Matches debt surges beyond estimates to 50 million pounds

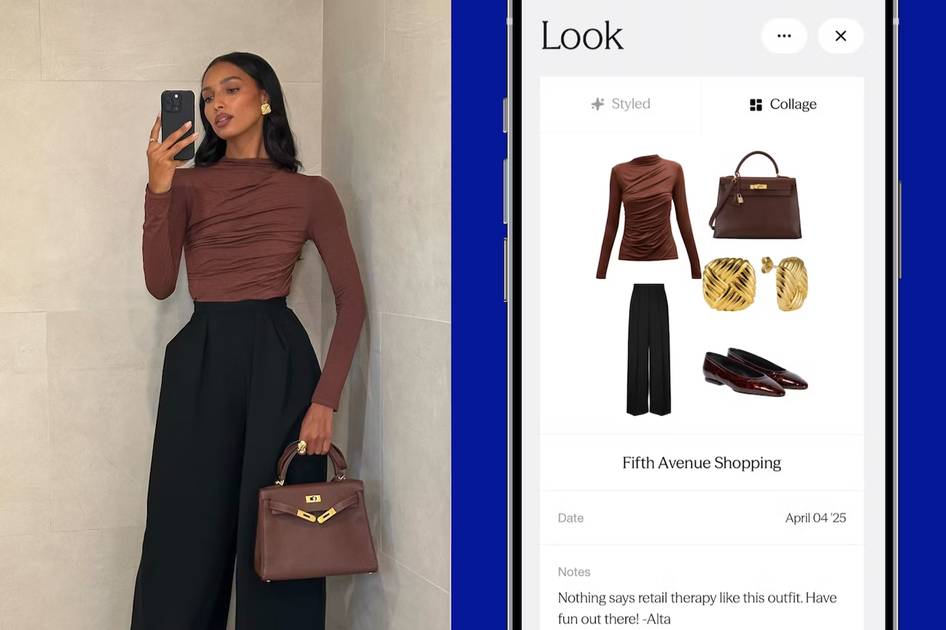

Matches headquarters in London Credits: Matches, Shaun James Cox Just over a year on from its administration, challenges triggered by Matches’ collapse continue to unravel. According to new documents filed by the company’s administrators, creditors of the former luxury e-tailer are now said to be owed around 49.5 million pounds, surpassing previously cited estimates. In the documents provided by administrator Teneo to the UK’s Companies House, it was stated that there are around 956 claims made by creditors–many former suppliers and partnered fashion labels–above what was initially reported. Unsecured debts have thus risen 62 percent on the 31 million pounds originally cited in the statement of affairs (SoA). Teneo said the increase is attributable to submitted claims that were “significantly higher” than initially estimated, with an additional 200 creditor claims having not been included in the SoA. A total of 13.8 million pounds was said to already have been paid out upon the publication of the report, while remaining creditors are anticipated to receive up to 600,000 pounds in total. The collapse of Matches last year sent the fashion world into a frenzy, throwing doubt into the state of luxury e-tail. Its descent into administration came shortly after it was acquired by Frasers Group in December 2023, in a 52 million pound deal that was significantly below the purchase price of its former owner Apax. Following the appointment of Teneo in March 2024, Frasers repurchased specific intellectual property assets of Matches.

Just over a year on from its administration, challenges triggered by Matches’ collapse continue to unravel. According to new documents filed by the company’s administrators, creditors of the former luxury e-tailer are now said to be owed around 49.5 million pounds, surpassing previously cited estimates.

In the documents provided by administrator Teneo to the UK’s Companies House, it was stated that there are around 956 claims made by creditors–many former suppliers and partnered fashion labels–above what was initially reported. Unsecured debts have thus risen 62 percent on the 31 million pounds originally cited in the statement of affairs (SoA).

Teneo said the increase is attributable to submitted claims that were “significantly higher” than initially estimated, with an additional 200 creditor claims having not been included in the SoA. A total of 13.8 million pounds was said to already have been paid out upon the publication of the report, while remaining creditors are anticipated to receive up to 600,000 pounds in total.

The collapse of Matches last year sent the fashion world into a frenzy, throwing doubt into the state of luxury e-tail. Its descent into administration came shortly after it was acquired by Frasers Group in December 2023, in a 52 million pound deal that was significantly below the purchase price of its former owner Apax. Following the appointment of Teneo in March 2024, Frasers repurchased specific intellectual property assets of Matches.

.jpg)