Expect ‘subdued’ peak container season in wake of tariffs, says analyst

The Trump administration is reshaping global trade, and the effects are being felt in the ocean and air freight sectors. The post Expect ‘subdued’ peak container season in wake of tariffs, says analyst appeared first on FreightWaves.

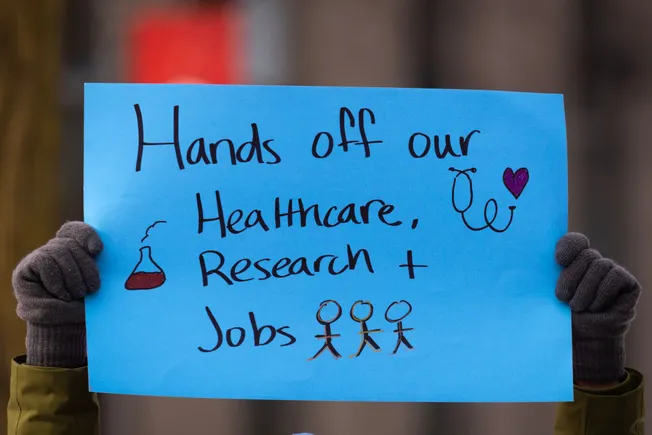

Recent policy changes by the Trump administration — call it an upheaval — are reshaping the dynamics of international commerce, and have profound implications for freight and logistics, says a supply chain analyst.

The scope of the current tariff implementations is unprecedented, both in terms of the levels applied to China and the high rates extended to other U.S. trading partners, said Judah Levine, head of research for Freightos, in a new report. Unlike previous trade tensions where flows simply shifted, the breadth of these tariffs means U.S. import costs will inevitably rise.

Most economists now predict slower U.S. gross domestic product (GDP) growth, an increased likelihood of recessions both domestically and globally, and a potential contraction in global trade. These factors will inevitably impact the freight market, particularly ocean freight and air cargo, said Levine.

For businesses relying on international trade, adaptability will be key. Levine said these strategies may include diversifying supply chains, exploring alternative shipping methods, and closely monitoring policy developments. While challenges lie ahead, he said, it is possible to find opportunities amid the disruption.

Levine advised providers to stay informed and agile, as the coming months will likely reshape the freight industry in ways we’re only beginning to understand.

Waves of uncertainty

In the ocean freight sector, anticipation of new tariffs has driven U.S. importers to frontload inventory since November 2024. This pull-forward effect has kept ocean import container volumes unusually strong. However, the landscape is about to change dramatically.

With reciprocal tariffs not applying to goods loaded before April 9, Levine said that there may be a brief scramble pushing container rates and demand up for a few days. But this is likely to be followed by a significant drop in volumes and rates as importers pause orders to let the tariff situation stabilize.

This pattern could lead to a subdued peak season, reminiscent of how tariff-driven frontloading in 2018 led to lower container rates and demand in 2019. Once inventories run down, the strength of the container market will hinge on the broader economic impacts of the trade war. Earlier, the Port of Los Angeles predicted container volumes will decline 10% in the second half of the year.

The container sector is reacting in other ways. Major ocean lines have blanked dozens of voyages while they wait for the tariff changes to settle, and U.S. exporters of agricultural products have reported difficulties obtaining vessel capacity amid proposed U.S. port charges on ships built in China.

Turbulence ahead

The air cargo sector is already feeling the effects of these policy shifts. Levine said Chinese e-commerce platforms, anticipating changes to de minimis rules, have begun diversifying their strategies. They’re moving manufacturing to countries like Vietnam, increasing ocean logistics usage, and investing in warehousing capabilities in Mexico and the U.S.

The industry is also seeing canceled China-U.S. Block Space Agreements (BSAs) and charters, with carriers redistributing capacity to other routes. While China-U.S. air cargo spot rates have eased, they remain higher than historical norms. The upcoming May 2 rollout of new policies is expected to cause a brief surge in demand, followed by a sharp drop in rates on this lane.

However, the ripple effects may extend beyond U.S.-China routes. As capacity is redistributed, we could see downward pressure on rates across many lanes. Shippers should also be prepared for potential customs delays if new systems aren’t fully implemented.

Find more articles by Stuart Chirls here.

Related coverage:

Port of LA’s Seroka says tariffs to cut container volumes by 10%

Tariff backdrop finds ocean rates steady

As China blocks terminals deal, BlackRock chief says ports ‘will define the future’

China port fees need more nuanced strategy, shipping industry tells hearing

The post Expect ‘subdued’ peak container season in wake of tariffs, says analyst appeared first on FreightWaves.

![F/A-XX hints, icebreaker ambitions and previewing day two of Sea Air Space [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/04/250407_SAS_2025_indopac_WELCH-scaled-e1744076170241.jpg?#)