How Are We Feeling About The Automotive Market These Days?

The automotive market has felt out of whack for quite some time. Dealer markups may have abated to a degree, with discounts starting to manifest, but we don’t really seem to be encountering the kinds of reasonable pricing North America enjoyed prior to 2020. Automakers have continued to prioritize larger vehicles that are easier to get past emissions and offer better profit margins . But consumers are tapped out and starting to notice they’re arguably getting less vehicle for their money than they used to and there is a wealth of data suggesting that the market is sincerely starting to struggle.

The automotive market has felt out of whack for quite some time. Dealer markups may have abated to a degree, with discounts starting to manifest, but we don’t really seem to be encountering the kinds of reasonable pricing North America enjoyed prior to 2020. Automakers have continued to prioritize larger vehicles that are easier to get past emissions and offer better profit margins. But consumers are tapped out and starting to notice they’re arguably getting less vehicle for their money than they used to and there is a wealth of data suggesting that the market is sincerely starting to struggle.

From the perspective of drivers, modern engines are getting smaller, interiors are becoming more austere (touch screens are cheaper to implement), and the technological features we’ve received in their stead don’t necessarily rationalize the swelling MSRPs. Outsourcing production and generalized cost cutting has also become commonplace across most manufacturers, right at the time consumers are reporting lapses in quality control and overall satisfaction. While there are always going to be exceptions to the rule, that has been the general trend within the industry over the last fifteen years.

The end result has been for modern vehicles to come with higher-strung motors prioritizing fuel efficiency over longevity. Technologies (including those that have been mandated as safety requirements in recent years) have likewise complicated vehicles to a point where it’s further impacting repair costs and maintenance fees. So we’ve ended up with larger, heavier, and more-expensive vehicles with levels of complexity that were previously unheard of — leaving some buyers scratching their heads or simply too poor to afford even the cheapest new vehicles presently available.

We’ve covered how regular people cannot sustain modern vehicle pricing in the past. The average transaction price of a new car was about $28,800 in 2005, $34,500 in 2015, and had ballooned to $40,100 by 2020. However, that figure spiked to over $48,500 by the start of 2025 — with Kelly Blue Book noting a 37 percent increase of vehicles priced above $80,000 between last December and the previous year.

We’re now seeing the resulting fallout from that truth begin to manifest, as vehicle pricing has vastly exceeded inflation. Repossession rates are absolutely skyrocketing.

Depreciation has always been an issue with new vehicles. However, loan trends have made ownership untenable for some drivers. Annual percentage rates now average between 5 and 7 percent for those with near-perfect credit and could already be considered extremely high. But non and sub-prime shoppers could see rates as high as 13 to 29 percent interest on a vehicle.

Considering that the average loan duration has also grown, with some lenders offering terms up to 72 or even 84 months now, the interest rates some people are forced to pay have made their daily driver a financial black hole they couldn’t hope to escape. It’s not uncommon to find someone owing more on their vehicle than it’s actually worth. Negative vehicle equity is presently averaging at an all time high of roughly $7,000 in the United States and about 25 percent of trade-ins toward new-car purchases had negative equity.

With the above in mind, it’s little wonder that vehicle repossessions have increased so dramatically. According to Cox Automotive, the number of U.S. vehicle repossessions is assumed to have increased by 23 percent through the first half of 2024. This comes after a nearly 15 percent increase between 2019 and 2024, suggesting that the issue has only accelerated over time.

This has also led to a sizable increase in GAP insurance fraud, as some drivers will total their own vehicle in the hopes of getting away from monthly payments that they can no longer keep up with and are just putting them deeper into debt anyway. Hard numbers on this are notoriously difficult to obtain, especially for recent years. But the Insurance Information Institute estimated that “staged accidents” increased by over 13 percent in New York and 58 percent in New Jersey between 2022 and 2023.

Speaking of which, insurance premiums have almost doubled over the last three years in the United States. In addition to the aforementioned fraud, reasons for this are because modern vehicles cost significantly more to fix and driver monitoring — made possible via connectivity features — has also become a convenient excuse to raise rates. Ironically, raising rates has encouraged fewer people to buy insurance — encouraging even higher pricing to help make up the difference in profits.

The Insurance Research Council estimated that about 14 percent of drivers (about one-in-seven) went without insurance in 2022. However, that number is assumed to have grown between then and now due to how much rates have risen. There’s also a prevailing sense among younger drivers that insurance is effectively a gamed-out financial scheme, backed by government regulations, that discourages drivers from taking responsibility.

As of now, the above issues haven't yielded any catastrophic sales collapses for the market as a whole. Last year ended relatively strong as volumes surged for December. But the outlook for 2025 hasn’t been quite as rosy. Some outlets, like Cox, assume this year will see upwards of 16 million deliveries inside the United States. That’s a modest improvement against 2024 of about 2.5 percent.

But there are a lot of concerns about the trends we’ve been seeing. Wages haven’t even kept pace with inflation, let alone automotive pricing. Older shoppers that are financially better off (e.g. Baby Boomers) are also starting to age out of driving, with many already having purchased their final automobile. Meanwhile, younger buyers are significantly more cash conscious without the same levels of disposable income.

Manufacturers actually seem a little less optimistic than industry analysts. But the mood really depends on the brand and how they’ve positioned themselves. While many automakers had actually been trying to manage the business in a way that would yield higher profits from fewer annual sales, plenty of brands went into 2025 anticipating less of both.

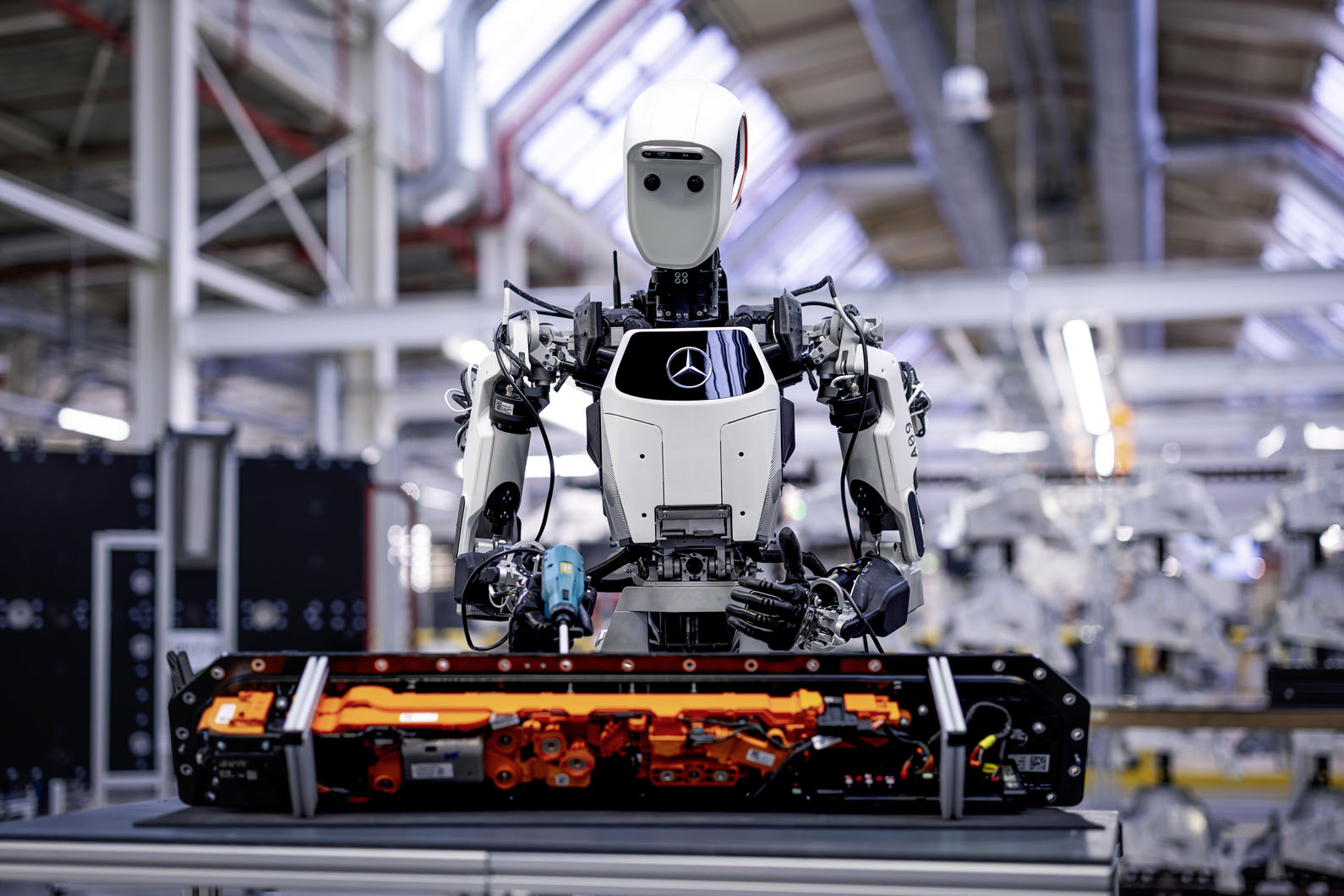

Ford went into this year expecting lower volumes and higher production costs. Its EV division lost over $5 billion in 2024 and that’s assumed to persist into this year. Stellantis noted a sharp decline in sales late last year and most assume this will continue deep into 2025. Like many domestic manufacturers, dealer lots appear to be particularly bloated and new product offerings haven’t resonated with customers. Mercedes-Benz saw a similar trajectory, with lackluster sales in China and lower-than-anticipated EV sales driving the issue.

While there are certainly companies with a rosier outlook and better profit expectations, some have it worse, and there is a lot of commonality between the issues they’re all confronting. Despite being heavily subsidized by Western governments, all-electric vehicles aren’t meeting sales expectations for most automakers and required massive investments that put them into a financial hole. Product mix has likewise become an issue after so many brands went upmarket and culled small, budget-focused vehicles from their North American lineup.

If you want to see the results on display, browse any dealership specializing in large SUVs and pickup trucks. You’ll probably find a surplus of large, new vehicles carrying high MSRPs that just aren’t selling like they used to. By contrast, consumers seem to be gravitating toward anything that’s still competitively priced and assumed to offer better-than-average reliability.

Keep in mind that dealers are losing money on every vehicle that goes unsold and dealer inventories have increased significantly in recent years. In March of 2019, there was roughly a 94-day supply of vehicles on dealer lots. That figure declined well below the desired average of 65-80 days during the pandemic. But it is now assumed to be above a 96-day supply average and growing.

But the true number hinges primarily on the desirability of certain models and where you live. Top sellers, like the Toyota RAV4, are lucky to have a 20-day supply. The Ford Bronco, which was previously enjoying a surplus of demand, is now estimated to be well above 140 days due to its high price tag. Meanwhile, the Dodge Hornet is assumed to exceed a 400-day supply at present and seeing staggering discounts.

Does that mean the industry is doomed and we’re about to see a crisis surpassing the bailouts witnessed in 2008? Not necessarily. However, plenty of brands seem to have done real harm to themselves by failing to offer a diverse lineup or assuming that electrification would be a catch-all solution. Some of that was the fault of government regulators trying to reduce emissions at the expense of literally everything else. But manufacturers ran with the premise and also made sure to do everything in their power to move away from traditional designs so they could implement electronics wherever possible while swelling per-vehicle profit margins. Regardless, modern vehicle trends (e.g. more tech, touch controls, smaller engines, higher prices) haven’t been a hit with low-to-middle-class consumers who are now struggling to afford their purchases.

Despite years of speculation that we're past due for a market correction, it doesn’t mean we’re guaranteed a crash in the next few months. However, if the industry doesn’t change course, it’s hard to imagine a scenario where everything mentioned above fails to lead to anything but market disaster. None of what’s happening feels sustainable for very much longer.

[Images: Bilanol/Shutterstock; Dolores M. Harvey/Shutterstock; Tada Images/Shutterstock]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

![Restoration of Li+ pathways in the [010] direction during direct regeneration for spent LiFePO4](http://pubs.rsc.org/services/images/RSCpubs.ePlatform.Service.FreeContent.ImageService.svc/ImageService/image/GA?id=D5EE00641D)

.jpg)