BNSF profits and revenue lag railway’s overall traffic growth

BNSF’s saw fourth quarter revenue decline primarily due to a 6.6% drop in average revenue per carload. The post BNSF profits and revenue lag railway’s overall traffic growth appeared first on FreightWaves.

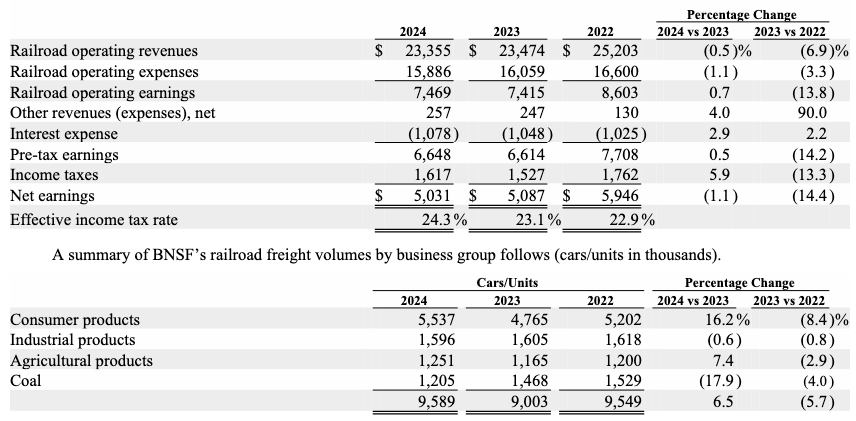

OMAHA, Neb. — BNSF Railway’s pretax profits increased slightly in 2024 as traffic-mix changes — more intermodal, less coal — and lower fuel surcharge revenue offset an overall 6.5% increase in freight volume.

For the year, BNSF’s pretax earnings increased 0.5%, to $6.64 billion, while revenue declined 0.5%, to $23.35 billion, the railway’s corporate parent, Berkshire Hathaway, reported on Saturday.

BNSF’s net income declined 1.1%, to $5.03 billion. The railway’s operating ratio was 68%, an improvement of 0.4 points.

The revenue decline, Berkshire said, was due primarily to a 6.6% drop in average revenue per carload, which was attributed to lower fuel surcharge revenue and changes in business mix.

Operating revenues from consumer products — which include intermodal and automotive shipments — increased 7.1%, reflecting a volume increase of 16.2% and lower average revenue per car/unit. The volume increase was primarily due to higher intermodal shipments from West Coast imports and volumes from a new customer.

Industrial products revenue declined 1.2%, reflecting slight declines in volume and average revenue per car. “The volume decline was primarily due to lower aggregates, taconite, minerals and waste shipments, substantially offset by higher plastics and petroleum products volumes,” Berkshire said.

Agricultural products revenue increased 4.5% as volume rose 7.4% due to higher grain, renewable fuels and fertilizer shipments.

Coal revenue fell 22.5%. “The decrease was attributable to a volume decrease of 17.9% and lower average revenue per car/unit. The volume decline was primarily due to lower natural gas prices,” Berkshire said.

Berkshire Hathaway Chairman Warren Buffett didn’t have much to say about BNSF in his widely read annual letter to shareholders. “Berkshire’s railroad and utility operations, our two largest businesses outside of insurance, improved their aggregate earnings. Both, however, have much left to accomplish,” he wrote.

The post BNSF profits and revenue lag railway’s overall traffic growth appeared first on FreightWaves.