A Lego approach helps prepare Manhattan Associates’ TMS for tariff chaos

Manhattan Associates is touting a TMS feature it likens to Lego bricks as it gets customers ready for an uncertain era of tariffs. The post A Lego approach helps prepare Manhattan Associates’ TMS for tariff chaos appeared first on FreightWaves.

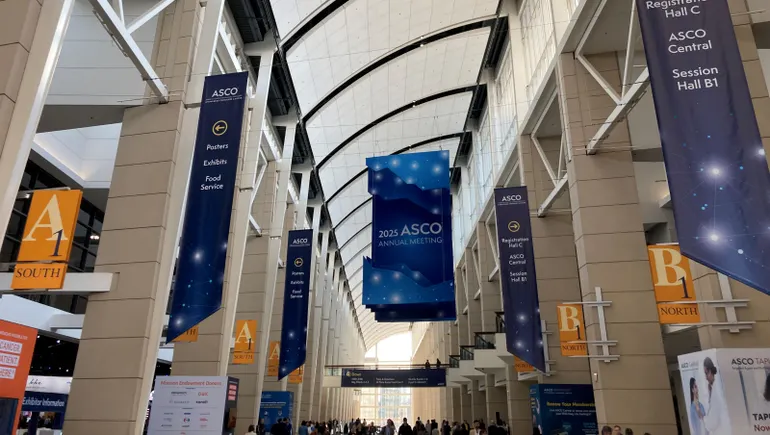

LAS VEGAS – Manhattan Associates has been in the transportation management system sector for about 15 years, taking a big step forward with its integrated Active platform in 2021.

But users of its TMS, which is designed to focus on shippers, are dealing with a new set of challenges brought on by the potential supply chain chaos created by tariffs, real and anticipated.

Bryant Smyth is the director of product management at Manhattan Associates (NASDAQ: MANH) with a focus on the company’s transportation management capabilities. It’s his team that is going to need to direct the company’s TMS customers to help limit the pain points and be flexible as the landscape shifts.

“You need to have the visibility into which lanes, which customers and which vendors are going to be impacted by these tariffs, especially on the import side, if you’re working with vendors who are importing from the other parts of the world,” Smyth said in an interview at Manhattan Associates’ Momentum meeting of customers and partners. “You may need to source a different vendor from a different part of the world, or even move it stateside. So now you’re going to be changing not only your vendor relationships, but you’re also going to be changing the lanes you’re shipping on.”

Maybe changing lanes, carriers and modes

Smyth said within the Manhattan TMS, it can do “modeling exercises” that take those various new inputs, combine them with what’s still in place and answer the question, “What does that cost look like with a change in lanes, a different carrier mix and also maybe a change in modalities?”

To provide that sort of service, one of the features of Manhattan Associates’ TMS, touted by executives like Smyth at Momentum, involves two terms they use frequently: “micro” and “Lego.”

Yes, Lego as in the bricks.

Trying to adapt a TMS for individual requirements in legacy systems – the type of need that might be created by a sudden shift in tariff policy – meant “you write a line of code, and then more lines of code, and now it just becomes this big monolith that the application can do,” Smyth said.

Making bespoke changes in a cloud-based system

But that is not always the case for a customer working with software installed on its own systems rather than on Manhattan Associates’ products in the cloud.

Smyth said the split between customers who are using Manhattan Associates’ cloud-based technical capabilities and those who are known as “on prem” – with the software installed on a customer’s system rather than accessing the cloud – is about 50-50.

While it is easy to knock those who remain tied to an on-prem system for lagging behind the growing industry standard of cloud technology, Smyth said those customers do have the advantage of being able to make changes in their system themselves without worrying about how it might affect other users.

The microservice “Lego” capabilities of Manhattan Associates’ TMS, he said, are the “best of both worlds.” The ability to create a bespoke process unique to a customer similar to what an on-prem user can perform now is available for cloud-based users as well, Smyth said.

The microcapabilities that Manhattan touted at Momentum, based on the use of underlying APIs, draw the comparison to Lego bricks.

“What that allows us to do is that customers need only to activate components that they’re going to use,” Smyth said. “We compartmentalize it so that a particular workflow is centered around a particular action. We break them apart, and then you can put them together as Lego pieces and compose the TMS that you need.”

Forward steps on AI

No conference about software services today for the supply chain can go very far without a discussion of AI. Momentum this year was no different.

A year ago at Momentum, a key focus was on generative AI and how it could be used in various Manhattan applications.

New “agentic” AI tools were rolled out at Momentum this year. And they were part of what Smyth talked about in an interview with FreightWaves, when he looked over his company’s TMS and what it was going to need to be able to provide users as they navigate the tariff jungle.

With so much focus last year on generative AI and this year on agentic AI – with an AI-based tool performing the work that a human agent might have performed earlier – Smyth was blunt in addressing a possible weak spot in AI: Is the data good enough for the tools?

AI tools, Smyth said, “are good only if you see something that you need to be able to take action against.” Given that, Smyth said Manhattan Associates has been working with customers to review what they have, “visualize it end to end” and “streamline” the data so it can be used in AI tools, whether it’s generative AI or agentic AI.

Asked for an example of what agentic AI can do, Smyth was succinct: “If I needed to schedule an appointment, you can have an agent do that for you,” he said.

But the process needs to be basic for users. “Our end users are not all technical; they aren’t software developers,” he said. “They need to be able to tell an agent to do something in a natural language, like ‘reschedule this appointment.’”

That could kick off actions by multiple agents.

“I might have an agent that looks at my shipments and tells me which ones are late,” he said in reviewing the process. Another might take a late shipment and reschedule it. A third might send a notification to a carrier that there’s been a rescheduling.

“Those are three independent agents that you can now cluster together into an automated process,” he said.

This is during a time when supply chain software companies, at least those that are publicly traded, are struggling, at least as evidenced in their stock price.

Manhattan Associates has traded near $188 this week, down from about $228 when Momentum was held in 2024.

Just a few days after the close of the Momentum meeting, supply chain software provider e2open announced it was being sold to WiseTech, an Australian company. E2open had seen a long decline in its stock price going back years, with its earnings reports and analyst calls often lamenting it was tough in that field to get anything done. Its stock was down about 75% in five years after getting a final boost from the sale.

Manhattan Associates’ stock price has not suffered as much, but it too has struggled. In the past year, it has swung from a 52-week peak of $312.60 on Dec. 12 – an all-time high – to a low of $140.81 on April 7.

Company executives have talked about difficulties in closing deals.

Smyth said sales are still hitting headwinds, particularly in industries where tariffs are a key issue. “They’re just sitting tight and seeing how things are going to play out,” he said. “They don’t want to make these big capital investments in enterprise software right now.”

More articles by John Kingston

Georgia tort reform aims to change practices in judicial ‘hell hole’

Double whammy for Wabash: 2 key agencies cut debt rating on trailer builder

Despite red ink at Heartland, Morgan Stanley report relatively upbeat

The post A Lego approach helps prepare Manhattan Associates’ TMS for tariff chaos appeared first on FreightWaves.

![[Video] The Weekly Break Out Ep. 20: Pacific policy in Singapore and the UK’s new defense plan](https://breakingdefense.com/wp-content/uploads/sites/3/2025/06/Break-Out-ep-20-thumb-Play-Button.jpg?#)