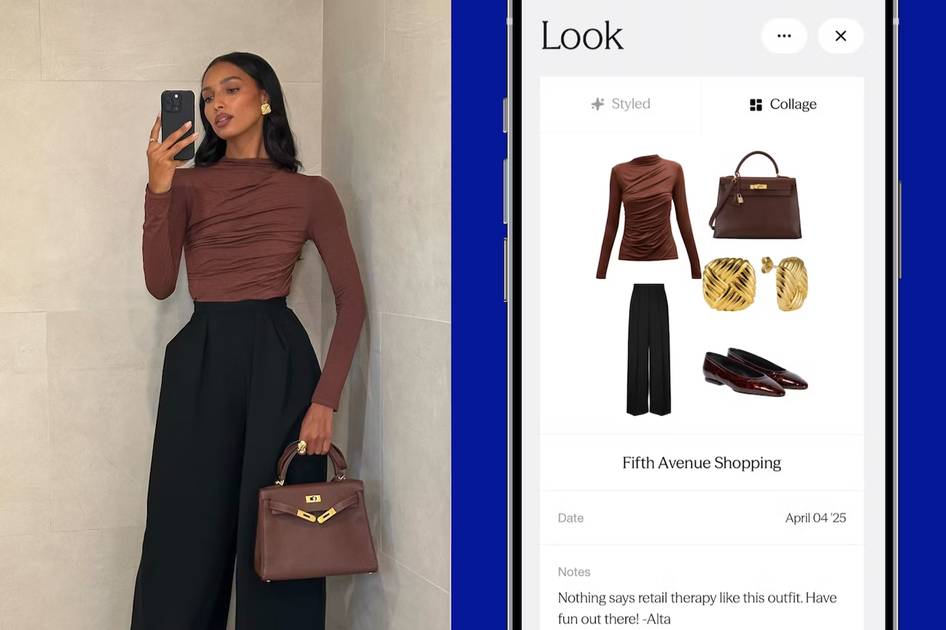

e.l.f. Beauty Shares Plunge Over 20% as Mass Beauty Demand Slows

e.l.f. Beauty's shares dropped more than 20% in extended trading after the brand cut its annual sales and profit forecasts due to weakening demand in the mass beauty category. The post e.l.f. Beauty Shares Plunge Over 20% as Mass Beauty Demand Slows appeared first on Global Cosmetics News.

THE WHAT? e.l.f. Beauty’s shares dropped more than 20% in extended trading after the brand cut its annual sales and profit forecasts due to weakening demand in the mass beauty category.

THE DETAILS

- e.l.f. now expects annual sales between US$1.30 billion and US$1.31 billion, down from its previous forecast of up to US$1.335 billion.

- Profit expectations were also reduced to a range of US$3.27 to US$3.32 per share, down from US$3.47 to US$3.53.

- CEO Tarang Amin noted that demand in the mass beauty channel was softer in January, with some newer product launches off to a slower start.

- Gen Z consumers, e.l.f.’s core audience, face distractions from economic and political uncertainty, as well as concerns over TikTok’s future, which could impact brand engagement.

- The imposition of a 10% tariff on imports from China may force price increases, as 80% of e.l.f.’s products are still manufactured there.

- Despite challenges, Q3 sales surged 31% to US$355.32 million, beating analyst expectations of US$329.67 million.

THE WHY? Despite strong growth in previous quarters, slower-than-expected launches and economic uncertainty have impacted performance, prompting a lower revenue outlook for the fiscal year.

The post e.l.f. Beauty Shares Plunge Over 20% as Mass Beauty Demand Slows appeared first on Global Cosmetics News.

.jpg)