February freight trends mixed, outlook ‘fraught with uncertainty’

Cass data for February showed a bounce back in shipments after a messy January, but uncertainty now hangs over a tepid demand environment. The post February freight trends mixed, outlook ‘fraught with uncertainty’ appeared first on FreightWaves.

February data from Cass Information Systems showed a claw back of what was lost to weather in January, but uncertainty overhangs an already sluggish freight market.

Freight volumes snapped back in February, up 10.5% from January, but remained pressured compared to last year, down 5.5% year over year. Normal seasonality, a recovery from harsh weather in January and shippers importing goods ahead of tariffs were cited as catalysts behind the latest sequential change.

February shipments increased just 4.9% sequentially on a seasonally adjusted basis.

The report cautioned that February’s positive trend could unwind in March as trade policy uncertainty looms. March is historically the strongest demand month of the quarter. If normal seasonal patterns persist, the shipments index should be down between 3% and 4% y/y (an implied 2% sequential increase), the report said.

| February 2025 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -5.5% | -9.7% | 10.5% | 4.9% |

| Expenditures | -4.6% | -23.4% | 3.6% | -0.3% |

| TL Linehaul Index | 1.9% | -3.6% | 1.2% | NM |

Cass’ freight expenditures dataset, which captures total freight spend including fuel, increased 3.6% sequentially in the month (off 0.3% seasonally adjusted) but was down 4.6% y/y. Retail diesel fuel prices were off 9% y/y in the month.

With shipments off 5.5% y/y but expenditures down just 4.6%, inferred freight rates were likely 1% higher y/y in the month, “further aligned with the more modest increases in contract rates which seem prevalent these days,” the report said.

The inferred rate index was off 6.2% from January (down 4.9% seasonally adjusted), negatively impacted by a freight mix favoring lower-cost modes.

“After a 7% decline in 2024, freight rates are starting 2025 on track for low- to mid-single-digit increases in 2025,” the report said.

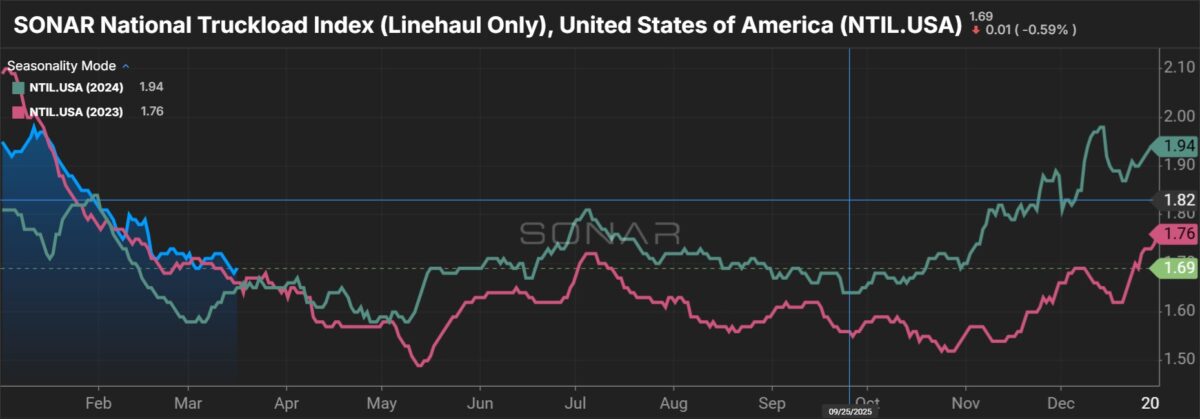

The Truckload linehaul index, which tracks rates without fuel and accessorial surcharges, logged a sixth straight sequential increase in February, up 1.2% from January and 1.9% y/y.

The dataset was down 3.6% on a two-year-stacked comparison, the smallest two-year decline since July 2023.

“While the outlook is fraught with uncertainty, and freight demand will be challenged by tariffs, we highlight a silver lining for the for-hire freight market amid rising recession risk,” the report said. “Elevated uncertainty may be turning the tide of private fleet capacity additions after a long for-hire downturn.”

It said even if the lower nitrogen oxide emissions standards for 2027 don’t come to fruition, tractor prices could still increase by $20,000 per unit “if/when the USMCA exemption ends (currently paused until April 2nd).” That would result in a supply shock pushing freight rates higher, the report said. The USMCA is the United States-Mexico-Canada Agreement on trade.

Data used in the indexes comes from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $36 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden:

- Knight-Swift adds LTL veteran to board as it targets Northeast expansion

- ArcBest takes on TL freight to fill empty capacity

- Deutsche Bank eyes industrial rebound, endorses these transportation stocks

The post February freight trends mixed, outlook ‘fraught with uncertainty’ appeared first on FreightWaves.

![Restoration of Li+ pathways in the [010] direction during direct regeneration for spent LiFePO4](http://pubs.rsc.org/services/images/RSCpubs.ePlatform.Service.FreeContent.ImageService.svc/ImageService/image/GA?id=D5EE00641D)

.jpg)