THG raises £90m in major fundraising push with £60m from founder

THG has raised £90m through a combination of a share placing and refinancing measures,

THG has raised £90m through a combination of a share placing and refinancing measures, marking another step in simplifying its debt structure and positioning the company for future growth.

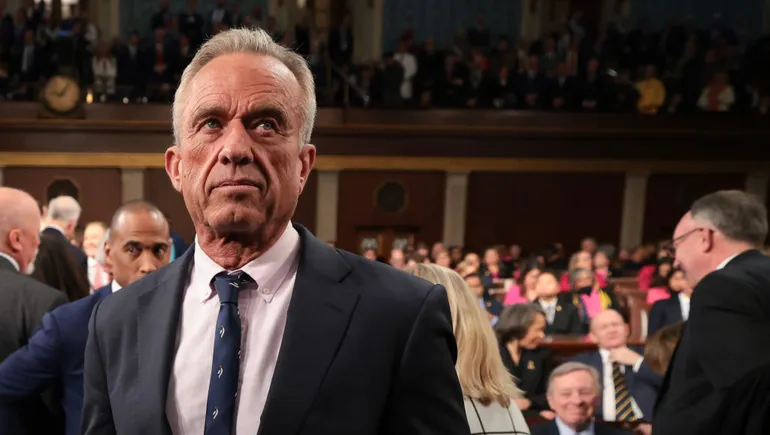

The fundraise included a £60m contribution from THG founder and CEO Matthew Moulding, who subscribed to £31.2m worth of shares at a price of 32.3p—representing a 5% discount on the previous day’s closing price.

The retailer said Moulding also injected a further £54.6m through a non-interest bearing convertible loan.

The remaining £30m was raised through a placing of new shares, with the company stating that the move was oversubscribed and well-supported by both existing and new investors.

“We are pleased with the support from both our existing and new investors. This raises funds to reduce our gross debt and strengthen our balance sheet as we move forward,” the firm said in a statement.

The fundraising follows the earlier demerger of THG Ingenuity and is aimed at simplifying the company’s capital structure, which THG says will enable it to focus on its core operations as a global retailer and brand owner.

THG has confirmed that the £90m capital raise, alongside the extension of its £150m revolving credit facility to May 2029, will lower the group’s leverage ratio from 3.2x to 2.6x. This is based on continuing adjusted EBITDA of £92m for 2024, excluding Ingenuity.

Moulding has been heavily involved in the funding process, including underwriting a significant portion of the fundraising.

In a LinkedIn post, he shared that he had invested £110 million in THG shares over the past five years, despite waiving his £3m annual salary and expenses since the company’s initial public offering (IPO).

“Joining the LSE 4 ½ years ago hasn’t proved too profitable for me or my family. I will soon have bought £110m of THG shares in less than 5 years.

“Despite the CEO role normally attracting remuneration of c£3m a year, since IPO I’ve waived all remuneration and expenses, effectively paying to go to work each day. I do get free coffee though,” he said.

Click here to sign up to Retail Gazette‘s free daily email newsletter