The End of De Minimis: How the Trump Administration’s Trade Crackdown May Reshape Supply Chains and Global E-Commerce

The Trump Administration’s executive order targeting imports from China, Mexico, and Canada has significantly impacted global supply chains. The order focuses on tightening the “de minimis” exemption, which previously allowed foreign e-commerce companies to ship numerous small packages to the U.S. without paying taxes. For logistics and supply chain companies, this change will have major […] The post The End of De Minimis: How the Trump Administration’s Trade Crackdown May Reshape Supply Chains and Global E-Commerce appeared first on Logistics Viewpoints.

The Trump Administration’s executive order targeting imports from China, Mexico, and Canada has significantly impacted global supply chains. The order focuses on tightening the “de minimis” exemption, which previously allowed foreign e-commerce companies to ship numerous small packages to the U.S. without paying taxes.

The Trump Administration’s executive order targeting imports from China, Mexico, and Canada has significantly impacted global supply chains. The order focuses on tightening the “de minimis” exemption, which previously allowed foreign e-commerce companies to ship numerous small packages to the U.S. without paying taxes.

For logistics and supply chain companies, this change will have major impacts, influencing customs processing, shipping costs, and e-commerce fulfillment strategies. Here is what businesses need to know and how they should prepare.

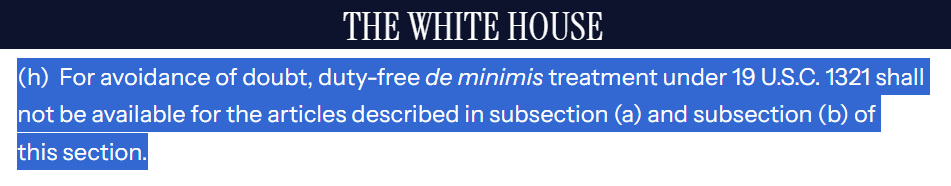

The de minimis exemption (under 19 U.S.C. 1321) permits goods valued under $800 to enter the U.S. without customs duties or extensive paperwork. Initially intended to simplify travel-related shipments, this rule has become a significant benefit for foreign e-commerce sellers, especially those in China.

Companies such as Temu, Shein, Alibaba, and JD.com have taken advantage of this loophole by shipping products directly to U.S. consumers in small packages, thereby avoiding import taxes that American retailers are required to pay. In 2023 alone, nearly a billion packages entered the U.S. under the de minimis exemption, some of which may have contained counterfeit goods, unsafe products, and potentially even chemicals used to manufacture fentanyl.

What Is the De Minimis Loophole and Why Is It Ending?

The Trump Administration’s executive order eliminates de minimis treatment for Canada, Mexico, and China, meaning all shipments from these countries—no matter how small—must now:

- Undergo full customs review.

- Be subject to tariffs (25% for Canada/Mexico, 10% for China)

- Have proper documentation.

This action is part of the Trump Administration’s comprehensive trade enforcement strategy, which includes tariffs, customs crackdowns, and emergency powers to reduce illegal imports and enhance U.S. manufacturing.

Key Impacts on Supply Chain & Logistics Companies

1. Increased Customs Processing & Delays

With de minimis eliminated, millions of shipments that previously bypassed customs will now require full documentation and tariff payments.

- Customs clearance times will increase, leading to potential delays at ports and distribution centers.

- Freight forwarders, customs brokers, and logistics providers will see a spike in processing requirements and administrative burdens.

- E-commerce platforms and direct sellers must now provide detailed customs declarations for every package, which could slow down deliveries.

2. Rising Costs for Logistics Companies

- Small-package carriers (DHL, FedEx, UPS, USPS) will need to adjust operations to manage increased customs processing, adding new costs and potential surcharges.

- Warehousing and fulfillment centers will have to implement new compliance measures, increasing overhead.

- Higher import duties may force U.S. consumers to reduce online purchases from foreign sellers, affecting overall shipment volumes.

3. Disruptions to E-Commerce Supply Chains

Foreign e-commerce retailers—especially those based in China—will feel the brunt of these changes. Companies like Temu and Shein have built their businesses around de minimis, shipping directly to U.S. consumers at ultra-low costs.

- Without de minimis, they may need to switch to bulk shipping, warehousing products inside the U.S. instead of shipping directly from China.

- Amazon and Walmart, which host thousands of Chinese third-party sellers, may see increased compliance costs and logistical challenges.

4. Increased Demand for U.S.-Based Warehousing & Distribution

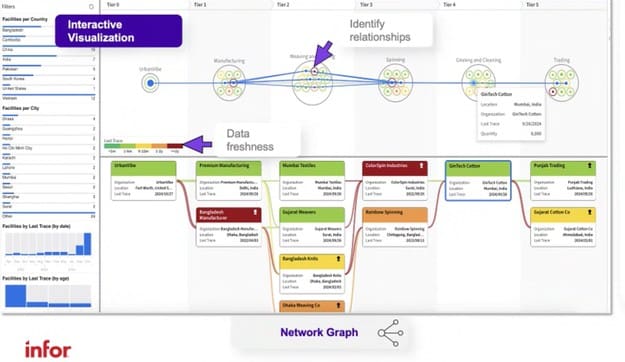

To adapt, foreign sellers may shift from direct shipping to maintaining U.S. inventory, creating new demand for warehousing, 3PL (third-party logistics) providers, and fulfillment centers.

- U.S.-based logistics companies may benefit from increased domestic storage and distribution needs.

- Retailers and manufacturers looking to avoid tariffs may expand nearshoring efforts, leading to growth in Mexican and U.S. manufacturing hubs.

5. Supply Chain Route Adjustments

With higher tariffs and customs scrutiny, businesses will look for alternative routes and trade partners:

- Companies may reroute supply chains to avoid direct China-U.S. shipments, potentially using third countries for final assembly and export.

- Some may shift production to Mexico or Southeast Asia to maintain cost advantages.

- Bulk shipping and ocean freight could see an increase in demand, as direct-to-consumer small parcel shipments become less viable.

6. Increased Compliance Risks & Smuggling Concerns

With stricter enforcement, businesses may attempt to misdeclare shipments or find creative workarounds to avoid tariffs.

- Customs audits and penalties will likely increase as authorities crack down on misreported imports.

- Logistics companies will need to be more vigilant to ensure they are not handling non-compliant shipments.

Benefits & Drawbacks

The main benefits and drawbacks of the Trump Administration’s executive order targeting imports from China, Mexico, and Canada, particularly the elimination of the de minimis exemption, are as follows:

Benefits:

- Enhanced U.S. Manufacturing: By reducing the influx of tariff-free imports, domestic manufacturers face less competition, potentially boosting U.S. manufacturing.

- Increased Demand for U.S.-Based Warehousing: Foreign sellers may shift from direct shipping to maintaining U.S. inventory, creating new demand for warehousing, third-party logistics (3PL) providers, and fulfillment centers.

- Improved Trade Regulation: The crackdown on de minimis aims to create a more regulated, secure, and balanced trade environment.

Drawbacks:

- Increased Customs Processing and Delays: With the elimination of de minimis, millions of shipments that previously bypassed customs will now require full documentation and tariff payments, leading to longer customs clearance times and potential delays at ports and distribution centers.

- Higher Costs for Logistics Companies: Small-package carriers and warehousing centers will need to adjust operations to manage increased customs processing, adding new costs and potential surcharges.

- Disruptions to E-Commerce Supply Chains: Foreign e-commerce retailers, especially those based in China, will feel the brunt of these changes. They may need to switch to bulk shipping and warehousing products inside the U.S., affecting their business models.

How Businesses Should Prepare

With the Trump Administration’s de minimis crackdown now in motion, supply chain and logistics firms must adapt quickly to the new landscape. Key steps to consider:

- Assess customs compliance strategies to avoid penalties and delays.

- Explore bulk shipping & warehousing solutions to maintain cost efficiency.

- Enhance tracking and customs documentation to streamline the new processes.

- Monitor tariff and trade policy updates to stay ahead of further regulatory changes.

The era of unchecked, duty-free small package imports is over, forcing a fundamental shift in global e-commerce logistics. Companies that adjust early will be best positioned to navigate this transformation successfully.

This tariff-driven supply chain overhaul may feel like a shock at present, but it could possibly lead to a more regulated, secure, and balanced trade environment overall. The question remains: Which businesses will evolve, and which will struggle to keep up?

The post The End of De Minimis: How the Trump Administration’s Trade Crackdown May Reshape Supply Chains and Global E-Commerce appeared first on Logistics Viewpoints.