How soon will drivers see price hikes from Trump's tariffs?

A one-month pause on tariffs has eased pressure on automakers, but they’re not in the clear yet.

Far-reaching tariffs on imports from Mexico and Canada sent the automotive industry spiraling earlier this week as share prices dipped and companies considered shifting their production strategies. The tariffs, which were set to take effect on Feb. 4, were paused for one month after President Trump reached agreements with leaders from Mexico and Canada to increase border enforcement.

Some experts have suggested that President Trump only plans to use tariffs as negotiating tools, but the president has yet to abandon the tariffs completely, even after achieving concessions from neighboring countries. Should the tariffs take effect, consumers could see vehicle prices begin to rise within just a couple of months.

Related: 2025 Honda Prologue vs Chevy Blazer EV: The same but different

A short buffer for consumers

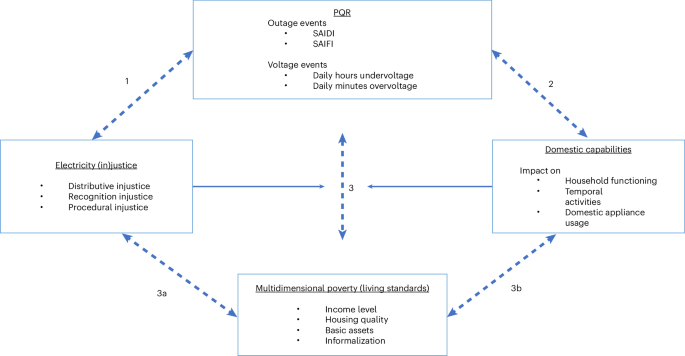

If Trump’s tariffs take effect next month, consumers are unlikely to see price increases until the current inventory is sold, according to Felipe Muñoz, a senior analyst at auto consulting firm JATO Dynamics. Across the industry, that could mean a roughly two-month buffer between tariffs starting and prices increasing at the dealership, Muñoz said.

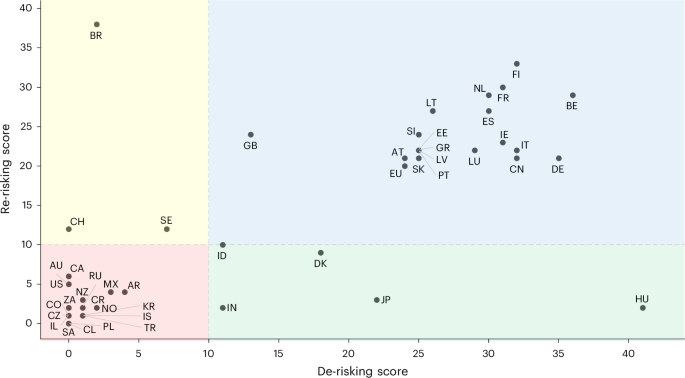

That timeline can fluctuate between manufacturers, some of which are more reliant on foreign production or have lower inventory levels than their rivals. About 18% of the 16.1 million cars sold in the U.S. last year were made in Canada and Mexico, according to data from JATO Dynamics.

That portion is much higher for automakers like Volkswagen. Last year, Mexican-made VWs made up 44% of the company’s U.S. sales, making it particularly vulnerable to added costs from tariffs. Other mass-market automakers like Toyota are also vulnerable. Just over 25% of the vehicles Toyota sold in the U.S. in 2024 were produced in Canada and Mexico. The company also has just 36 days of supply in its U.S. inventory, less than half the industry average, according to the latest figures from Cox Automotive.

Related: 2025 Cadillac Escalade IQ pushes technology to new heights

A plea for carveouts

Automakers and parts suppliers have been clear about their opposition to the proposed tariffs. Flavio Volpe, president of Canada’s Automotive Parts Manufacturers’ Association, told Bloomberg News that the auto sector would shut down within a week of the tariffs being imposed. “At 25%, absolutely nobody in our business is profitable by a long shot,” Volpe said.

Automakers are trying to speed up imports to the U.S. during the current 30-day pause, but stock-pilling vehicles is far from a long-term solution. Matt Blunt, president of the American Automotive Policy Council that represents Ford, GM, and Stellantis, said that they would like to see an exemption carved out from Trump’s tariffs for vehicles and parts that meet the USMCA’s domestic and regional content requirements.

“Our American automakers, who invested billions in the U.S. to meet these requirements, should not have their competitiveness undermined by tariffs that will raise the cost of building vehicles in the United States and stymie investment in the American workforce,” Blunt said in a written statement.

Related: How Bring a Trailer pulled off $1.5 billion in auction sales

Are American-made cars safe?

Automakers, including General Motors, Audi, and Porsche, are considering moving more production to the United States in response to Trump’s tariffs. GM announced last month that it is exploring ways to produce more pickups domestically, where it has available factory space. Volkswagen Group, meanwhile, is considering utilizing its underused Chattanooga, Tennessee, plant to assemble large Porsche and Audi SUVs. The question is: will production in the U.S. shield vehicles from tariff-induced price hikes?

Even if a car is technically assembled in the United States, some portion of the parts are often sourced from auto parts suppliers in Mexico and Canada. Cox Automotive estimated that the average tariff on models assembled in neighboring countries or assembled with parts from those countries would increase the cost of a vehicle by $5,855. That amounts to nearly 17% of an average new-vehicle price, on average.

Of course, that percentage can range anywhere from 3% to 25%, depending on the vehicle. Domestically produced vehicles with some imported parts will likely fall on the lower end of the spectrum, but they still can’t escape it.

“It is likely that not all the costs will be passed directly to buyers, but one reality is hard to ignore: Prices will go up for suppliers, for automakers, and for buyers,” the Cox Automotive team wrote earlier this week. “The impact on ‘affordable’ vehicles would likely make many of them unviable in the U.S. market.”

Related: Nissan shares fly as a new partner enters deal talks

Is the European Union next?

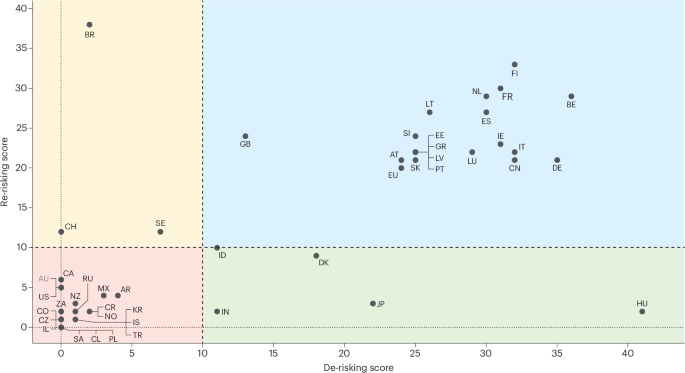

Last year, U.S. sales of vehicles from European Union plants surpassed 820,000 units, exceeding the total sales of Canadian-made cars in the country. Three German automakers—Volkswagen Group, Mercedes-Benz, and BMW Group—accounted for 73% of that total. While Mexico remained Volkswagen Group’s largest source of U.S. imports, the EU was the primary origin for Mercedes-Benz vehicles sold stateside.

“While it’s difficult to predict the next move from the Trump administration on trade, the policies implemented in its first month signal a broader shift,” Muñoz said “Importing cars into the U.S. is becoming more challenging across the board, and the European Union should brace for potential trade restrictions.”

Related: Stellantis' future takes a wild turn after CEO exit

Final thoughts

The one-month pause on tariffs has given automakers a brief reprieve, but uncertainty looms large over the industry. Even if negotiations lead to adjustments or exemptions, the broader trend suggests that importing vehicles into the U.S. is becoming more costly and complex. Consumers may not feel the impact immediately, but price hikes appear inevitable if tariffs move forward.

For automakers, the pressure is mounting to rethink supply chains and production strategies, whether through stockpiling, shifting manufacturing to the U.S., or pushing for carveouts. However, as past trade policies have shown, these adjustments take time—and in the meantime, buyers, suppliers, and manufacturers alike will be left navigating an unpredictable market.

Love reading Autoblog? Sign up for our weekly newsletter to get exclusive articles, insider insights, and the latest updates delivered right to your inbox. Click here to sign up now!

Related: 2025 Lexus LX 700h review: A hybrid SUV that defies expectations