Oil prices are higher out of the gate after Iran attack, but increase isn’t gigantic

The increase in oil prices in early trading after the U.S. attack on Iran was strong but not overwhelming. The post Oil prices are higher out of the gate after Iran attack, but increase isn’t gigantic appeared first on FreightWaves.

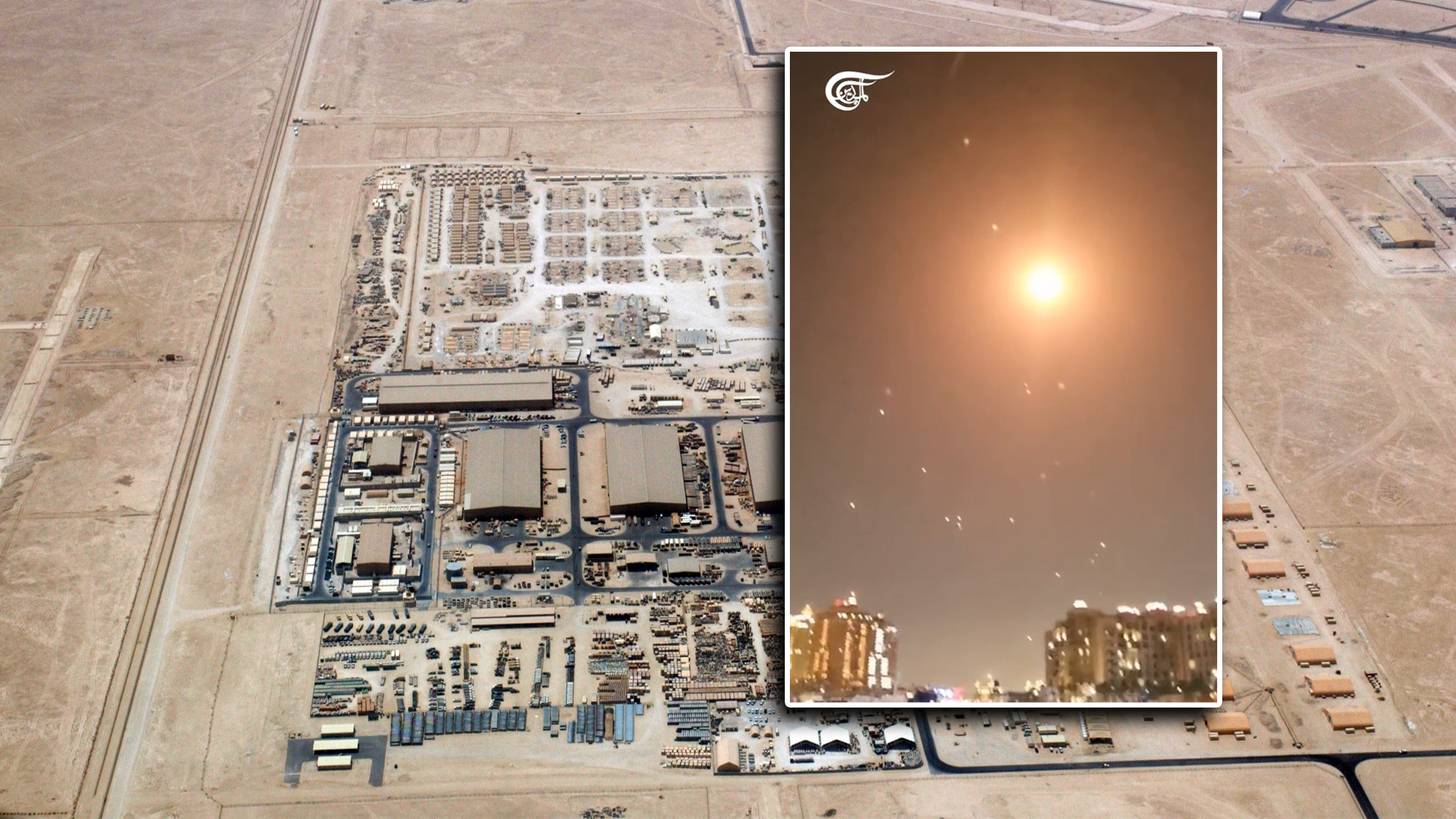

Oil markets opened higher Sunday evening U.S. time following the military strike on Iran by the Trump administration, but the size of the increase was considered somewhat underwhelming compared to the more apocalyptic predictions heard prior to the attack.

However, from the perspective of the trucking industry, it was the continued strength of diesel compared to crude and gasoline that might get the greatest amount of attention.

At approximately 7:05 p.m. EDT, about an hour after trading began on various exchanges, global crude benchmark Brent was up $1.88/barrel to $78.89/b, a gain of 2.44%. The U.S benchmark crude grade, West Texas Intermediate, was up 2.52% to $75.70/b, a gain of $1.86/b. RBOB gasoline, which is a semi-finished gasoline product that serves as the trading platform for finished gasoline, was up 2.19% to $2.3806/gallon, an increase of 5.11 cts/g. (RBOB is essentially gasoline without the added ethanol).

But it was ultra low sulfur diesel (ULSD) that showed the largest increase Sunday evening. It rose 3.67% to $2.6352/g, an increase of 9.34 cts/g.

If ULSD settled at that level Monday afternoon in the U.S., it would be the highest price since a settlement of $2.6513/g on April 16, 2024.

The most bullish scenario for the oil market in the weeks leading up to the attack by the U.S. on Iranian nuclear facilities and now in the wake of an actual one is the fate of the Strait of Hormuz, which is the gateway to the Persian Gulf and the route of oil exports from numerous countries, including Saudi Arabia, Kuwait, Iraq and Iran.

A Reuters report from 2023, quoting various sources, said about 20% of the world’s roughly 103 million b/d of consumption passes through the Strait of Hormuz every day. There are alternative export routes via pipeline for some of the countries, but it is unclear how much the infrastructure ramping up to 100% of capacity can replace normal export levels through the Strait.

The Strait of Hormuz is not international waters. Part of it is Iranian territorial waters; the other portion is the territorial waters of Oman.

The Iranian Parliament voted over the weekend to close the Strait of Hormuz, though several news reports noted that the decision whether to implement such a radical step would be up to the country’s senior leadership.

Secretary of State Marco Rubio, in an interview with Fox News Sunday, called upon China to dissuade Iran from pursuing that policy. China is easily the largest customer for Iranian crude, and the supply line for it comes out of Iran via the Strait and on to China.

“I encourage the Chinese government in Beijing to call them about that, because they heavily depend on the Straits of Hormuz for their oil,” Rubio said, according to several reports of his interview.

It was noted by other analysts that closing the Strait of Hormuz would have an outsized impact on Iranian exports, cutting off its most important revenue source.

Meanwhile, the soaring spread between crude and diesel is a relatively new phenomenon.

On a straight comparison of front month ULSD to front month Brent, that spread Sunday evening, using the 7:05 pm prices, translated to about 75 cts/gallon. It is the widest spread since February 2024. A month ago it was about 56 cts/g.

In its monthly report on the market for middle distillates including diesel, published just before the actual attack, the oil market analytics research firm of Energy Aspects spelled out some of the reasons for the continuing strength of diesel relative to crude.

“We see increasing risks to middle distillates supply due to the escalation of the Israel–Iran conflict after last Friday’s attacks,” EA said.

As far as the two Middle East combatants, the EA report said all Israeli refiners are “non-operational” after attacks by Iran. The country has a relatively small refining capacity, but it is a net exporter of diesel, EA said. That means it presumably will need to turn to imports to replace the lost capacity.

As far as Iran, EA said, it produces about 700,000 b/d of diesel. It also is a net exporter of diesel, “but could need to import in case of any supply disruptions,” it said.

EA’s report also contained a chart showing a relatively tight level of diesel inventories in Europe. U.S. inventories also have been well below the five and 10-year average for the second week in June, but with diesel demand down as well, the amount of “days cover”–the size of the stocks measured as how long on their own they could cover consumption–has been climbing in recent weeks.

More articles by John Kingston

DAT and OTR, embroiled in dispute over factoring, reach settlement and end battle

Onstage in Chicago, CHRW talks tech and staffing; RXO sees language order hitting capacity

Logistics GDP share rose in ’24, not likely to drop: CSCMP report

The post Oil prices are higher out of the gate after Iran attack, but increase isn’t gigantic appeared first on FreightWaves.