Mass Corporate Governance

Under the classic corporate governance framework, informed shareholders vote their own shares. However, this framework is increasingly a relic of a different era. Today, most investors hold equity assets indirectly through a variety of intermediary agents. As a result, the classic framework has been replaced in large part by a new model of intermediation. Intermediation […]

Caleb N. Griffin is an associate professor at the University of North Carolina School of Law. This post is based on his article forthcoming in the Washington University Law Review.

Under the classic corporate governance framework, informed shareholders vote their own shares. However, this framework is increasingly a relic of a different era. Today, most investors hold equity assets indirectly through a variety of intermediary agents. As a result, the classic framework has been replaced in large part by a new model of intermediation.

Intermediation involves the decoupling of financial and voting rights, which weakens incentives to invest in informed governance. Regulators “solved” the problem of weak intermediary incentives by imposing an effective voting mandate—today, intermediaries face significant pressure to vote their shares even when such voting is not intrinsically valuable. As a result of the effective regulatory obligation to vote and weak financial incentives to vote well, intermediaries have developed a privately optimal strategy of high-volume, low-value, non-firm-specific, and compliance-oriented governance activity, which this article terms “mass corporate governance.”

Mass corporate governance generates a number of problems for investors, the corporate governance system, and the broader economy. Indeed, the scale of the problem has led some scholars to question whether certain intermediaries should vote at all, or, more modestly, to consider how such governance authority should be constrained.

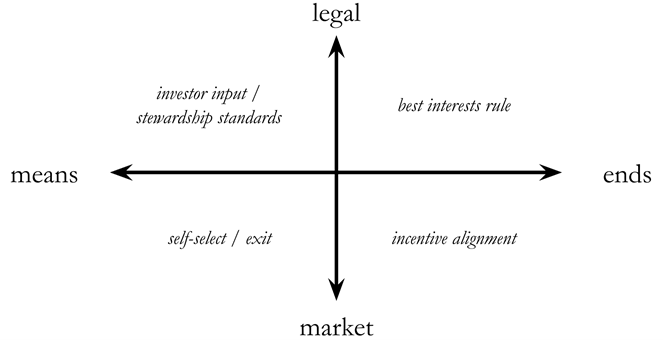

In a forthcoming paper, I construct a framework categorizing possible constraints on intermediary governance. This framework classifies potential constraints by their reliance on either legal or market forces and their target of either the means or ends of intermediated governance. Strategies to constrain governance costs can be situated in one of four quadrants, as shown in the figure below. Possible constraints in each quadrant will be discussed in turn.

Figure I: Theoretical Constraints on Intermediated Governance