What is Top of Mind for US Investors in 2025?

Over the past few years, investors have been contending with forces that are transforming the global economy. During this time, they have sought to understand how these changes will impact economic performance at the companies in which they invest and cover. In fall 2024, PwC surveyed 345 investors across geographies, asset classes and investment approaches […]

Matt DiGuiseppe is Managing Director, Paul DeNicola is a Principal, and Ariel Smilowitz is a Director at the PricewaterhouseCoopers (PwC) Governance Insights Center. This post is based on their PwC memorandum.

Over the past few years, investors have been contending with forces that are transforming the global economy. During this time, they have sought to understand how these changes will impact economic performance at the companies in which they invest and cover.

In fall 2024, PwC surveyed 345 investors across geographies, asset classes and investment approaches to learn more about their expectations, concerns and outlook for the future. The resulting analysis, PwC’s Global Investor Survey 2024: Cautiously optimistic, investors expect growth, identifies four key themes:

- Reinvention imperative: Innovation and new ways of doing business are top of mind for investors.

- Generative AI optimism: The promise of GenAI is high for a large majority of investors.

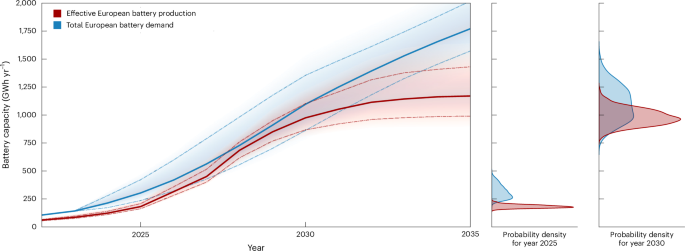

- Climate investment opportunities: Climate actions are important investment drivers.

- Trust through communication: Most investors trust companies to make decisions for the long term.

Compared to their global counterparts, those who invest in or cover companies based in the United States (US investors) are equally grappling with how to hedge against myriad risks and tap into the opportunities that megatrends like artificial intelligence and climate change have to offer. However, they are increasingly relying on budding information sources like GenAI to draw new investment conclusions, and with more disclosures on the horizon due to global reporting regulations, US investors may be less familiar with how to interpret the new data at their disposal.

So what are the top priorities of US investors and what steps should boards and management teams take to respond and adapt?

.jpg)