 that Japan’s “defense level of effort” was increasing “far too slowly” and that “it makes little sense for Japan” to spend only 2 percent of its GDP on defense in light of threats from China and North Korea. “Japan should be spending at least 3 percent of GDP on defense as soon as possible,” Colby told senators.

Days later, Trump himself decried what he described as a lopsided relationship, telling reporters that “we have an interesting deal with Japan that we have to protect them but they don’t have to protect us.” Amb. George Glass, Trump’s pick for ambassador to Japan, was pressed about Trump’s comments at his confirmation hearing a week later. Glass said Japan was increasing its defense spending and had said it was open to further increases, and he acknowledged a backlog in US weapons deliveries, but, he told senators, “we’re also placing the pressure that we need Japan to be the tip of the spear in how we push back” against China.

Trump and Colby have made similar remarks before, and Japanese officials have been measured in their responses, saying they intend to emphasize the benefits of the alliance in future meetings. Ishiba said he was not “surprised or troubled” by Trump’s comments and that Japan had obligations to the US as part of the alliance, including to provide basing. Ishiba said Japan would not set its defense spending “at the direction of any other country.”

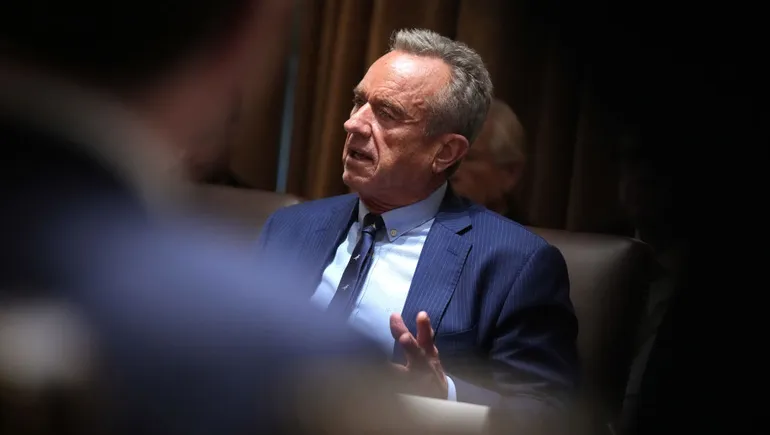

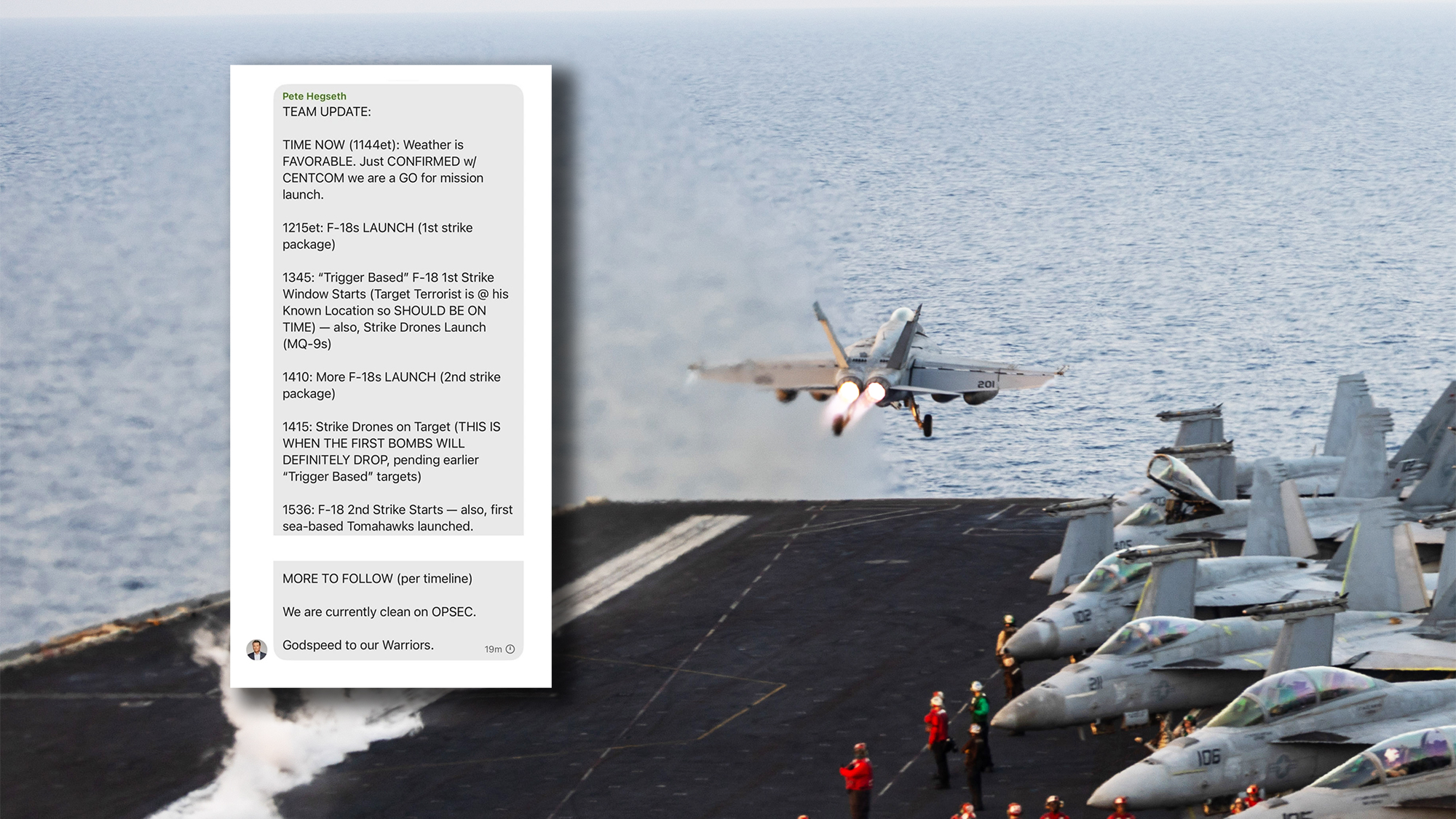

While observers expect cooperation to continue in important areas, including defense, other points of tension could emerge. The US-Japan host-nation-support agreement expires in 2027, and Trump reportedly demanded Tokyo dramatically increase its payment the last time it was renewed. Defense Secretary Pete Hegseth’s upcoming visit to Japan may help address uncertainty in the relationship, but moves Trump has already made, particularly his reversal on support for Ukraine against Russia and more hostile stance toward NATO allies, have raised concerns in Tokyo about how he will handle their alliance and the US’s security role in the region.

Japanese diplomatic and defense officials “are increasingly alarmed about the scale of options that the White House [and] President Trump will be having towards the traditional sense of the alliance,” Jimbo said. Kishida’s comment in 2022 that “Ukraine today may be East Asia tomorrow” has new meaning for some, highlighting now “the notion that the transactional politics could also happen vis à vis China,” Jimbo added.

Christopher Woody is a defense journalist based in Bangkok. You can follow him on social media here and read more of his work here.

.jpg)