Trucking execs see green shoots as industry awaits upturn

Executives at some of the nation’s largest truckload transportation providers are seeing incrementally positive signs that the market is turning. The post Trucking execs see green shoots as industry awaits upturn appeared first on FreightWaves.

Signs that a freight recovery may be taking shape continue to surface, said trucking executives on the investor conference circuit this week. The overall sentiment is that the truckload industry is no longer in a recession and that normal seasonal trends have returned, but no one is ready to commit to when a meaningful positive inflection will occur.

“We know we’re coming off the bottom of the market,” Drew Wilkerson, CEO at truck broker RXO (NYSE: RXO), told investors at Citi’s 2025 Global Industrial Tech and Mobility Conference in Miami on Wednesday. “You are starting to see the signs of a market that’s shifting. The thing that’s not known is, what’s the pace of the recovery?”

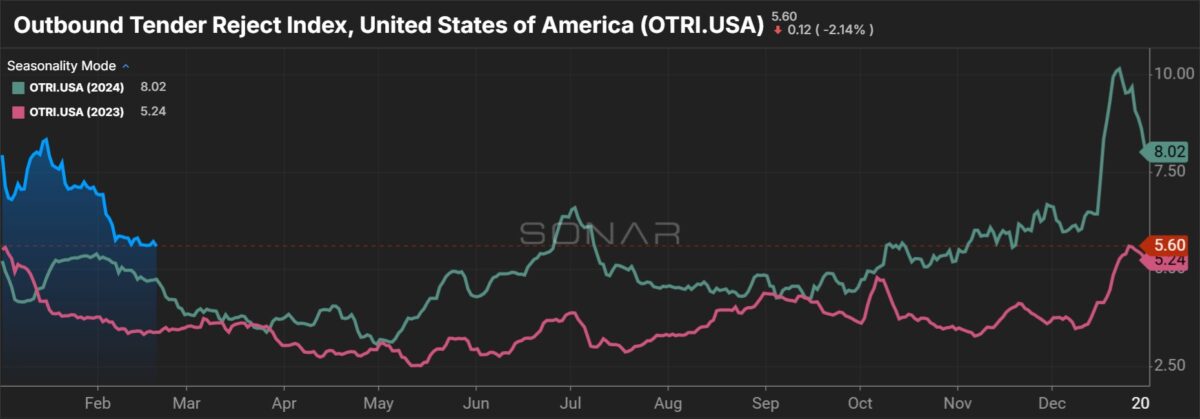

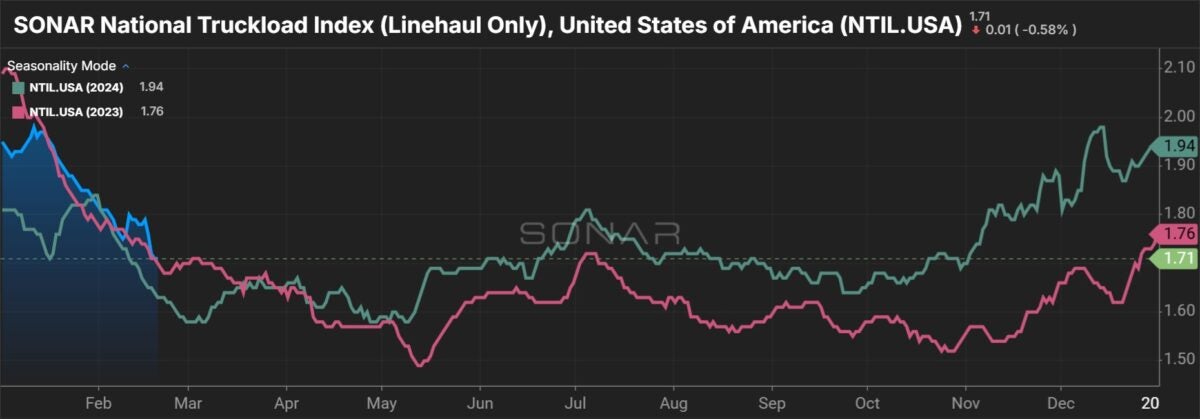

He cited a recent run in TL spot rates and noted that contract rates have turned positive. He also talked about the increase in carrier tender rejections and said internal data shows load-to-truck ratios have nearly doubled year over year.

RXO is calling for contract rates to increase y/y by low- to mid-single digits this year. The company’s TL revenue per load is up y/y by a low-single-digit percentage to start the year after being flat in the fourth quarter.

Management from TL carrier Werner Enterprises (NASDAQ: WERN) offered some positive anecdotes as well.

The company said dialogue with customers – mostly nondiscretionary retail and food and beverage companies – has been more positive than it was a year ago. The carrier is coming off a peak season in which project freight volumes doubled y/y even though rates were higher.

Werner also pointed to an improvement in spot rates and said its one-way TL unit has seen two straight quarters of y/y rate improvement. It is calling for a “gradually improving market throughout the rest of the year.” The outlook calls for rate per total mile in the one-way fleet to increase by 1% to 4% y/y during the first half of 2025, with revenue per truck per week in its dedicated unit to be flat to 3% higher for the full year.

Management said it was still early in bid season but results from contractual negotiations are consistent with expectations heading into the year. It expects truck capacity to continue to exit even as the market improves, pointing to the end of payment forbearance programs as lenders to the industry are taking sizable write-offs.

“If you’re a small or medium-size carrier that’s just been barely scraping by and maybe doing an interest-only payment, or maybe not making a payment at all, and the [market] turn comes later, it’s probably too late,” Nathan Meisgeier, Werner president and chief legal officer, said at Barclays 42nd Annual Industrial Select Conference in Miami on Wednesday.

“Even with an improvement in spot rate, even with the turn, we expect to see capacity attrition. We’re still seeing it right now.”

Werner is calling for truck growth of 1% to 5% y/y, with most of the additions coming at its dedicated fleet where the pipeline remains strong.

J.B. Hunt Transport Services (NASDAQ: JBHT) said the fact that it doesn’t have anything negative to announce is probably a positive. It said the market has reached an inflection as normal seasonal patterns have returned after a 30-month-plus freight recession. Its customers are bracing for TL rates to increase 3% to 8% y/y in 2025 but it also cautioned that the same customers were expecting rate increases a year ago.

The company said it’s still too early to forecast what will happen with intermodal rates this year but that it plans to focus on freight selection in hopes of running a balanced network with improved asset utilization and minimal repositioning costs.

It also expects to get back to adding trucks in its dedicated service, without any notable offset from customer attrition, by the back half of the year. The company placed more than 1,700 trucks into a new service last year, but the additions were wiped out as some customers cut back on their capacity needs and others went out of business.

J.B. Hunt reiterated a long-term goal of adding 800 to 1,000 net trucks in dedicated annually.

More FreightWaves articles by Todd Maiden:

- LTL panel tells shippers to start using new freight classification codes now

- ABF Freight latest LTL carrier to nab Yellow terminals

- J.B. Hunt working on intermodal mix, awaiting rate inflection

The post Trucking execs see green shoots as industry awaits upturn appeared first on FreightWaves.