Tariffs Will Test Investors’ Long-term Thinking

Uncertainty has gripped markets since the U.S. announced new tariffs on trade partners, raising the specter of a global trade war and escalating barriers. The impact to trade of goods will be swift, yet it’s still unclear how deeply tariffs will affect services, capital flows, and households. Long-term investors like pension funds, insurance companies, and […]

Joel Paula is a Research Director at FCLTGlobal. This post is based on his FCLTGlobal memorandum.

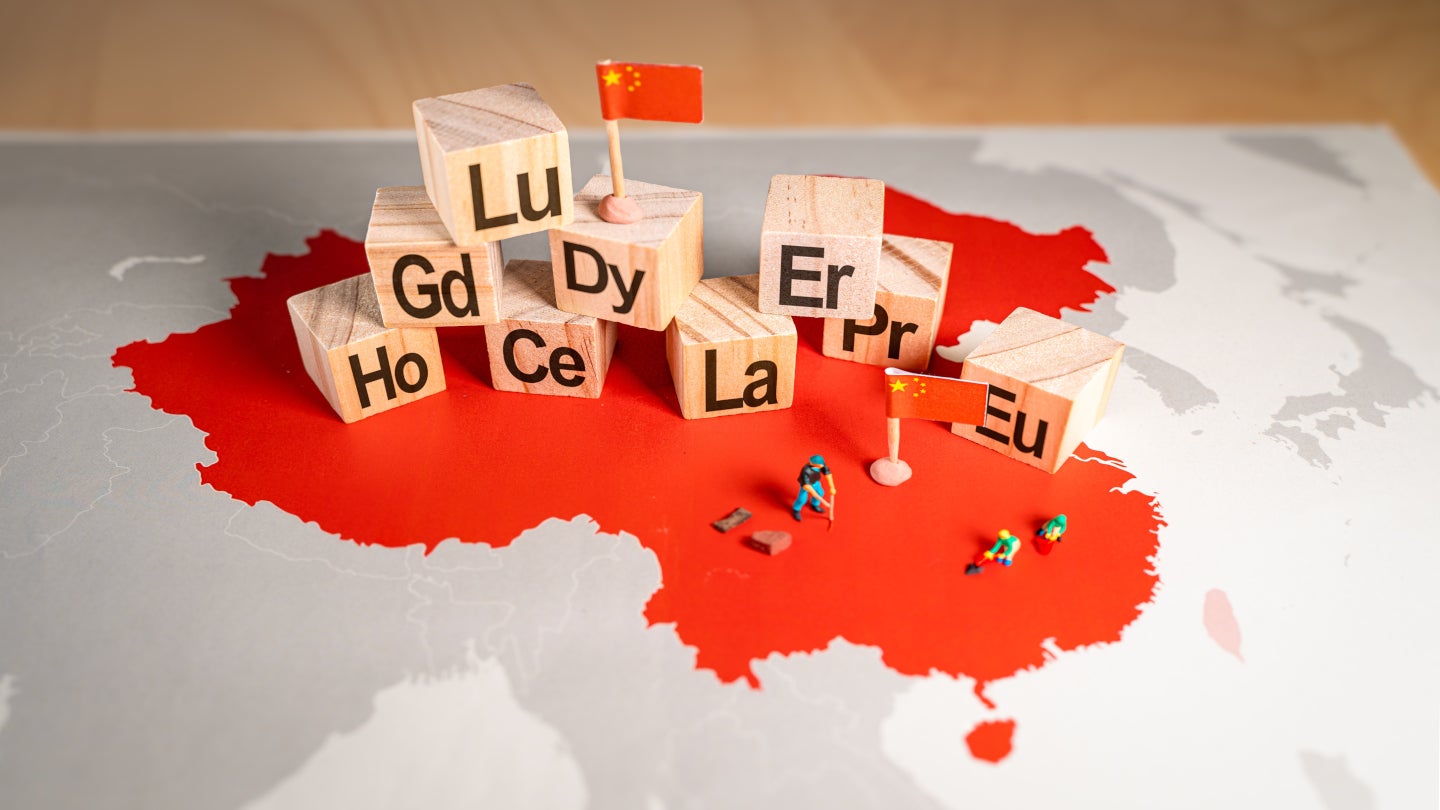

Uncertainty has gripped markets since the U.S. announced new tariffs on trade partners, raising the specter of a global trade war and escalating barriers. The impact to trade of goods will be swift, yet it’s still unclear how deeply tariffs will affect services, capital flows, and households.

Long-term investors like pension funds, insurance companies, and sovereign wealth funds invest significant amounts of capital in world equity and debt markets, where reaction to tariffs prompted significant volatility, to levels not seen since the pandemic and global financial crisis of 2008. It’s easy to get swept up in the panic, but that’s just it: panic and an immediate short-term reaction could lead to bad investment decision-making. Now, more than ever, focusing on the long-term implications of tariffs and the greater geopolitical context is needed to navigate the storm. Resilient portfolios are able to cope with extreme events, and it buys time to develop the strategy and organizational readiness to survive through a crisis. Ensuring resilience in portfolios and organizations is crucial.

That makes it all the more important for investors to focus on the longer-term geopolitical trends, where tariffs and trade wars are just one facet of a world in transition. Even if announced tariffs are reduced or canceled, or a trade war fizzles, risks will persist. Trade reshuffling is but one aspect of a structural rewiring of globalization, with likely second- and third order effects, and far-reaching implications for inflation, growth, and financial stability. Looking back, we have been through periods of significant trade barriers before (Exhibit 1). Trade openness, a measure of imports and exports as a percent of GDP, is one way to look at globalization over time. The indicator grew substantially in the 60 years ending around 2008 but has been flat since, and could shrink further given isolationist policies.