FW25 collections under pressure: tariffs reshape pricing and production timelines

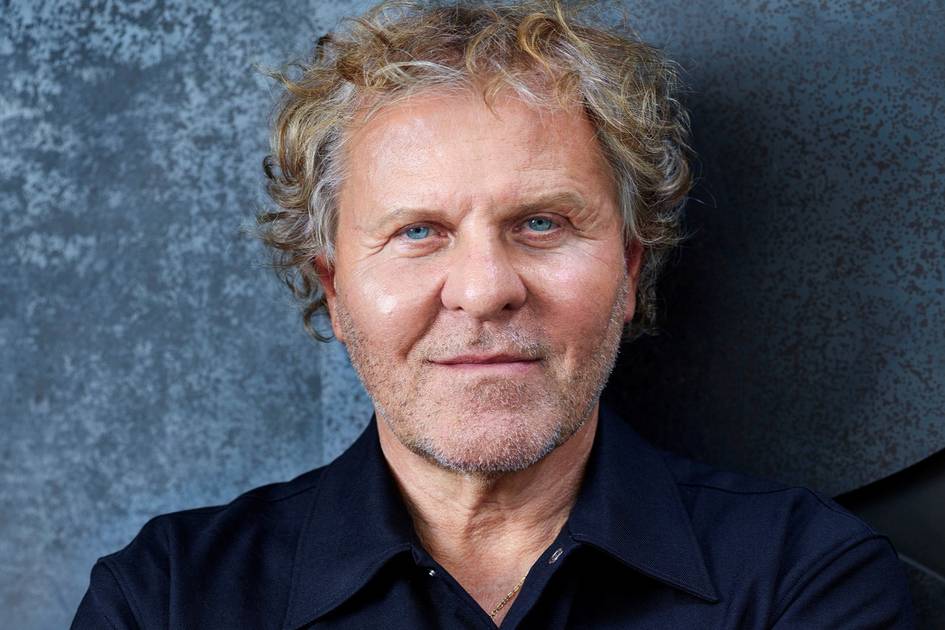

FW25 collection showed at tradefair Modefabriek. Credits: FashionUnited / Photo by Alicia Reyes Sarmiento The fashion industry's meticulous planning for the Fall/Winter 2025 season has been thrown into turmoil. As buyers finalize orders, a seismic shockwave in the form of sweeping new tariffs has collided with supply chains, forcing U.S. retailers to confront a perfect storm of logistical disruptions, pricing dilemmas, and escalating financial risk. This tariff shock, impacting orders placed throughout the first half of 2025 for delivery in the latter half, injects unprecedented uncertainty into a process normally defined by carefully calculated lead times and pre-determined costs. In what many in the industry describe as a “tariff shock,” the Trump administration’s expanded list of trade penalties — covering China (104 percent), Vietnam (46 percent), Bangladesh (37 percent), and India (27 percent) — is set to reshape how brands source, price, and deliver collections over the next 18 months. The Fall/Winter 2025 season, traditionally ordered in the first half of 2025 and shipped between July and September, now falls into a period of extreme volatility. Apparel retailers and distributors are most likely recalculating their margins, and some brands are certainly delaying purchase orders, others are revisiting vendor relationships or renegotiating prices. Pricing pressures and profitability at risk According to The Fashion Law, most brands are expected to implement price increases in the low single digits, typically between 5 and 8 percent, in order to cushion the blow. For a retail item priced at 90 dollars, that could mean a final tag closer to 97 or 98 dollars — a significant adjustment in a price-sensitive market. For a retailer with a typical margin of, say, 40 percent, absorbing a 5-8 percent tariff-induced cost increase could translate to a 12-20 percent reduction in net profit for affected items. Also read From margins to sell-through: Important figures used in the fashion industry But while these adjustments might help brands maintain profitability, they could also have downstream consequences. Lower sales not only reduce revenue but also trigger a cascade effect: increased inventory holding costs, higher markdown rates, and potential damage to brand perception if price increases are perceived as excessive. Supply chain disruptions and vendor strain The supply chain impact is equally critical. Vendors in tariff-affected countries now face slower order volumes and uncertainty around pricing, which may lead to delays in production and shipping. This volatility manifests as unpredictable order volumes, fluctuating raw material costs, and pressure on suppliers to absorb losses, which can lead to delayed production and compromised quality. In countries like Bangladesh and Vietnam, where large-scale manufacturing depends on high and predictable U.S. demand, some suppliers are already reporting a drop in confirmed orders for Q3 and Q4. The pressure to renegotiate contracts and push suppliers for lower prices strains long-term partnerships, potentially undermining ethical sourcing practices and supply chain stability. The limitations of supply chain diversification highlight the inherent fragility of a fashion industry built on complex global sourcing networks, where disruptions in one region inevitably ripple across the entire system. Moreover, supply chain diversification, often touted as a solution to tariff exposure, offers limited relief. With most major sourcing destinations now affected, brands can no longer simply shift orders from one country to another. Domestic production, theoretically a fallback, still represents less than 2 percent of apparel consumption in the U.S., and the infrastructure needed to scale is years away. While some companies are experimenting with automated nearshoring pilot programs, the widespread adoption of robotics for complex garment assembly remains years away, particularly for intricate designs and varied fabric types. Retailers are also juggling contractual constraints: many entered agreements before tariffs were announced, locking them into prices that no longer reflect real costs. The contractual dilemma forces retailers into a high-stakes gamble: either absorb potentially crippling losses on existing orders or engage in difficult renegotiations that risk damaging supplier relationships and delaying deliveries. Whether brands eat the difference or renegotiate remains to be seen — but either way, the pressure is rising. Consumer behavior and industry repercussions Some are turning to strategic assortment curation — reducing SKU counts, eliminating lower-margin products, or switching fabrics and finishes to preserve profitability. This strategic curation aligns with a growing consumer preference for timeless, high-quality pieces, but it also raises concerns about reduced consumer choice and potential job losses in design and manufacturing. Others may lean into “

The fashion industry's meticulous planning for the Fall/Winter 2025 season has been thrown into turmoil. As buyers finalize orders, a seismic shockwave in the form of sweeping new tariffs has collided with supply chains, forcing U.S. retailers to confront a perfect storm of logistical disruptions, pricing dilemmas, and escalating financial risk. This tariff shock, impacting orders placed throughout the first half of 2025 for delivery in the latter half, injects unprecedented uncertainty into a process normally defined by carefully calculated lead times and pre-determined costs.

In what many in the industry describe as a “tariff shock,” the Trump administration’s expanded list of trade penalties — covering China (104 percent), Vietnam (46 percent), Bangladesh (37 percent), and India (27 percent) — is set to reshape how brands source, price, and deliver collections over the next 18 months. The Fall/Winter 2025 season, traditionally ordered in the first half of 2025 and shipped between July and September, now falls into a period of extreme volatility. Apparel retailers and distributors are most likely recalculating their margins, and some brands are certainly delaying purchase orders, others are revisiting vendor relationships or renegotiating prices.

Pricing pressures and profitability at risk

According to The Fashion Law, most brands are expected to implement price increases in the low single digits, typically between 5 and 8 percent, in order to cushion the blow. For a retail item priced at 90 dollars, that could mean a final tag closer to 97 or 98 dollars — a significant adjustment in a price-sensitive market. For a retailer with a typical margin of, say, 40 percent, absorbing a 5-8 percent tariff-induced cost increase could translate to a 12-20 percent reduction in net profit for affected items.

But while these adjustments might help brands maintain profitability, they could also have downstream consequences. Lower sales not only reduce revenue but also trigger a cascade effect: increased inventory holding costs, higher markdown rates, and potential damage to brand perception if price increases are perceived as excessive.

Supply chain disruptions and vendor strain

The supply chain impact is equally critical. Vendors in tariff-affected countries now face slower order volumes and uncertainty around pricing, which may lead to delays in production and shipping. This volatility manifests as unpredictable order volumes, fluctuating raw material costs, and pressure on suppliers to absorb losses, which can lead to delayed production and compromised quality. In countries like Bangladesh and Vietnam, where large-scale manufacturing depends on high and predictable U.S. demand, some suppliers are already reporting a drop in confirmed orders for Q3 and Q4. The pressure to renegotiate contracts and push suppliers for lower prices strains long-term partnerships, potentially undermining ethical sourcing practices and supply chain stability.

The limitations of supply chain diversification highlight the inherent fragility of a fashion industry built on complex global sourcing networks, where disruptions in one region inevitably ripple across the entire system.

Moreover, supply chain diversification, often touted as a solution to tariff exposure, offers limited relief. With most major sourcing destinations now affected, brands can no longer simply shift orders from one country to another. Domestic production, theoretically a fallback, still represents less than 2 percent of apparel consumption in the U.S., and the infrastructure needed to scale is years away. While some companies are experimenting with automated nearshoring pilot programs, the widespread adoption of robotics for complex garment assembly remains years away, particularly for intricate designs and varied fabric types.

Retailers are also juggling contractual constraints: many entered agreements before tariffs were announced, locking them into prices that no longer reflect real costs. The contractual dilemma forces retailers into a high-stakes gamble: either absorb potentially crippling losses on existing orders or engage in difficult renegotiations that risk damaging supplier relationships and delaying deliveries. Whether brands eat the difference or renegotiate remains to be seen — but either way, the pressure is rising.

Consumer behavior and industry repercussions

Some are turning to strategic assortment curation — reducing SKU counts, eliminating lower-margin products, or switching fabrics and finishes to preserve profitability. This strategic curation aligns with a growing consumer preference for timeless, high-quality pieces, but it also raises concerns about reduced consumer choice and potential job losses in design and manufacturing. Others may lean into “quiet luxury” narratives, justifying price hikes by emphasizing craftsmanship and timeless design.

In parallel, consumers could become more selective, especially if inflation remains high or recession fears deepen. Consumers, increasingly mindful of both economic uncertainty and the environmental and social costs of fast fashion, may prioritize value, durability, and ethical sourcing over fleeting trends, further reshaping demand patterns. The U.S. fashion market, valued at 400 billion dollars in 2024, accounts for 22 percent of global industry spending, according to Uniform Market. A contraction in U.S. consumer spending would not only impact American retailers but also send shockwaves through the global fashion industry, affecting supplier nations and brands that rely heavily on the U.S. market for revenue growth.

The Fall/Winter 2025 season, therefore, represents a critical inflection point for the fashion industry. Beyond a test of immediate resilience, it forces a fundamental reckoning with the vulnerabilities of globalized supply chains and the true cost of trade policies. The choices made by brands and retailers in the coming months will not only determine their profitability in the short term but could also reshape the industry's structure, sourcing practices, and relationship with consumers for years to come. The question remains: will the industry emerge from this crisis stronger and more sustainable, or will it succumb to a race to the bottom in pursuit of short-term survival?