No manufacturing alternatives for US clothing

AI clothing production Credits: FashionUnited The United States fashion industry is confronting a challenging landscape as tariffs are now universally applied to imported apparel, eliminating previous avenues for cost mitigation through diversification of manufacturing locations. This development necessitates a reassessment of sourcing strategies and pricing models for fashion brands operating within the US market. A theoretical exemption from these tariffs lies in domestic manufacturing. However, current US apparel production capacity is estimated at a mere 2 percent of total consumption, rendering a significant short-term increase in output unattainable. Furthermore, domestic production costs are substantially higher due to elevated wage levels and a comparatively less experienced workforce. Industry experts suggest that even if a rapid expansion of US manufacturing were feasible, the resultant price increases for consumers might be less significant if tariff costs were absorbed, at least partially, within the existing supply chain. To illustrate, a garment with a Free on Board (FOB) price of 18 US dollars could face an average tariff of 38 percent, adding approximately 6.84 US dollars to its cost. This translates to a potential 7 US dollars increase on a retail item priced around 90 US dollars. While the prospect of fully automated domestic nearshoring offers a potential long-term solution for competitive US-based production, this remains a future prospect requiring substantial capital investment and technological advancements. In the immediate term, fashion executives must navigate a US market where cost pressures are unavoidable, necessitating strategic pricing adjustments and a thorough evaluation of supply chain efficiencies.

The United States fashion industry is confronting a challenging landscape as tariffs are now universally applied to imported apparel, eliminating previous avenues for cost mitigation through diversification of manufacturing locations. This development necessitates a reassessment of sourcing strategies and pricing models for fashion brands operating within the US market.

A theoretical exemption from these tariffs lies in domestic manufacturing. However, current US apparel production capacity is estimated at a mere 2 percent of total consumption, rendering a significant short-term increase in output unattainable. Furthermore, domestic production costs are substantially higher due to elevated wage levels and a comparatively less experienced workforce.

Industry experts suggest that even if a rapid expansion of US manufacturing were feasible, the resultant price increases for consumers might be less significant if tariff costs were absorbed, at least partially, within the existing supply chain. To illustrate, a garment with a Free on Board (FOB) price of 18 US dollars could face an average tariff of 38 percent, adding approximately 6.84 US dollars to its cost. This translates to a potential 7 US dollars increase on a retail item priced around 90 US dollars.

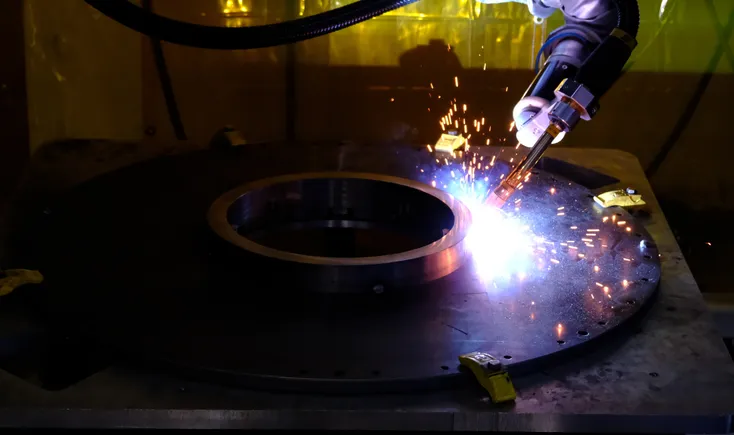

While the prospect of fully automated domestic nearshoring offers a potential long-term solution for competitive US-based production, this remains a future prospect requiring substantial capital investment and technological advancements. In the immediate term, fashion executives must navigate a US market where cost pressures are unavoidable, necessitating strategic pricing adjustments and a thorough evaluation of supply chain efficiencies.

![What you need to know before you go to Sea Air Space 2025 [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2024/05/Screen-Shot-2024-05-14-at-12.19.19-PM.png?#)

.jpg)