Too Many Trucks, Not Enough Freight – Why Rates Aren’t Rising Yet

Market Update: Spot Rates Still Dropping — Where Can You Find the Money? If you’ve been feeling like rates just aren’t moving in the right direction, you’re not alone. This map breaks down spot rate changes over the past four days, and the message is clear: Most outbound lanes across the country are still seeing […] The post Too Many Trucks, Not Enough Freight – Why Rates Aren’t Rising Yet appeared first on FreightWaves.

Market Update: Spot Rates Still Dropping — Where Can You Find the Money?

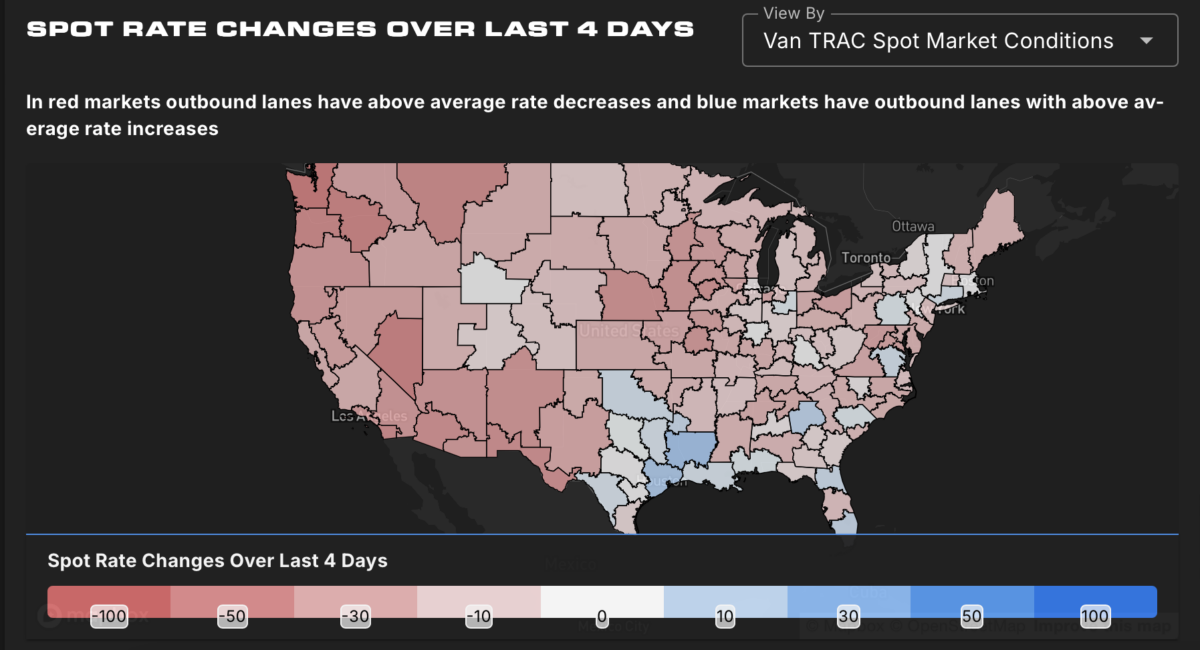

If you’ve been feeling like rates just aren’t moving in the right direction, you’re not alone. This map breaks down spot rate changes over the past four days, and the message is clear: Most outbound lanes across the country are still seeing rate declines.The red areas on the map? That’s where rates have dropped more than average. The blue spots? That’s where rates have increased, meaning shippers are having to pay more to move freight. As you can see, there’s a whole lot more red than blue.

What This Tells Us About the Market Right Now

Spot rates have been on a downward trend, and this map confirms that in the past few days, that trend is continuing.

Most major freight markets are cooling off — shippers aren’t feeling pressure to raise rates.

- Only a few areas are showing rate increases — and they’re isolated, meaning no big marketwide rebound yet.

Carriers relying on the spot market are still in a tough position — because brokers know they can push rates lower and still get loads covered.

Where Are the Best Opportunities?

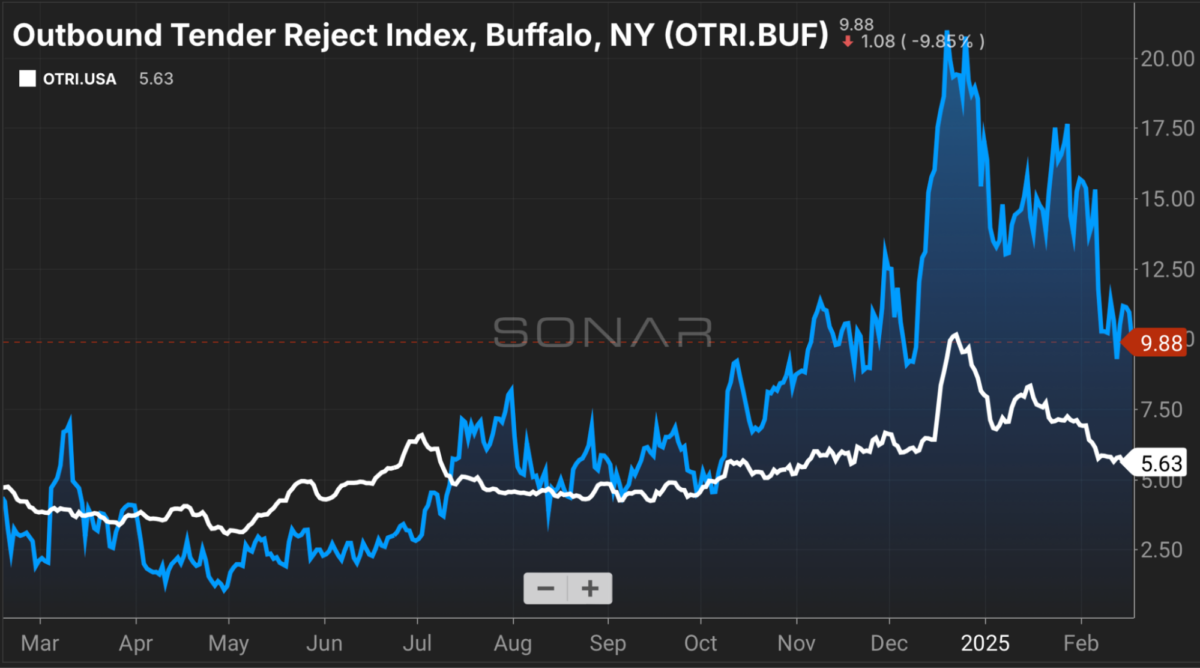

I did some digging and one of the bright spots that jumped off the tape is in New York. Buffalo is emerging as one of the hotter freight markets in the country right now. The tender rejection rate there is sitting at 12.01%, more than double the national average of 5.72%. That tells us capacity is tightening — meaning there are fewer trucks available compared to the volume of freight moving out of the area. The load board data backs this up, showing strong per-mile rates on outbound lanes, with multiple loads exceeding $4 per mile. Even though rates are down in much of the country, Buffalo is holding steady as a high-demand market where carriers can negotiate better rates. If you’re looking for stronger lanes, Buffalo might be a solid place to position your truck right now, or if you are running outbound into Buffalo, it’s not a bad backhaul market at ALL. …

Running the spot market, you have to be strategic about where you go. Don’t just play the cards where they fall; have a plan. Here’s what stands out: The Southeast and parts of Texas have some rate increases – A few blue patches are showing higher-than-average outbound rate growth. If you’re looking for a lane that might pay better, this is where to check first.

The Southeast and parts of Texas have some rate increases – A few blue patches are showing higher-than-average outbound rate growth. If you’re looking for a lane that might pay better, this is where to check first. The West is still struggling – Most of California, Arizona and the surrounding region are seeing heavy rate declines. If you’re picking up loads out West, you need to be extra careful about where you’re heading next.

The West is still struggling – Most of California, Arizona and the surrounding region are seeing heavy rate declines. If you’re picking up loads out West, you need to be extra careful about where you’re heading next. The Northeast is mixed – Some areas are holding steady, but most of the region is still seeing downward pressure on rates.

The Northeast is mixed – Some areas are holding steady, but most of the region is still seeing downward pressure on rates.

What This Means for Small Carriers

It’s clear that brokers still have pricing power, because there’s just too much capacity chasing too little freight. That means: Stay away from falling markets – If you’re in a deep red zone, don’t expect to negotiate higher rates. Move toward better-paying markets.

Stay away from falling markets – If you’re in a deep red zone, don’t expect to negotiate higher rates. Move toward better-paying markets. Don’t chase bad freight – Some of these declining markets are getting worse by the day. Know your cost per mile and walk away from loads that don’t make sense.

Don’t chase bad freight – Some of these declining markets are getting worse by the day. Know your cost per mile and walk away from loads that don’t make sense. Capitalize on blue zones – If you find yourself near a blue market, push hard for better rates. Those are the few areas where shippers are struggling to get trucks.

Capitalize on blue zones – If you find yourself near a blue market, push hard for better rates. Those are the few areas where shippers are struggling to get trucks.

Bottom Line: Stay Smart, Watch the Data, and Move With Intention

This is not the kind of market where you can just run loads without a plan. If you’re booking freight, study the trends, watch the markets, and know where the rates are actually improving.Don’t run cheap freight just to stay moving — make sure every mile counts. We’ll keep tracking this data, so stay sharp and run smart.

Market Update: Carrier Numbers Are Stabilizing — But the Market Still Has a Long Road Ahead

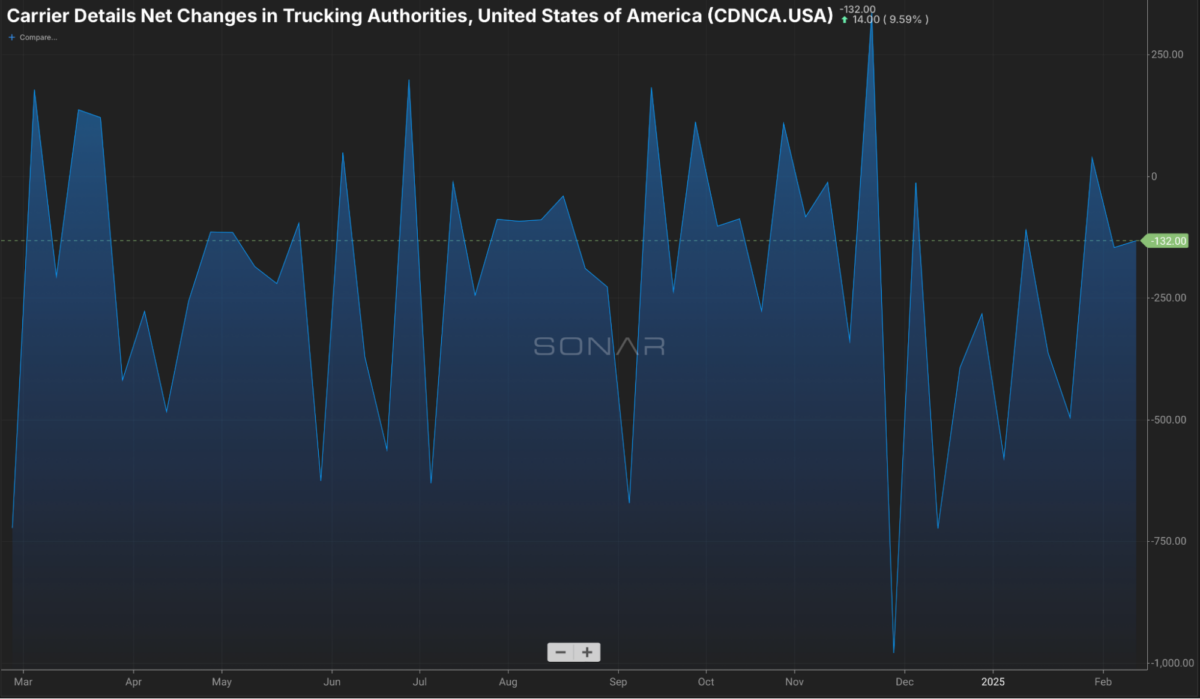

Last week, we covered the continued shutdown of small carriers, tracking the steady stream of trucking authorities being revoked month after month. This week, we’re seeing a shift — the rate of carriers exiting the market is slowing.The latest data shows a net change of minus-132 trucking authorities, a notable improvement from previous months when the losses were much deeper. While this suggests the market is stabilizing, it does not mean we’re out of the woods just yet.

What This Chart Is Showing You

This chart tracks net changes in trucking authorities, meaning how many new carriers are entering the market versus how many are shutting down. Over the past year, we’ve consistently seen more carriers exiting than starting up, leading to reduced competition in the industry.

Now, the trend is starting to level off. That means: Fewer small carriers are going out of business.

Fewer small carriers are going out of business. More carriers are sticking it out despite tough conditions.

More carriers are sticking it out despite tough conditions. The gap between new entrants and exits is shrinking — but it hasn’t flipped positive yet.This is something we’re tracking closely because, historically, a declining number of carriers combined with strong freight demand leads to higher rates. But we’re not seeing that demand piece quite yet.

The gap between new entrants and exits is shrinking — but it hasn’t flipped positive yet.This is something we’re tracking closely because, historically, a declining number of carriers combined with strong freight demand leads to higher rates. But we’re not seeing that demand piece quite yet.

What This Means for Freight Rates

We’ve said this before, and we’ll say it again: Just because fewer trucks are leaving the market doesn’t mean rates are about to take off.

Here’s why:

- There are still plenty of trucks running. The slowdown in carrier exits means the industry still has enough trucks to handle existing freight.

- Freight demand isn’t increasing fast enough. If shippers aren’t pushing out more loads, there’s no pressure on rates to rise.

- Brokers still have pricing power. As long as trucks continue to accept lower-paying loads, brokers and shippers won’t be forced to bid higher.

Think of it like this: Imagine you’re in a town with 10 gas stations. If four shut down, the remaining six can start charging more because people have fewer choices. But if those six decide to stay open despite slow business, they have to keep prices low to stay competitive. That’s exactly what’s happening in trucking right now.

What Small Carriers Should Focus on Right Now

While fewer shutdowns are a positive sign, the market is still extremely competitive. Here’s how to stay ahead: Stick to running higher-volume lanes – Not every market is struggling equally. Identify regions where freight volume is still solid.

Stick to running higher-volume lanes – Not every market is struggling equally. Identify regions where freight volume is still solid. Minimize costs – With rates still soft, keeping expenses low is key to survival. Fuel prices are dropping – take advantage of that.

Minimize costs – With rates still soft, keeping expenses low is key to survival. Fuel prices are dropping – take advantage of that. Strengthen direct and broker relationships – Shippers will always pay more to reliable carriers. Avoid relying solely on load boards.

Strengthen direct and broker relationships – Shippers will always pay more to reliable carriers. Avoid relying solely on load boards. Plan for the long haul – The market will turn eventually. Position yourself now by staying lean, efficient and focused on profitable freight.

Plan for the long haul – The market will turn eventually. Position yourself now by staying lean, efficient and focused on profitable freight.

Bottom Line: We’re Stabilizing But Not Rebounding Yet

The decline in carrier shutdowns is a sign that we’re moving toward a more balanced market, but we’re not there yet. Freight demand still needs to pick up before rates improve. Until then, small carriers that manage their costs and pick the right lanes will be in the best position when the market finally shifts.We’ll keep tracking these trends week by week, making sure you stay ahead of the curve. Stay sharp, run smart, and don’t haul for cheap.

Market Update: Too Many Trucks, Not Enough Pressure to Push Rates Up

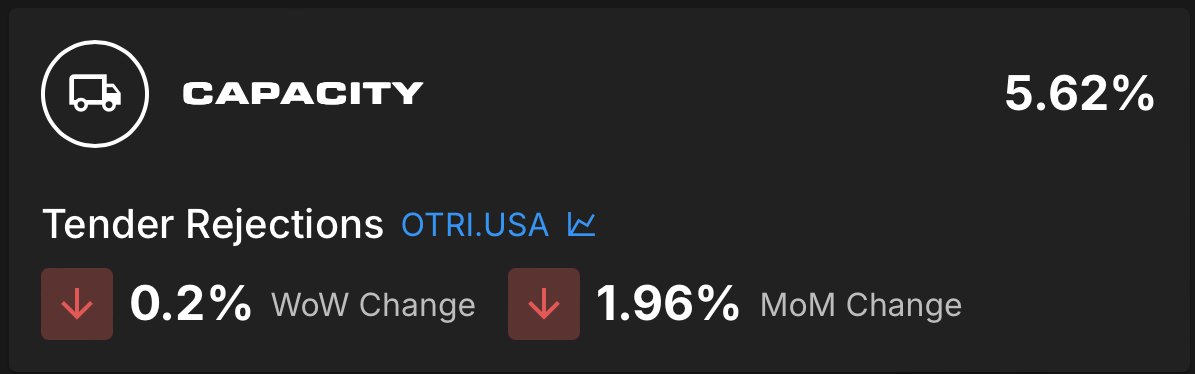

One of the most important things to understand in trucking right now is capacity — which is just a fancy way of saying how many trucks are available to haul freight. If there are too many trucks compared to the number of loads available, it means shippers and brokers have the upper hand because they don’t have to fight for trucks.Right now, the numbers are showing that capacity is still wide open — and that’s keeping rates from climbing.

Tender Rejections: What They Tell Us

Tender rejections track how often carriers turn down contract freight. If rejection rates are high, it means trucking companies are busy and are rejecting contract freight in favor of better-paying spot market loads. If rejection rates are low, it means carriers are taking whatever loads they can get because there aren’t many better options out there.

Currently, the Outbound Tender Reject Index (OTRI) is at 5.62%, and it’s been falling – down 1.96% month over month and 0.2% week over week.That tells us one big thing: Read More

Read More