McKinsey: Geopolitical partners trading more with one another, less with rivals

China’s share of U.S. manufactured goods imports is falling, while Vietnam’s and Mexico’s are rising. The post McKinsey: Geopolitical partners trading more with one another, less with rivals appeared first on FreightWaves.

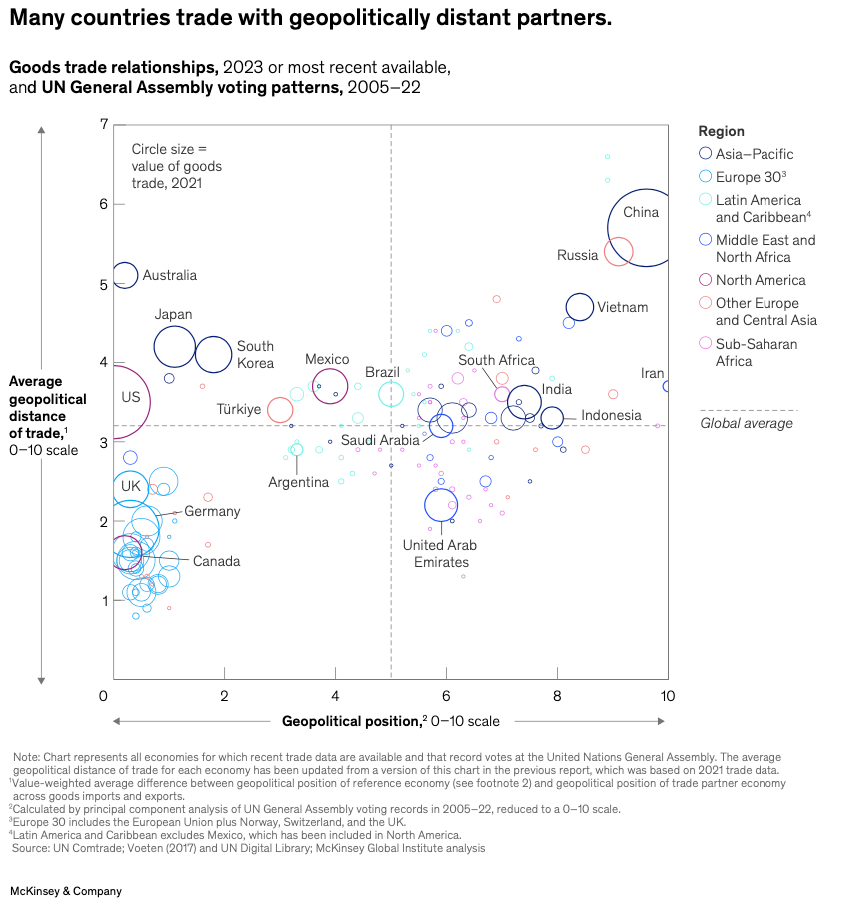

A new report from the McKinsey Global Institute reveals that geopolitical tensions are reshaping global trade patterns, with the United States and China at the center of the realignment. The analysis, which examines trade data through 2024, shows that economies are increasingly trading more with geopolitically aligned partners and less with rivals.

The report cites ongoing U.S.-China trade tensions and Russia’s invasion of Ukraine as key drivers of the trend. “The most significant ongoing shift in trade patterns is a fall in the average geopolitical distance of trade,” the authors noted. This measure declined by about 7% between 2017 and 2024, reflecting reduced trade between economies at opposite ends of the geopolitical spectrum.

The key metric that allows McKinsey to make this kind of analysis rigorous and based on quantified data is its notion of “geopolitical position,” which the report says is calculated by a principal component analysis of U.N. General Assembly voting records from 2005 to 2022. The voting records let McKinsey assign geopolitical position scores to each country, and from there calculate their geopolitical distance from one another.

(Graph: McKinsey Global Institute)

The United States has been at the forefront of this realignment, continuing to diversify away from China as a trading partner. Between 2017 and 2024, the U.S. reduced its share of trade in manufactured goods with China by 6 percentage points. At the same time, it increased imports from Mexico and countries in the Association of Southeast Asian Nations (ASEAN) by about 2 and 4 percentage points, respectively.

This shift was particularly pronounced in sectors like electronics, machinery, and textiles and apparel. In these areas, China’s share of U.S. imports fell by 14 to 16 percentage points over the period. As a result, Mexico overtook China in 2023 as the largest supplier of goods to the United States, a position China had held since 2007.

However, the report cautions that the shift away from direct U.S.-China trade may be partially offset by indirect connections. For instance, while U.S. imports from ASEAN countries have risen sharply, many of these goods still contain significant Chinese value-added content. The report notes that “about 25 percent of the value of Vietnam’s electronics exports represented value added originally in China” in 2023, up from 10% in 2015.

On the Chinese side, trade has increasingly tilted toward developing economies, particularly ASEAN countries, Latin America and Russia. By 2024, developing economies accounted for the majority of China’s imports and exports, overtaking advanced economies. ASEAN became China’s largest trading partner region in 2024, surpassing the Europe 30 bloc.

China’s trade with Latin America has also grown rapidly, driven by agricultural imports and exports of manufactured goods like consumer electronics and clean technology products. Trade between Brazil and China, for example, grew about 13% annually between 2017 and 2024.

The report highlights how Russia has become an increasingly important trade partner for China in the wake of Western sanctions. Russia has emerged as a growing source of energy resources for China and a significant destination for Chinese automobiles and transportation equipment. The share of China’s transportation equipment exports going to Russia jumped from 2% in 2017 to over 10% by 2024.

For U.S. companies, these shifting trade patterns could have significant implications for supply chains across multiple industries. The report suggests that firms may need to navigate a more complex network of suppliers and intermediaries as direct U.S.-China trade declines. Industries like electronics and textiles, which have seen the largest shifts away from Chinese imports, may face particular challenges in reconfiguring their supply chains.

The authors note that “shifting the fundamental geography of import dependence happens slowly.” While gross import figures show a sharp decline in U.S. reliance on Chinese goods, the shift in terms of value-added content has been less dramatic. This suggests that many U.S. supply chains still have significant indirect exposure to China, even as direct imports fall.

Despite these challenges, the report also points to potential opportunities for U.S. firms. The growing U.S. trade relationships with Mexico and ASEAN countries could offer new sourcing options and export markets. Additionally, the U.S. has gained share in some European markets, particularly in energy exports to the EU.

The McKinsey analysts conclude that while the shifting geopolitical geometry of trade creates risks, “carefully navigating it may deliver opportunities, too.” They advise organizations to closely monitor changes in trade patterns and develop strategies to respond to geopolitical disruptions.

The post McKinsey: Geopolitical partners trading more with one another, less with rivals appeared first on FreightWaves.