Perhaps The Greatest Stock Market Correction Ever, Truly Terrific, Remember To Thank Your FAVORITE PRESIDENT!

A 15% drop here, a 15% drop there, and soon you're talking real problems. The post Perhaps The Greatest Stock Market Correction Ever, Truly Terrific, Remember To Thank Your FAVORITE PRESIDENT! appeared first on Above the Law.

For many years, I have tried to emphasize in this column that presidents typically have a very limited amount of control over the stock market. Long term, presidential policies might determine stock market returns to a certain extent, although the whole thing is so ridiculously complicated that giving a president credit for good stock market performance is pretty much an exercise in futility.

Perhaps I should have been more specific. It is very difficult for a president to simply will the stock market to rise, but a president definitely can unilaterally choose to drive the stock market off a cliff. Welcome to the preceding week.

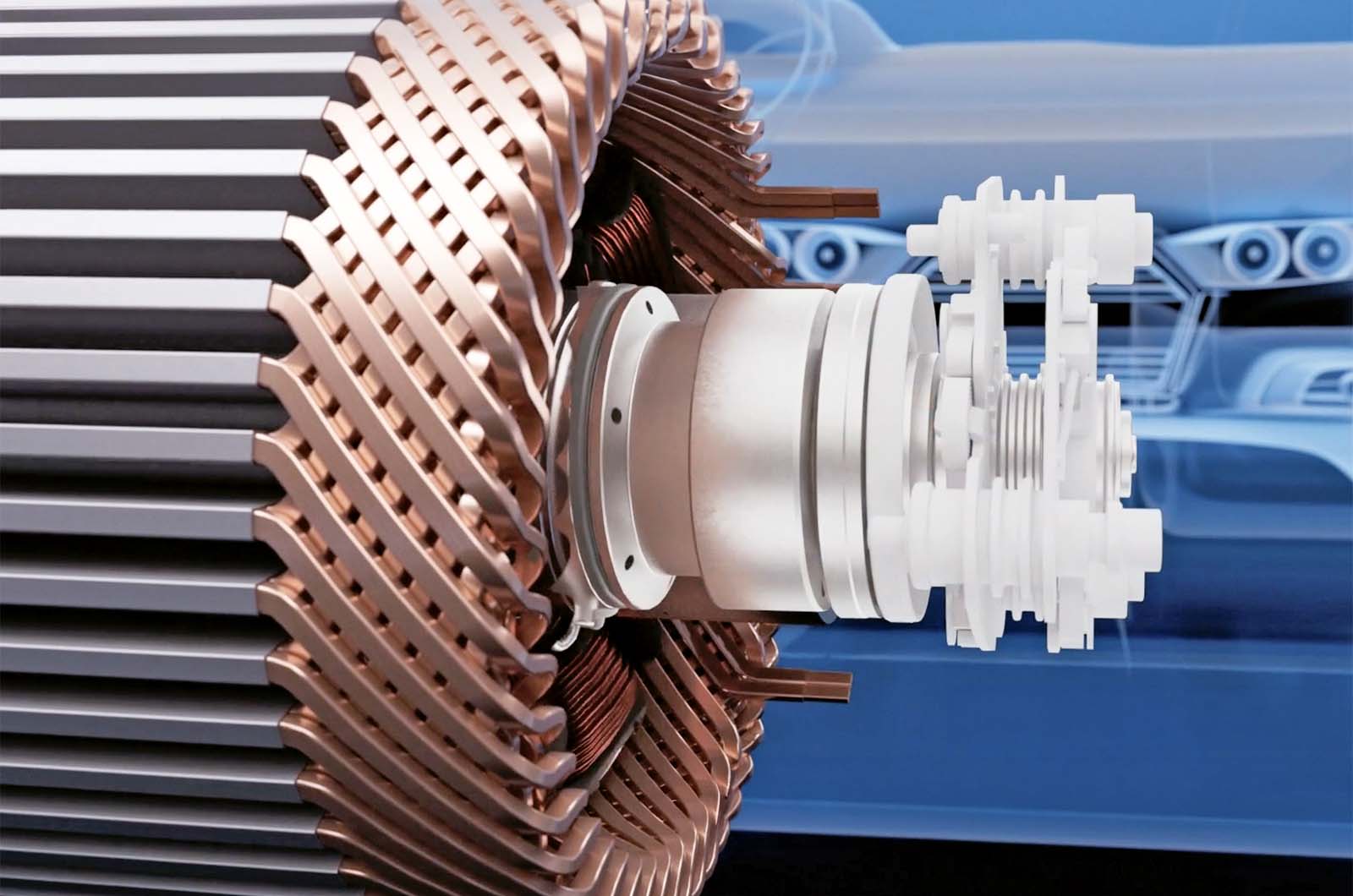

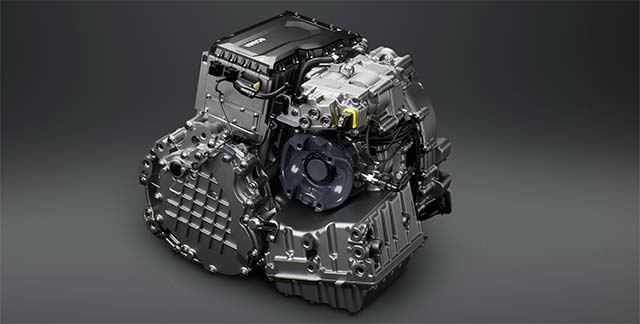

The Nasdaq plummeted into correction territory last Thursday, and the bloodbath has more or less continued ever since. Big tech stocks have been hit particularly hard. No surprise, with CEO Elon Musk DOGE-ing his way through the federal workforce, Tesla investors (myself included) were slammed worst of all. On Monday alone, shares in the electric automaker cratered by 15%. Ouch.

Now, the stock market goes up and down all the time for all kinds of reasons, and often, for no reason at all. So what makes any of this Donald Trump’s fault?

Well, his own words, for one thing. Asked in an interview that aired on state media station Fox News this Sunday whether he expects a recession in 2025, Trump said, “There is a period of transition because what we’re doing is very big.”

Most economists would agree that the “very big” things Trump’s administration is doing very much could cause a recession. That is now being reflected in the stock market.

The stock market likes stability and certainty. Slapping huge tariffs on our two nearest export markets, Mexico and Canada, and then mostly pulling them off two days later for no apparent reason, is the opposite of stability and certainty. Tariffs are bad for trade and for the economy in general, especially the retaliatory tariffs from China that went into effect on Monday in order to punish American producers for Trump’s doubling of his blanket Chinese tariff to 20%. In case you haven’t noticed, we get a lot of our stuff from China.

Tariffs make goods more expensive to U.S. consumers, and make it far more difficult for U.S. producers to market their products. Trump claims he has good reasons for imposing all these tariffs, but beyond a vague feeling of grievance, he hasn’t been able to articulate (or prove) how exactly we have been being screwed so badly by our best customers abroad. Trump’s demands, so far, have been nonsensical, which does little to reassure markets that he won’t just keep slapping tariffs on our trading partners almost at random. This is a recipe for market meltdown, and at this point I can practically hear the dinner bell a’ringin’.

Trump’s trade war is most directly to blame for the recent market sell-off. Yet, it is not his only policy that is bad for the stock market. Suddenly turning on our ally Ukraine demonstrates international instability, which is bad for stocks. Immigration crackdowns are bad for the economy, and ultimately, bad for stocks. Firing tens of thousands of federal workers, including financial regulators and others tasked with upholding the rule of law, is bad for stocks.

For several months, traders thought that Trump’s priorities would be deregulation and lower taxes — two things that can actually have a positive impact on stocks. Now it’s sinking in that he’s just as happy firing the people who are supposed to do the regulating and tax-collecting, which will only lead to arbitrary — or worse yet, politically targeted — enforcement.

Sigh. At least the Dow and the S&P 500 fared a bit better than the Nasdaq (for now). Prepare for another pounding though if Trump and the Republican-controlled Congress can’t keep the government running by the end of the week.

Isn’t this fun? Like a roller coaster, except if your doddering old granddad in the big white nursing home decides foreigners are stealing from him, you fly off the tracks and lose your retirement savings and your kid’s college fund. Be sure to thank your favorite president!

Jonathan Wolf is a civil litigator and author of Your Debt-Free JD (affiliate link). He has taught legal writing, written for a wide variety of publications, and made it both his business and his pleasure to be financially and scientifically literate. Any views he expresses are probably pure gold, but are nonetheless solely his own and should not be attributed to any organization with which he is affiliated. He wouldn’t want to share the credit anyway. He can be reached at jon_wolf@hotmail.com.

The post Perhaps The Greatest Stock Market Correction Ever, Truly Terrific, Remember To Thank Your FAVORITE PRESIDENT! appeared first on Above the Law.