TACO in container ship data

Ocean carriers are maintaining pricing power This chart of ocean spot rates has moved in a manner similar to stock market averages. (Chart: SONAR) By now, most of us have seen memes about a new and creative way to say “Buy the dip,” which is, of course, Trump Always Chickens Out, or TACO. In addition […] The post TACO in container ship data appeared first on FreightWaves.

Ocean carriers are maintaining pricing power

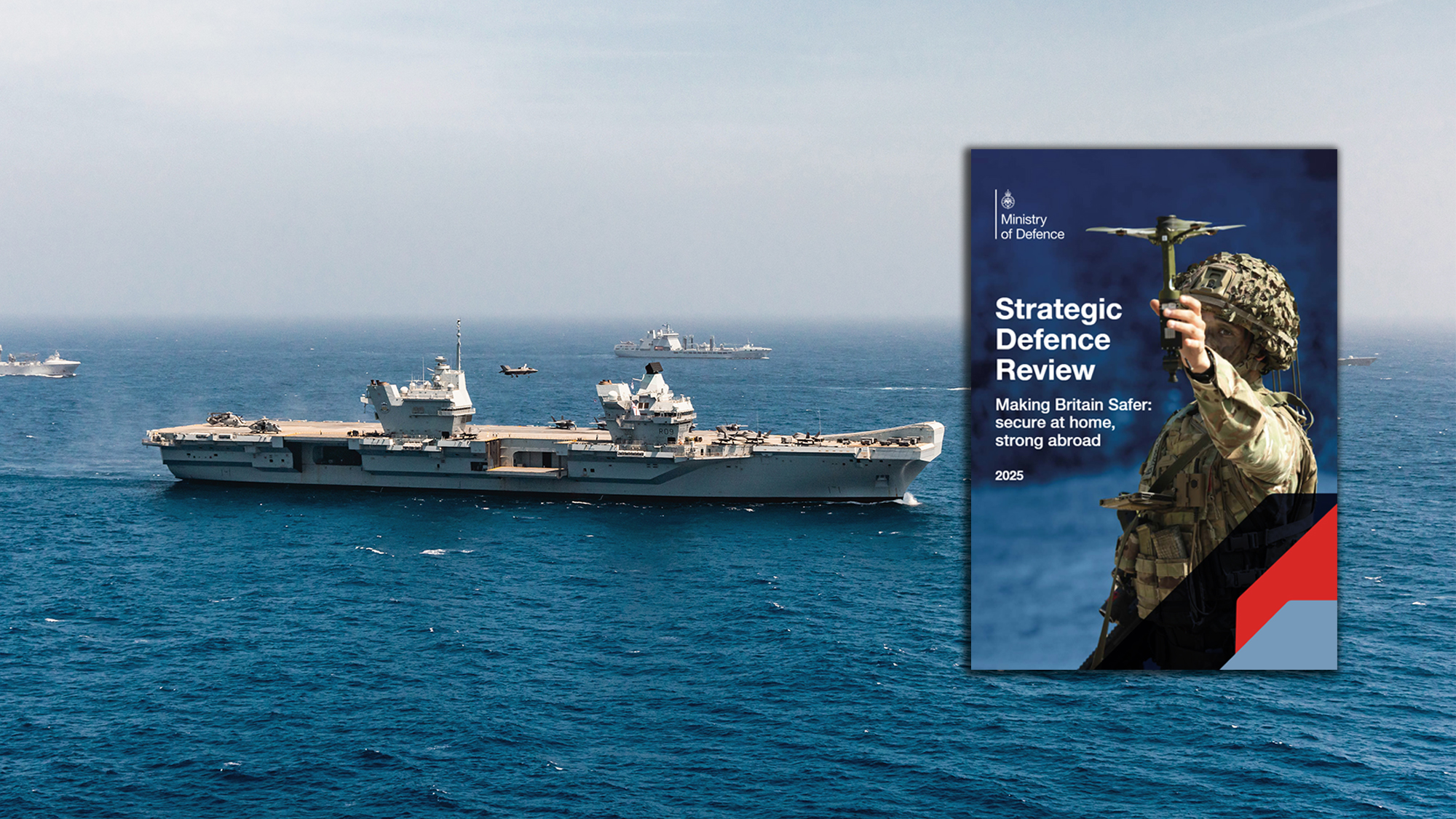

This chart of ocean spot rates has moved in a manner similar to stock market averages. (Chart: SONAR)

By now, most of us have seen memes about a new and creative way to say “Buy the dip,” which is, of course, Trump Always Chickens Out, or TACO. In addition to being a philosophy for timing stock trades, I argue it’s a way to think about supply chain management, to make measured temporary adjustments while keeping in mind that draconian tariffs will likely be cut heavily. However, they are unlikely to go away entirely during the current administration since the courts are unlikely to end the trade war.

Ocean spot rates from China to the U.S. have risen, though that is currently impacted by a 90-day delay in most tariffs. Following the announcement of triple-digit tariffs on Chinese goods on “Liberation Day,” Chinese factories did not shut down like they did during COVID. Rather, they kept producing while withholding overseas shipments (or zone skipping to another region.) That created pent-up demand for container shipments. Ocean carriers responded by blanking sailings – our data showed that as many as 20% of booked containers were canceled – and kept sailing times slow, a method that saves fuel while also rationalizing capacity. As a result, ocean rates held up in April and early May better than many would have expected and have bounced the past few weeks. That can be seen in numerous ocean spot rate datasets in SONAR, including the ocean spot rate from Yantian to Los Angeles, which is shown above.

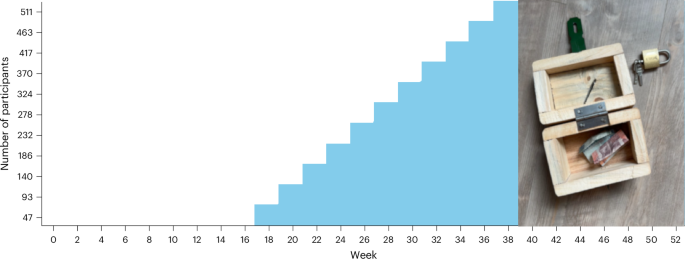

Ocean booking volume came roaring back after the 90-day delay to tariffs in China. Average lead time between booking and departure date increased from 11-12 days in April to 15-17 days the past few weeks as some shippers looked to secure capacity for later departure dates. (Chart: SONAR Container Atlas app)

For additional detail, including stories on immigration reform and fraud in supply chains, sign up for The Stockout Newsletter.

The post TACO in container ship data appeared first on FreightWaves.

![[Video] The Weekly Break Out Ep. 20: Pacific policy in Singapore and the UK’s new defense plan](https://breakingdefense.com/wp-content/uploads/sites/3/2025/06/Break-Out-ep-20-thumb-Play-Button.jpg?#)