J.B. Hunt working on intermodal mix, awaiting rate inflection

J.B. Hunt Transport Services said it will focus on what it can control as the industry awaits a meaningful recovery. The post J.B. Hunt working on intermodal mix, awaiting rate inflection appeared first on FreightWaves.

J.B. Hunt Transport Services said it’s focused on finding the right intermodal freight to improve efficiency and minimize costs as market fundamentals remain tepid.

The Lowell, Arkansas-based multimodal transportation provider outlined a three-pronged approach centered on rates, volumes and freight mix for the current intermodal bid season at Barclays 42nd Annual Industrial Select Conference held in Miami on Wednesday.

While rate increases are the most impactful lever the company has to drive margins higher, it may have to settle for improving mix as there is no guarantee pricing will move up materially this year with capacity readily available.

J.B. Hunt (NASDAQ: JBHT) said it’s focused on winning the right freight that allows it to run a balanced network with minimal empty containers and repositioning costs. It views freight selection as the primary “controllable” at this point of the cycle.

“It might not necessarily do a lot to revenue per load or rate or yield, but it can do a lot in terms of making us more efficient and productive with our assets and with utilization,” said Brad Delco, senior vice president of finance.

The unit saw record volumes for a second straight time during the fourth quarter, but the operating ratio (inverse of operating margin) deteriorated 170 basis points year over year to 92.7%. Equipment repositioning costs from network imbalances and peak season hiring expenses were the culprits, along with a decline in revenue per load.

J.B. Hunt’s long-term operating margin target for intermodal is 10% to 12% (90% to 88% OR). Part of the recent overhang on the business is the company’s decision to grow capacity ahead of demand. J.B. Hunt has been carrying incremental costs tied to equipment acquisitions but believes the gamble on capacity will pay off over time. It estimates there are 7 million to 11 million loads that should be moved off the highway and onto the railroads.

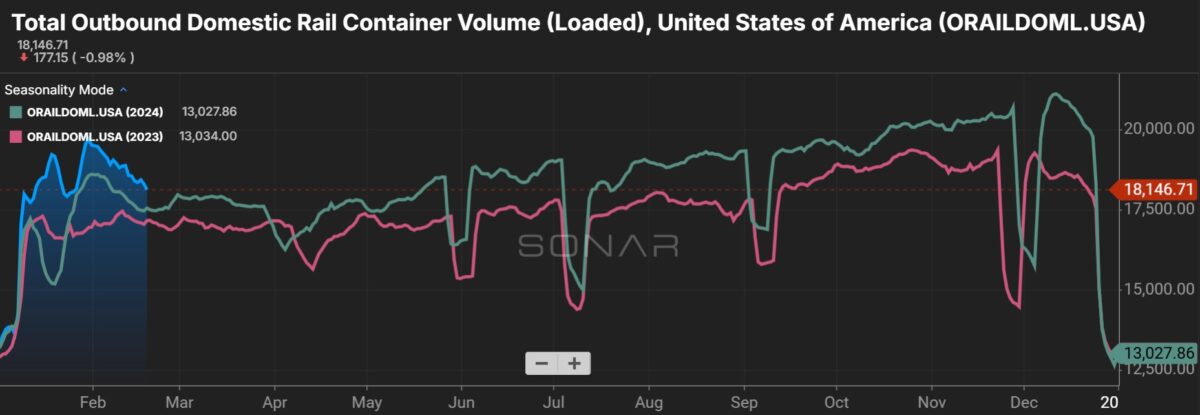

On the current demand front, management said it’s “still a little too early” to say what intermodal rates will do this year. It said more will be known in May and June but also noted that March is an important month. Importantly, it said the recent volume surge is not from customers pulling forward inventory due to tariff concerns as some analysts have suggested. It also said some customers have indicated they will be converting truck shipments to the rails this year as one-way truckload rates rise.

It said the fact that it has nothing negative to report after a 30-month-plus freight recession is a positive. It believes the market has reached an inflection, noting normal seasonal trends from the fourth to the first quarter.

The company guided to a 20% to 25% sequential decline in consolidated operating income for the first quarter during its fourth-quarter call one month ago.

Management reiterated its expectation for dedicated account losses to end in the second quarter.

J.B. Hunt spent 2024 adding more than 1,700 trucks into service at new or existing customers, but those additions only offset account shrinkage and customer losses. It expects to get back to a net addition run rate of 800 to 1,000 trucks annually and views dedicated as a $90 billion market.

It noted that new accounts are usually unprofitable in the first three months, reaching breakeven by month six, and profitability thereafter. That means it will likely continue to run under a long-term margin target of 12% to 14% in the near term.

The company’s 2025 capital expenditures budget doesn’t include trailing equipment purchases. It could be awhile before those investments are required again.

Shares of JBHT were down 2.7% at 2:52 p.m. EST on Thursday, a down day for trucking and intermodal providers. The S&P 500 was up 0.3% at the time.

More FreightWaves articles by Todd Maiden:

- Jack Cooper LTL caper concludes

- Cass TL linehaul index up y/y for first time in 2 years

- Knight-Swift headlines buyers in latest Yellow terminal sale

The post J.B. Hunt working on intermodal mix, awaiting rate inflection appeared first on FreightWaves.