RXO Q1 forecast: 2025 upswing will feel more like 2014 than 2021

RXO recently released its Q1 2025 Truckload Market Forecast, with its Curve Index showing a continuation of rate inflation first observed in Q4 2024. The post RXO Q1 forecast: 2025 upswing will feel more like 2014 than 2021 appeared first on FreightWaves.

RXO Q1 forecast: Truckload rates likely to rise but not skyrocket

RXO recently released its Q1 2025 Truckload Market Forecast, with its Curve Index showing a continuation of rate inflation first observed in Q4 2024. The Curve, formerly the Coyote Curve, is a proprietary index measuring year-over-year changes in truckload linehaul spot rates, excluding fuel.

The forecast highlighted how rising spot rates and capacity exiting the market are driving the upswing, though the authors caution that the extreme conditions of the last inflationary market in 2020 and 2021 are not expected. While shippers may not feel dramatic changes yet, RXO warns that conditions are shifting in ways that could lead to tightening later this year.

The Q4 2024 Curve Index showed spot rates up 11.6% year over year, a jump from the 5.8% increase in Q3. This rise was driven by continued carrier exits, impacts from hurricanes Helene and Milton, and typical holiday shipping seasonality.

Contract rates, while still showing a slight year-over-year decline of 1.5% in Q4, moderated from the 3.4% y/y drop seen in Q3. This aligns with typical market behavior, as contract rates tend to lag spot rates by two to three quarters.

“Over the holidays, we saw market rate and coverage KPIs reach levels we haven’t hit since Christmas 2022. While we have seen some of those gains moderate through the first quarter to date, the baseline has reset higher,” said Corey Klujsza, vice president of pricing and procurement at RXO. “Though the rest of 2025 may not look like the peak in the COVID-era truckload market, we’re seeing continued signs that we’re past the bottom of the cycle.” Read the full article here.

ATA’s chief economist predicts consumer spending shifts may help trucking companies

The trucking industry may see an unexpected boost later this year as inflation reshapes consumer spending habits, according to Bob Costello, chief economist of the American Trucking Associations. Costello spoke at the 2025 Recruitment & Retention Conference in Nashville, Tennessee, Transport Topics reported, on how current economic trends could influence freight demand.

He says that as consumers face sticker shock from inflated costs of flights and accommodations, they might redirect their spending. “They might start buying goods again, and that could help trucking,” he added.

However, Costello cautioned against overreliance on GDP growth as an indicator of trucking prosperity. “About 70% of what is embedded in GDP are services, and you are not putting services in a trailer,” he pointed out.

On the housing front, Costello painted a mixed picture. While demand for housing remains strong, high interest rates have sidelined many potential buyers, impacting dry van and flatbed carriers that haul residential construction supplies. “If your company hauls residential construction supplies, it’s been tough,” he acknowledged. Adding complexity, Costello noted concerns about the availability of construction labor, partly due to recent immigration policies.

In contrast, nonresidential construction has shown promise. “This is on the rise — it’s been quite good,” he said, pointing to infrastructure projects and semiconductor plant construction as bright spots for trucking demand.

Costello forecasts modest growth in trucking demand for the year. However, he warns of a potential shakeout in capacity as companies that expanded during the pandemic boom times reassess operations. “I think people got ahead of themselves and thought the recovery was coming sooner, and it wasn’t. … “Fleets are saying this is the worst downturn they can remember.”

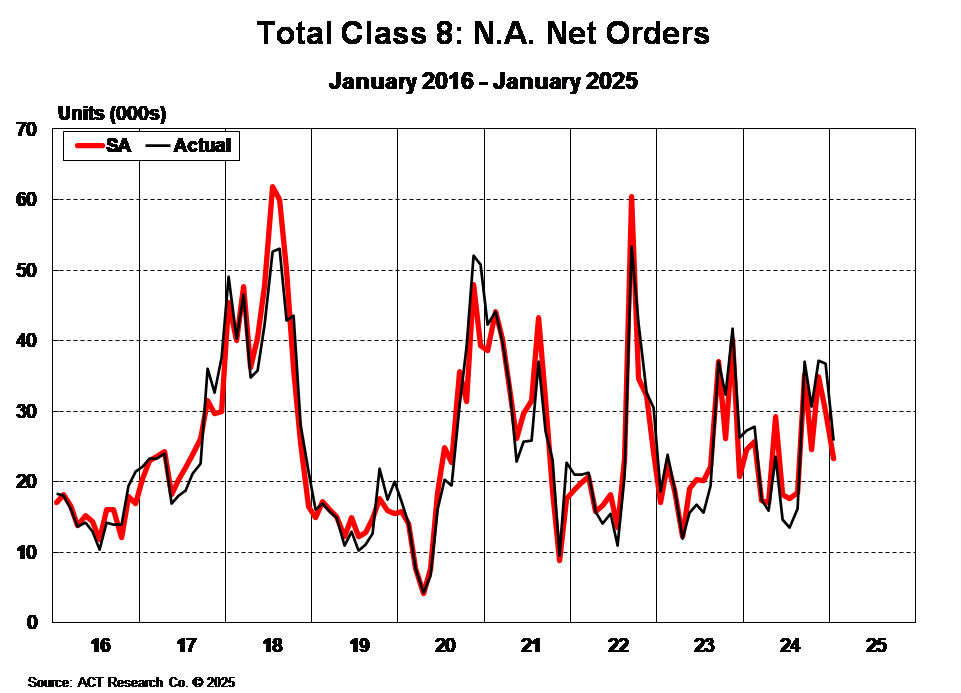

Market update: Truck orders slow in January, tariff concerns loom

ACT Research recently released its seasonally adjusted final January Class 8 order numbers, which showed still-healthy tractor orders despite lower year-over-year comps. Vocational truck demand was also strong. Carter Vieth, research analyst at ACT Research, wrote, “Tractor orders totaled 18.4k units, down 11% y/y. It remains to be seen whether the decrease in orders this month will continue or was just a reversion after November and December highs. One month does not make a trend.”

According to FTR Transportation Intelligence, preliminary North American Class 8 net orders in January totaled 24,000 units, representing a 28% decrease month over month and a 15% drop year over year. This figure fell short of the seven-year January average of 27,950 net orders.

FTR notes the on-highway segment primarily drove the softening in order activity, while vocational orders remained relatively stable. Despite the January dip, cumulative net orders from September 2024 through January 2025 for builds in 2025 still show a 3% increase from the previous year.

Dan Moyer, senior analyst, commercial vehicles at FTR, said, “A 25% U.S. tariff on imports from Canada and Mexico – currently paused for trade negotiations through early March – and a 10% tariff on Chinese imports as of February 4 could significantly increase costs for North American Class 8 trucks and parts if fully implemented and enforced indefinitely.”

Another challenge is the potential tariff impacts on the interconnected Class 8 OEM truck makers’ supply chains. Moyer added, “With roughly 40% of U.S. Class 8 trucks built in Mexico and around 65% of Canada’s Class 8 trucks built in the U.S., tariffs and likely counter-tariffs threaten to disrupt supply chains and drive up vehicle prices.”

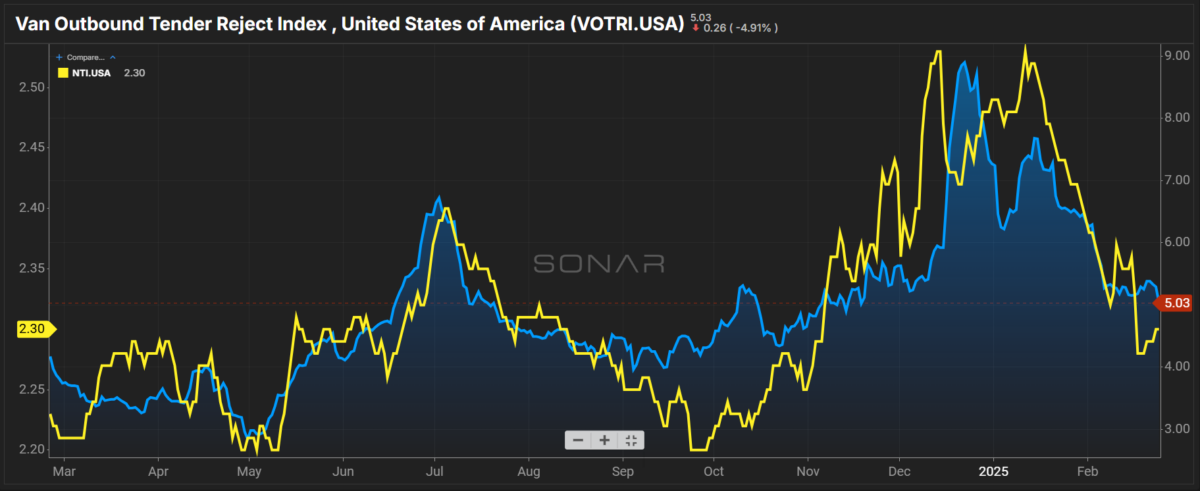

SONAR spotlight: Dry van dips outperform seasonal expectations

Summary: Despite ongoing deterioration in the dry van space, spot market and outbound tender rejection rates are outperforming compared to seasonal year-over-year comps. The past week saw the SONAR National Truckload Index 7-Day average rise 2 cents per mile all-in from $2.28 on Feb. 17 to $2.30. Spot rates are down 13 cents per mile m/m from $2.43 on Jan. 25, but when compared to last year, NTI is up 7 cents per mile from $2.23.

Spot market linehaul rates saw a smaller increase, up from $1.72 to $1.73 per mile w/w. Fuel costs are based on the average retail price of diesel fuel and fuel efficiency of 6.5 miles per gallon. The formula is NTID – (DTS.USA/6.5). Linehaul rates saw a similar decline compared to all-in spot rates, with the NTIL down 13 cents per mile m/m from $1.86 and 13 cents per mile higher y/y from $1.60.

Dry van outbound tender rejection rates posted a slight decline, down 15 basis points w/w from 5.18% on Feb. 17 to 5.03%. VOTRI is down 150 bps m/m but 86 bps higher y/y. A challenge for dry van carriers is that despite the higher outbound tender rejection rates on y/y comps, outbound tender volumes are low.

The Routing Guide: Links from around the web

ATRI Invites Motor Carriers to Participate in 2025 Operational Costs Data Collection (ATRI)

Low pay keeping millions of Americans out of trucking, survey suggests (Land Line)

Trump’s Threat to EV Trucking Rules Undermines Big-Rig Bets (Bloomberg)

Truckstop exec joins Trucking Parking Club to boost ties with enterprise fleets (FreightWaves)

BMO’s numbers on trucking credit suggest worst may be over (FreightWaves)

Werner pilots sideview cameras for safety, legal protection (Trucking Dive)

Most recent episode

Like the content? Subscribe to the newsletter here.

The post RXO Q1 forecast: 2025 upswing will feel more like 2014 than 2021 appeared first on FreightWaves.