A New Regulatory Environment for Climate and Other ESG Reporting Rules

The Ill-Fated SEC Climate Rule On March 6, 2024, the SEC adopted final rules “to enhance and standardize climate-related disclosures for investors,” which included, among other things, requirements to disclose material climate-related risks and related governance policies and practices and mitigation and adaptation activities, targets and goals, Scope 1 and 2 emissions reports and financial […]

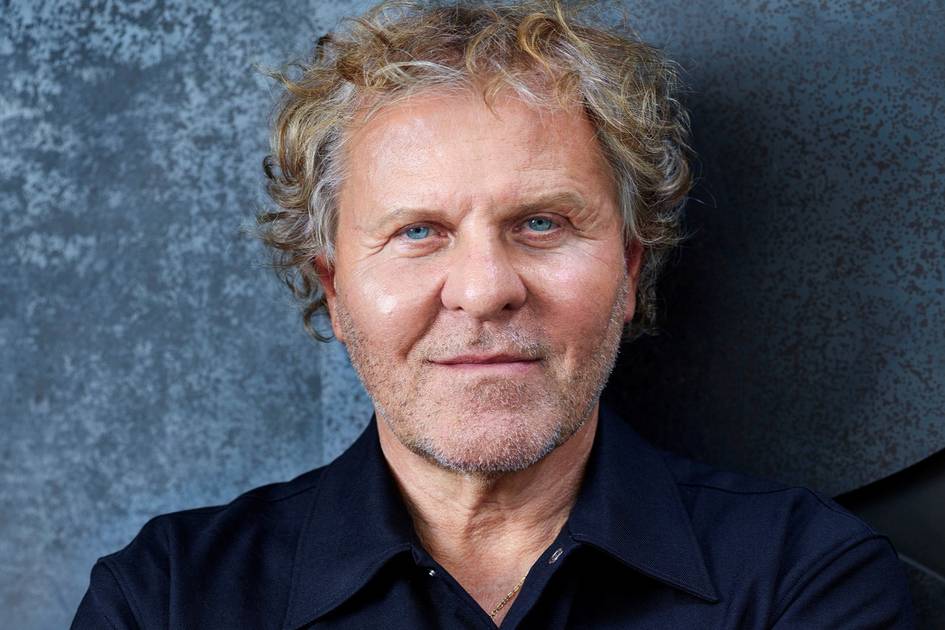

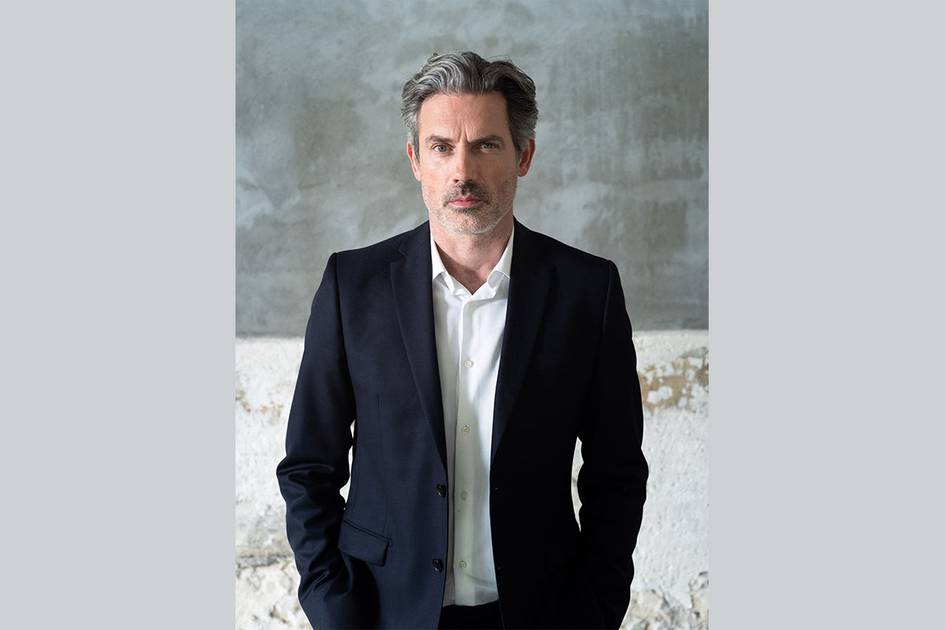

Amelie Champsaur, Helena Grannis, and Shuangjun Wang are Partners at Cleary Gottlieb Steen & Hamilton LLP. This post is based on a Cleary memorandum by Ms. Champsaur, Ms. Grannis, Ms. Wang, and Léa Delanys.

The Ill-Fated SEC Climate Rule

On March 6, 2024, the SEC adopted final rules “to enhance and standardize climate-related disclosures for investors,” which included, among other things, requirements to disclose material climate-related risks and related governance policies and practices and mitigation and adaptation activities, targets and goals, Scope 1 and 2 emissions reports and financial statement effects of severe weather events and other natural conditions, including related costs and expenditures (the Climate Rule). [1]

Almost immediately upon release of the Climate Rule, multiple lawsuits were filed in federal court objecting to the rule on multiple bases, including that the rule is arbitrary and capricious under the Administrative Procedure Act, the rule exceeds the SEC’s statutory authority and the rule violates the First Amendment by compelling political speech. [2] The U.S. Court of Appeals for the Eighth Circuit was randomly selected as the venue for consolidating the nine filed lawsuits and on April 4, 2024 the SEC voluntarily stayed the rules pending the outcome of the litigation. Briefs have been filed by all parties and the case is currently pending a hearing date.

On December 4, 2024, President-elect Donald Trump announced that Paul Atkins would be his nominee to the SEC as Chairman. Current Chair Gensler and Commissioner Lizárraga both announced their intentions to step down in January 2025 before the inauguration, meaning the SEC will have a majority of Republican Commissioners even before Atkins can be confirmed. The change in administration is expected to bring a deregulatory focus and anticipated reduction in budget and spending for administrative agencies, which, together with the quick turnover at the SEC, is anticipated to mean the end of certain ESG related SEC rulemaking initiatives, including the Climate Rule (along with any new proposed rules on board diversity disclosure and human capital management reporting). Procedurally, the SEC under the new administration could abandon the defense of the rule in court (leading to its vacatur); alternatively, it could take regulatory action to rescind the rule (which would require formal rulemaking, including new notice and comment periods), and, pending a final determination, the SEC could announce that it will not lift the stay or enforce the rule, so that in practice it is never implemented.