FreightTech set for AI revolution

Coursing through the different segments within FreightTech, just as with cloud computing before it, are big bets on AI. The post FreightTech set for AI revolution appeared first on FreightWaves.

This article is the second of three on the landscape of venture capital and FreightTech in 2025 and beyond. Click here for Part I.

In our prior analysis, we noted how private equity firms were cautiously optimistic for venture capital in 2025. Optimistic, because markets were due to benefit from the freeing of some much-needed liquidity as falling interest rates and aging unicorns stimulate exit activity. But cautious, because this forecast is predicated on the expectation that interest rates will continue to fall in the coming months. Yet this expectation could prove false if, say, tariff-centric trade policies spur inflation once again.

Suffice it to say, the VC landscape is far different today than it was during the 2020-21 boom.

2020-21: FreightTech’s cloud-seeded boom

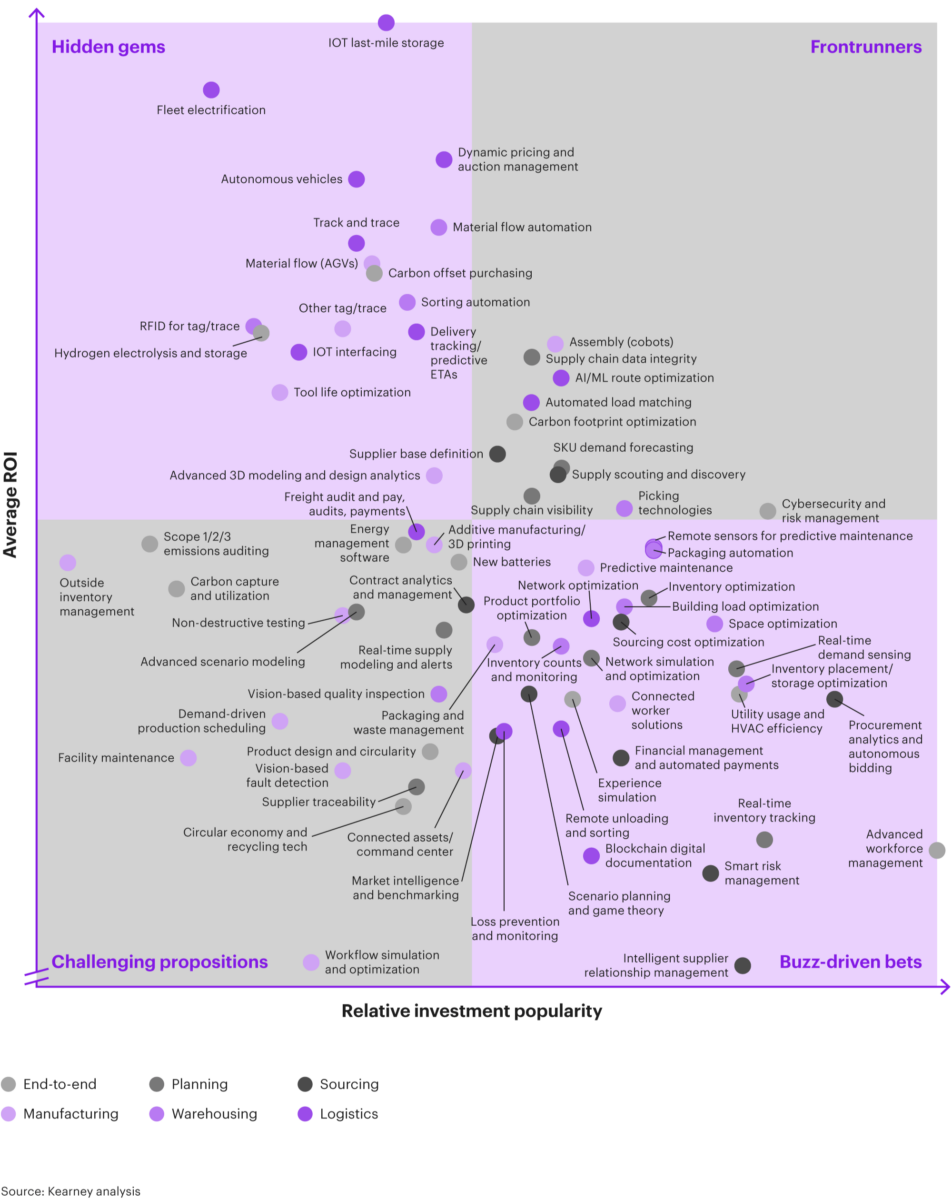

FreightTech itself has changed similarly. While the sector remains one of the most attractive for VC — per analysis by Kearney, FreightTech accounts for 15% to 20% of global VC deal activity — it is attractive for different reasons now.

The technology driving the previous FreightTech boom might best be characterized as a shift from on-premise resources (like server rooms) to cloud computing, the cost of which fell dramatically in the early stages of the COVID-19 pandemic.

RELATED: 8VC raises $998M in new funding with a focus on reshaping logistics

The pandemic drove hordes of new entrants into the sector, as consumers under government quarantine turned their federal stimulus into grist for the e-commerce mill. This dramatic shift in consumer behavior upended global supply chains and laid bare the underinvestment in FreightTech up to that point.

VC was eager to rectify that underinvestment: In 2020, VC spent $12.6 billion across 555 deals with FreightTech startups, with much of that money aimed at middle- and last-mile solutions to get goods to consumers’ doorsteps.

Yet 2020’s spending would ultimately prove to be chump change compared with 2021, when VC injected $41.3 billion — more than triple the previous year’s spree — into FreightTech across 1,203 deals.

As was the case with private equity more broadly, FreightTech suffered in 2022 from soaring interest rates and an inflationary environment that deterred investment for the next few years. Fundraising and exit activity slowed during this period, tying up liquidity into the bets already made.

All in on AI

Still, VC activity in FreightTech already began to gain momentum in the run-up to 2025. In the fourth quarter of 2024 alone, the value of supply chain tech deals shot up to $9.1 billion — thanks mostly to autonomous driving tech firm Waymo’s $5.6 billion round in the quarter.

Even excluding this outlier, however, the $3.5 billion in Q4 supply chain deal value marked a sequential gain of 155% and a yearly rise of 158%, according to analysis by PitchBook.

Coursing through the different segments within FreightTech, just as with cloud computing before it, are big bets on AI. Nearly every investor, large or small, still appears to have an appetite for AI.

Also like cloud computing, the cost of AI is quickly becoming a race to the bottom.

In January, the Chinese AI startup DeepSeek triggered a sell-off of U.S. tech stocks when it released its latest model. The model, DeepSeek R1, rivaled established competitors like ChatGPT in its capabilities but reportedly cost far less to create and is less memory-intensive to use.

AI is a natural pairing with some FreightTech segments like autonomous vehicles (e.g., Waymo, Aurora, Waabi) and driver safety (Motive, Samsara).

But AI has also revitalized some of the more mature FreightTech segments, such as fleet management and TMS (Platform Science, Mercury Gate).

At the same time, AI is helping some segments withstand a seismic shift in cultural priorities. Under the Biden administration, sustainability-focused companies were rewarded with government funding, like the Infrastructure Investment and Jobs Act of 2021 or the Inflation Reduction Act of 2022.

Needless to say, such green initiatives have found little favor with the current Trump administration.

AI entitles certain segments of FreightTech, like digital freight matching, to boast sustainability as a knock-on effect — and not the primary selling point — of their software. Load optimization would thus be the main draw, though investors who are still passionate about climate action could be enticed by the promise of reduced carbon emissions.

Finally, AI has enabled the development of entirely new segments in FreightTech.

Take, for example, AI-powered software that is being marketed to brokerages as a digital customer service representative: FleetWorks, CloneOps and HappyRobot are some of the leading startups in this category. These platforms aim to assist brokers in finding freight, covering loads and boosting margins by automating phone calls and optimizing workflows.

Though burgeoning, VC interest in this technology has already been profound. In December 2024, HappyRobot closed a $15.6 million Series A funding round led by Andreessen Horowitz — by far the largest VC firm with $42 billion in assets under management.

The post FreightTech set for AI revolution appeared first on FreightWaves.