Better-than-expected industrial production data hides softness

Utility power production during cold weather was behind the growth in industrial production in January. The post Better-than-expected industrial production data hides softness appeared first on FreightWaves.

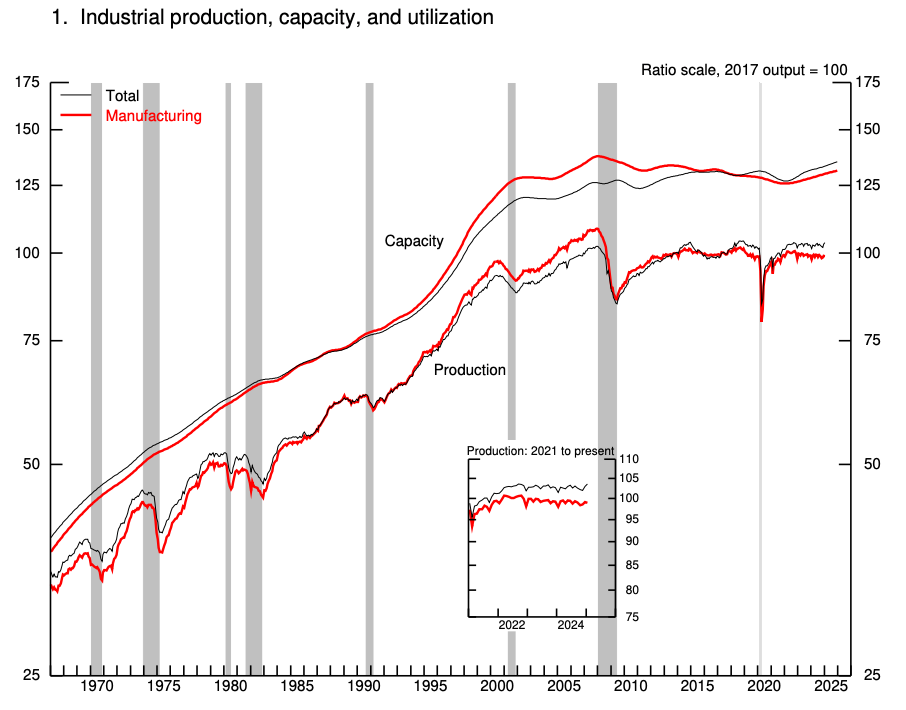

U.S. industrial production increased more than expected in January, driven by a surge in utilities output due to cold weather that obscured underlying weakness in manufacturing and mining, which both declined. The Federal Reserve reported on Friday that industrial production rose 0.5% last month, surpassing economists’ forecasts of a 0.3% gain.

The better-than-expected headline figure comes after a 1% jump in December, which was revised up from the initially reported 0.9% increase. Compared to a year earlier, total industrial production was up 2% in January.

“The industrial production report was choppy in January with obvious weather effects boosting utilities demand and weighing on mining and manufacturing,” said Bill Adams, chief economist for Comerica Bank. “These short-term fluctuations will fade quickly.”

Breaking down the data, utilities output spiked 7.2% in January as frigid weather across much of the country boosted demand for heating. This outsize gain in utilities masked weakness in other sectors.

Manufacturing output, which accounts for about 75% of total industrial production, edged down 0.1% in January after rising 0.5% in December. The decline was led by a 5.2% drop in motor vehicles and parts production. Excluding the volatile auto sector, manufacturing output dipped just 0.1%.

“The decrease in manufacturing output in January was held down by a 5.2 percent decrease in the index for motor vehicles and parts,” the Fed noted in its release.

The mining sector, which includes oil and gas extraction, saw output fall 1.2% in January following a 2% gain in December. The Fed attributed the decline largely to an 18.1% drop in coal mining.

Looking at major market groups, consumer goods production increased 0.8% in January, with nondurable consumer goods rising 1.8% while durable consumer goods fell 3%. Business equipment output jumped 2.1%, boosted by a strong increase in the production of civilian aircraft. Construction supplies dipped 0.2%.

Capacity utilization, which measures how fully firms are using their resources, ticked up to 77.8% in January from 77.5% in December. This remains 1.8 percentage points below its long-run average from 1972 to 2024.

Manufacturing capacity utilization edged down 0.1 percentage point to 76.3%, staying 1.9 points below its long-run average. Meanwhile, utilities capacity utilization surged to 75.7% from 70.8% in December.

(Chart: United States Federal Reserve)

The mixed report suggests the industrial sector continues to face headwinds from high interest rates and a shift in consumer spending toward services. However, easing supply chain pressures and moderating inflation are providing some support.

“Manufacturing business surveys show many of the industry’s leaders think they have more to gain than lose from protectionist economic policies,” Adams noted, pointing to potential policy shifts that could boost the sector.

Looking ahead, economists expect the industrial sector to gradually improve over the course of 2025 as interest rates potentially decline and global growth picks up. The Fed’s latest projections show industrial production rising 1.5% in 2025 after an estimated 1.2% gain in 2024.

However, risks remain tilted to the downside amid geopolitical tensions, tight monetary policy and the potential for a broader economic slowdown. The manufacturing sector in particular faces ongoing challenges from tepid export demand and the lagged effects of interest rate hikes.

“2025 will likely mark a better year for manufacturing output after declines in 2023 and 2024,” Adams said, while cautioning that a robust rebound is not guaranteed.

Economists will be closely watching upcoming data on retail sales, housing starts and regional manufacturing surveys to gauge the health of the industrial sector and overall economy in the early months of 2025. The Fed’s next policy meeting in March will also be pivotal in shaping the outlook, as markets anticipate potential rate cuts later this year that could help bolster industrial activity.

The January industrial production report paints a picture of an industrial economy that is, at least for now, holding up better than expected to start the year, even as significant weak spots remain.

The post Better-than-expected industrial production data hides softness appeared first on FreightWaves.