Bad vibes in the market for new Class 8 rigs

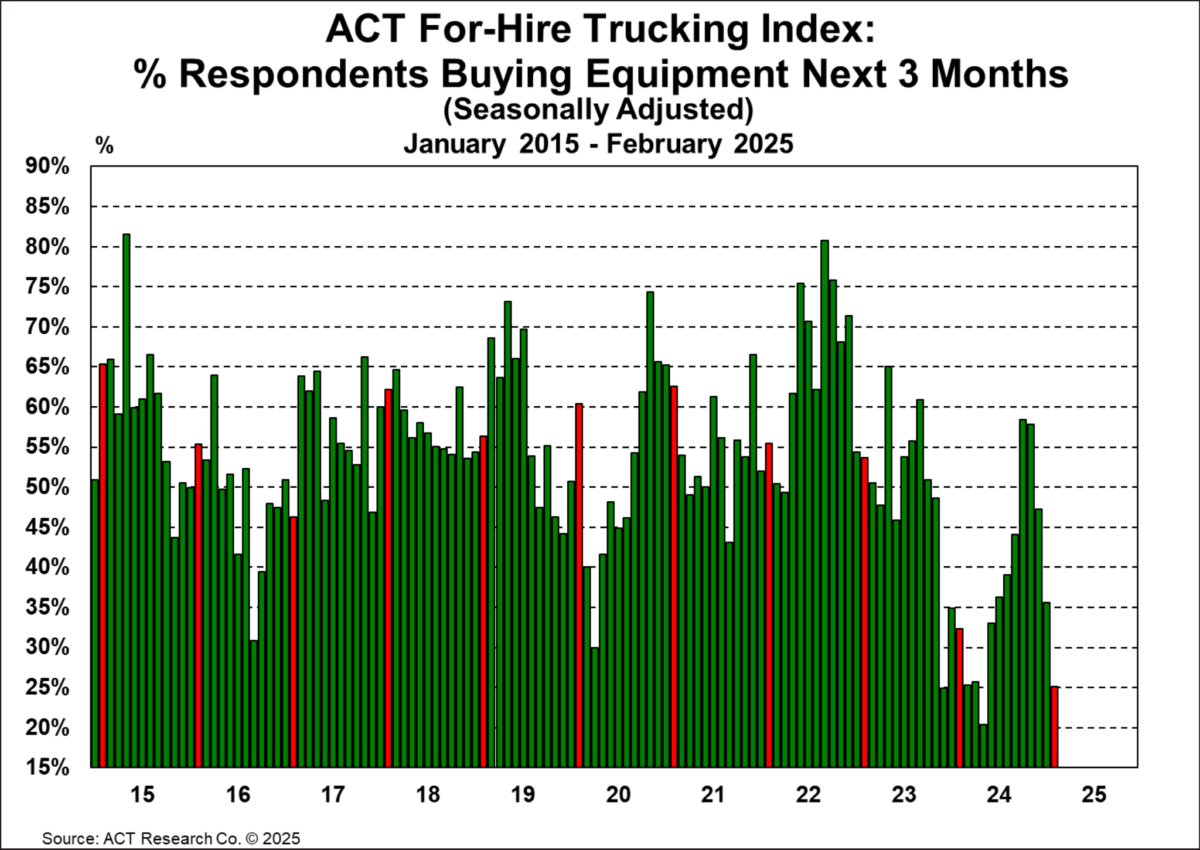

Recent data from ACT Research’s March For-Hire Trucking Index showed fleet purchasing intentions at 35% compared to a historical average of 56% for February. The post Bad vibes in the market for new Class 8 rigs appeared first on FreightWaves.

Bad vibes in the market for new Class 8 rigs

For fleets looking to purchase new equipment, concern over tariffs and an ongoing lack of extra cash continue to complicate their plans. Recent data from ACT Research’s March For-Hire Trucking Index showed fleet purchasing intentions at 35% compared to a historical average of 56% for February.

The report notes: “Tariff uncertainty, which has thrown a wrench into business planning, is likely one factor dampening future equipment purchases, but three years of constrained profitability is the biggest factor for the weak buying sentiment. Amongst the publicly traded TL carriers, net profits in 2024 were at their lowest levels since 2010.”

The bad vibes were further evident in ACT’s report on final North American Class 8 net orders for February, which totaled 17,900 units. That’s a decline of 35% from the previous year. Carter Vieth, research analyst at ACT Research, wrote in the release, “Economic uncertainty, fueled by the current administration’s policy/behavior, has largely stalled business planning.”

Splitting the total Class 8 orders between vocational and tractors showed a larger y/y gap. Vieth added, “Tractors orders of 11.2k units are down 42% y/y, which is likely attributable to private fleets stopping capacity additions after two years of strong demand, coupled with still weak for-hire carrier profitability.”

Amid the decline in intentions to buy new Class 8s, the used truck market remained resilient. ACT notes that preliminary Class 8 same-dealer used truck retail sales grew 12% m/m in February compared to a seasonal expectation of 6%. Steve Tam, vice president at ACT Research, gave more detail. “Gains in preliminary auction activity were muted, up 2.2% from January,” he wrote. “Moving in the opposite direction, wholesale transactions contracted 4.9% y/y. Altogether, February preliminary sales strengthened 7.9% m/m.”

Tam added that despite the tough trucking environment, “The gain is a testament to the stalwart nature of truckers, but also somewhat counterintuitive considering all the economic and political uncertainty they are currently facing.”

Market update: Cass Transportation Index February data notes uncertainty reigns

Recent data released by Cass Information Systems pointed to greater uncertainty for a seasonally sluggish freight market. The February Cass Transportation Index saw improvements in Shipments, Expenditures and Linehaul rates, but the Inferred Freight Rates, expenditures divided by shipments, saw a m/m decline.

Regarding volumes, FreightWaves’ Todd Maiden writes, “Freight volumes snapped back in February, up 10.5% from January, but remained pressured compared to last year, down 5.5% year over year. Normal seasonality, a recovery from harsh weather in January and shippers importing goods ahead of tariffs were cited as catalysts behind the latest sequential change.”

The Expenditures Index, measuring the total amount spent on freight, rose 3.6% m/m in February, but y/y declines widened from 4.2% in January to 4.6%. The report adds, “The y/y decline was more than explained by lower volumes, as shipments fell 5.5%. From these respective changes, we infer rates rose 1.0% y/y in February.”

A positive development was the continued gains in the Truckload Linehaul Index, which rose 1.2% m/m in February. This is the sixth straight small increase from a cycle low in August, with the index 4.8% above that cycle low.

Regarding future freight expectations, the report had some optimism. “While the outlook is fraught with uncertainty, and freight demand will be challenged by tariffs, we highlight a silver lining for the for-hire freight market amid rising recession risk. Elevated uncertainty may be turning the tide of private fleet capacity additions after a long for-hire downturn.”

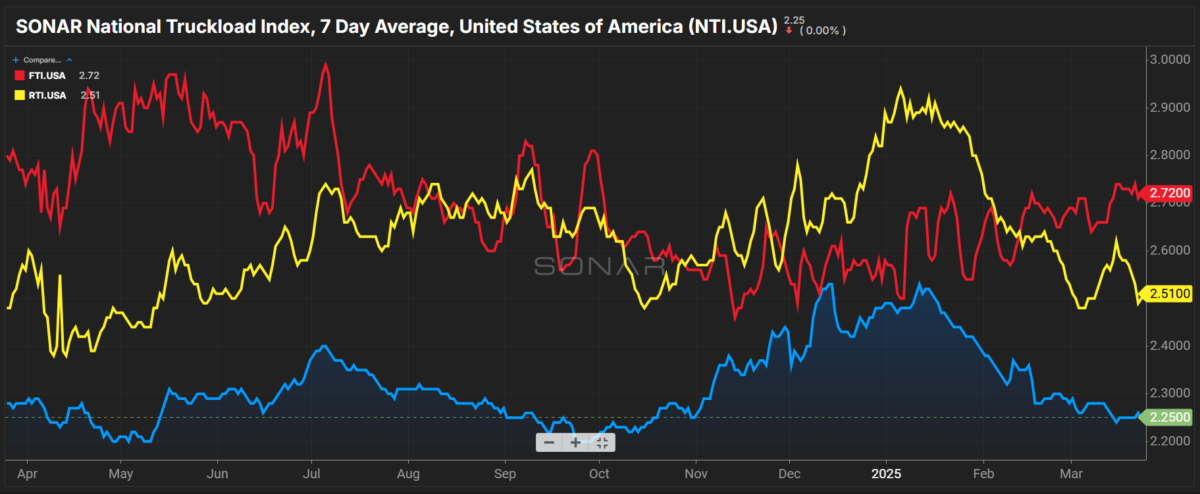

SONAR spotlight: Spot market rates are a mixed bag

Summary: The past week saw a mixed performance for dry van, reefer and flatbed spot market rates. The dry van segment continues to be in a seasonal holding pattern, with the SONAR National Truckload Index 7-Day Average remaining flat w/w at $2.25 per mile all in. Despite the sluggish performance in the spot market, dry van outbound tender rejection rates made modest gains, up 58 basis points w/w from 4.9% on March 17 to 5.48%. The positive movement in VOTRI was against a backdrop of mostly flat dry van outbound tender volumes, which fell 5.19 points or 0.07% w/w from 7,193.95 points to 7,188.76 points.

The smaller and more volatile reefer market saw all-in spot rates fall 7 cents per mile w/w from $2.58 to $2.51. Reefer outbound tender rejection rates posted a slight decline of 17 bps w/w from 9.96% to 9.79%. Similarly, reefer outbound tender volumes lost ground in the past week, down 22.94 points or 1.75% from 1,310.01 points to 1,287.07 points.

The flatbed segment remains the only truckload equipment type that has posted volatile but sustained upward movement. Flatbed all-in spot rates remain elevated but fell 1 cent per mile w/w from $2.73 to $2.72. For the month, FTI is up 7 cents per mile from April 25’s reading of $2.65. The arrival of spring and warmer weather for open deck paired with macroeconomic uncertainty in flatbed-sensitive sectors may be fueling the rapid increase in outbound tender rejection rates. FOTRI rose a dramatic 2,329 bps w/w from 17.65% to 40.94%.

Flatbed has a smaller share in outbound tender volumes than the dry van and reefer segments. A rapid increase of this magnitude in FOTRI has no historical precedent when looking at five years of seasonal data. While the early March jump in FOTRI was within seasonal trends, this second and larger surge is outside seasonal norms and may be related to geopolitical and macroeconomic factors such as tariffs.

The Routing Guide: Links from around the web

U.S. trailer production surges 23% in February as OEMs brace for potential tariffs (Commercial Carrier Journal)

Text messages for unpaid tolls are a scam, DOTs say (Land Line)

Punitive damages in huge Wabash judgment slashed but still over $100M (FreightWaves)

Arkansas lawmakers debate crackdown on undocumented truckers (FreightWaves)

Trump nominates trucking official to head FMCSA (FreightWaves)

Trucking company owner gets almost 4 years in prison for lying to FMCSA (FreightWaves)

Like the content? Subscribe to the Loaded and Rolling newsletter here.

The post Bad vibes in the market for new Class 8 rigs appeared first on FreightWaves.