Europe is pouring money into defense. Can US firms reap the reward amid trans-Atlantic tension?

At Paris Air Show, US executives said they see multiple paths for enlarging their share of the European defense market, including coproduction deals, mergers and acquisitions, and the creation of European-based subsidiaries.

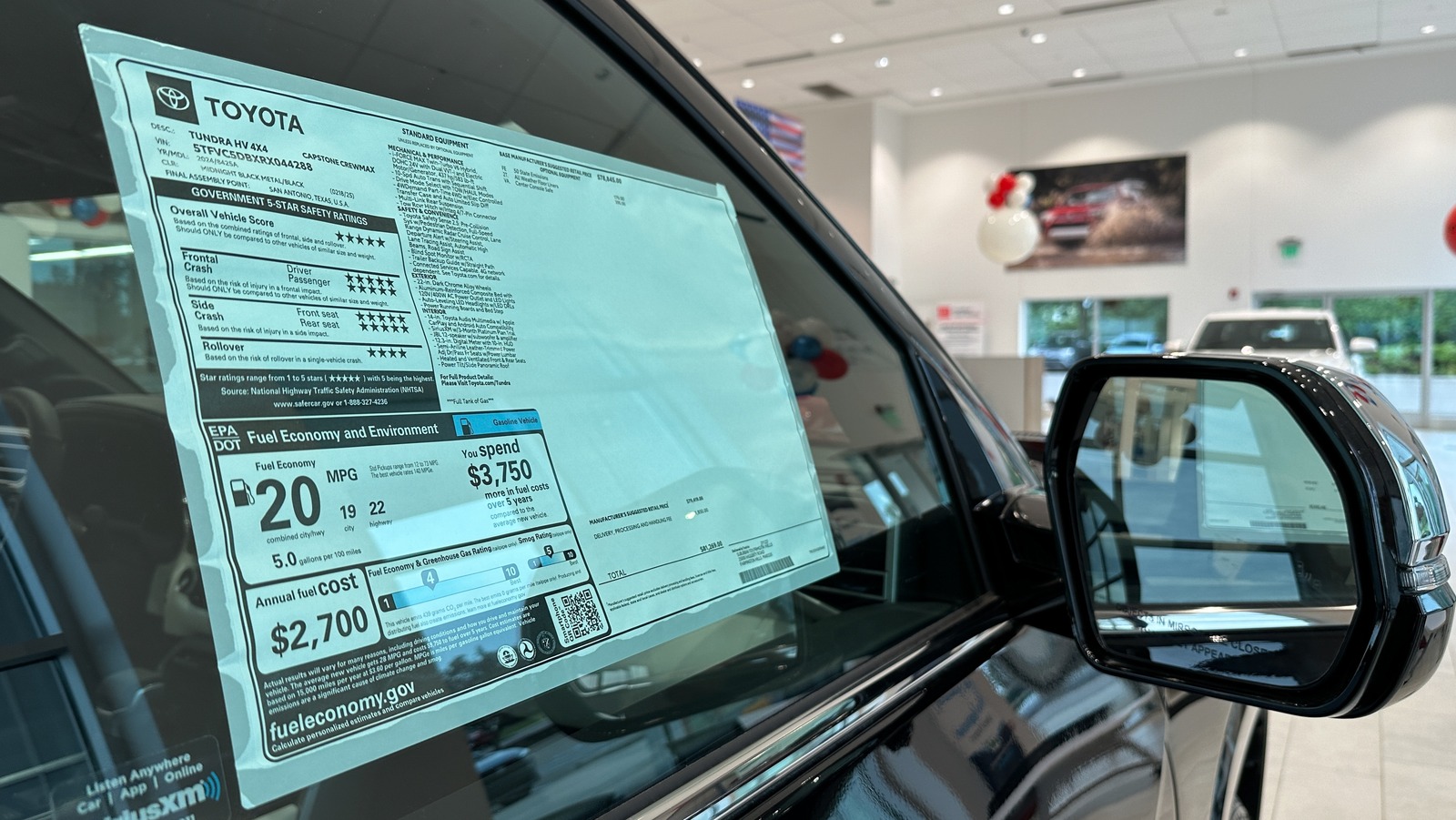

The crowd gathers at the Paris Air Show 2025. (Daniel Woolfolk / Breaking Defense)

PARIS — European nations are in the process of pouring billions of dollars into their defense budgets, individually and collectively, quickly becoming one of the hottest growth markets for defense on the planet. As Anduril executive Greg Kausner put it, the continent is “having a moment right now.”

And at this year’s Paris Air Show, it was evident that the influx of cash has caught the attention of American companies eager to expand their customer base and to do what they can to dive, Scrooge McDuck-style, into that new European pot of money.

But nailing down contracts may not be so easy. Geopolitical tensions between Washington and European capitals have pushed European officials to look more to European solutions, favoring — and in some cases mandating — domestic production of defense articles to reinforce national sovereignty.

“If there’s one fear, it’s probably that the European companies are going to pull away from partnerships or try to prioritize partnering with each other, or maybe even India, South Korea and Japan,” Eric Fanning, president and CEO of the Aerospace Industries Association trade group, told Breaking Defense on the sidelines of the show.

In a series of interviews at the show, US defense firm executives exuded confidence, however, and described their strategies for navigating the delicate trans-Atlantic defense market, including by establishing more partnerships with European companies, allowing more flexible teaming arrangements and setting up a local presence that includes developmental work for engineers as well as manufacturing.

“It’s about co-innovating, and it’s also about producing in the region and developing the IP in the region itself,” Honeywell Aerospace CEO Jim Currier said.

A ‘Definite Increase In Opportunities’

Earlier today the NATO alliance formally adopted a goal of spending 5 percent of members’ GDP on defense and security-related capabilities, an increase that NATO Secretary General Mark Rutte said amounted to “trillions” of extra dollars. Then there’s the European Union’s €800 billion ($928 billion) ReArm Europe spending plan, which includes a €1.5 billion ($1.7 billion) pot of money to boost Europe’s defense industrial base between 2025 to 2027.

How much of that is up for grabs by US businesses remains to be seen, as that €1.5 billion fund comes with stipulations mandating that 65 percent of an item’s cost must derive from European companies, Reuters reported earlier this month.

Still, US executives told Breaking Defense they see multiple paths for enlarging their share of the European defense market.

“We view it as a growth market,” Raytheon President Phil Jasper said last week at the air show. “We’re going to see a definite increase in opportunities for Raytheon, and honestly, the entire industry here in Europe.”

RELATED: America ‘isn’t going anywhere,’ US ambassador tells NATO summit

Raytheon, the weapons producing arm of defense and aerospace giant RTX, is largely focused on partnerships with European companies, Jasper said. That could take the form of coproduction agreements, such as with Norway’s Kongsberg on NASAMS air defense systems, or joint ventures, like its agreement with MBDA to produce the GEM-T interceptor for the Patriot air-defense system.

Most important, Jasper said, is not becoming too proscriptive about the structure of teaming arrangements and ensuring it benefits the local economy.

“One size is not going to fit all,” he said. “There may be cases where it makes complete sense that … we’ll be a follower in this case, for this particular product or capability. And there’s others where that just doesn’t make sense — because of our heritage, because of the products that we’ve got, we want to take the lead.”

Honeywell’s Currier pointed to the company’s 2024 acquisition of Civitanavi Systems, an Italian company that produces navigation systems, as an example of their approach in the region.

The acquisition “wasn’t just about the technology and the capability. … They have a manufacturing footprint in Italy as well,” he said. “So that becomes an anchor point for us to do more manufacturing in region, to support more of that indigenous desire in the EU and to be a little bit more self-autonomous in terms of how they address their defense needs going forward.”

Having an established footprint in Europe that includes about 1,000 engineers and local manufacturing also ensures that Honeywell’s business ventures in Europe feel culturally European instead of being an Americanized offshoot of the company meant to generate short-term business, Currier said.

“We act like an EU company. We operate like an EU company, even though we’re headquartered in the US, but we have that cultural look and feel of being a European company,” he said. “[We’re] not looking at this from an opportunistic standpoint, because we’re there for the long haul.”

RELATED: Lithuania warns Europe against making ‘big mistake’ of breaking off from US defense industry

For some defense startups, like San Diego-based Shield AI, the question is how to expand the company’s existing footprint from the battlefield environments of Ukraine into a long-term presence in Europe, said its CEO, Gary Steele. In January, the company announced it had begun training Ukrainian forces to operate its V-Bat drone, and by April stated that the Ukrainian military had flown more than 130 V-Bat sorties.

“Separate from that, from a longer-term basis, is finding the right way in which we can engage with the European primes and others to leverage our autonomy capabilities more broadly. There’s been tremendous interest there,” he said. Steele added that the company has built products that can be customized by an indigenous workforce with intellectual property that then could be owned by the European prime.

“I think that that will unlock a lot of long-term opportunity for the company,” he said.

Meanwhile, Anduril, the fast-growing defense tech startup originating from Costa Mesa, Calif., has already established a subsidiary in the United Kingdom and is open to creating additional subsidiaries in Europe, said Kausner, senior vice president of global defense.

During the company’s first visit to the air show last week, it inked a partnership with Germany’s Rheinmetall for potential development and production of a European version of its Fury drone and Barracuda low-cost cruise missile. Such partnerships are another way for Anduril to continue expanding its footprint in Europe, he added.

“It’s really recognition of the threat, and it’s recognition matched with funding,” Kausner said of Europe’s spending outlook.

A Europe Investing In Itself

Europe is upping defense spending at a time when President Donald Trump is putting increasing pressure on European nations to be able to secure the continent, including saying the US may not come to the aid of allies who had not paid enough to their own defense.

He has hinted that the United States may withdraw some troops from the region and successfully pushed for NATO allies to increase its spending pledge from 2 percent to 5 percent GDP — even as Trump professes that the United States may not hit that marker.

RELATED: NATO allies besides Spain set to make 5 percent GDP spending pledge

“It’s quite clear to us, from a military perspective, that we need to take responsibility for our security. And that’s been our standpoint the whole way,” Swedish Air Force commander Maj. Gen. Jonas Wikman told reporters in a June 15 briefing before the air show.

Wikman added that Sweden’s link with the United States continues to be “really important … and I don’t think we see a separation there, but I think we agree with the NATO perspective, a NATO standpoint, that, yes, we need to do more for European security.” Wikman’s comments have been widely echoed by other European leaders during the NATO summit at The Hague this week.

While American defense CEOs were largely bullish about the market prospects for US firms, American lawmakers and other industry figures who attended the show underscored the impact that geopolitical anxieties could have on potential partnership opportunities and, ultimately, overall sales to the region.

After all, if European militaries are forced to become less reliant on the US military, its defense industry could follow.

RELATED: Lithuania warns Europe against making ‘big mistake’ of breaking off from US defense industry

Sen. Jerry Moran, R-Kan., a member of the Senate Appropriations Committee who co-led a Senate congressional delegation to the air show, praised the Trump administration for its success in rallying European nations to increase defense spending.

At the same time, he pointed to “the presence of China in significant numbers here at the air show” as a critical reason why the US needs to “to demonstrate we are reliable [partners] today.”

Sen. Jeanne Shaheen, D-N.H., also a delegation co-leader, stressed the need for the United States to work together with Europe, both in the national security arena and industrially.

“I do think if you combine the United States with Europe, whether it’s on the economic front or the national security front, we are a lot more formidable, and so that’s how we should be operating,” said Shaheen, who is a member of the Senate’s armed services, foreign relations and appropriations committees. “I think antagonizing our allies does not make us stronger.”

Asked whether Europe had the defense industrial base capable of handling the burgeoning demand on its own, she responded, “I don’t think we should be asking Europe to carry its own weight.”

‘Kill Switch’ Collateral Damage

Meanwhile, European firms are trying to protect their own territory, with officials arguing that strategic autonomy should also include industrial independence from US defense companies.

In some cases, questions about the dependability of the United States as a partner can be a sales boon for European companies who can argue that their products offer European customers more sovereign control over their weapons systems.

Asked why potential customers would choose to buy Turkish Aerospace Industries’ fifth-generation KAAN aircraft — rather than the proven F-35 Joint Strike Fighter built by Lockheed Martin, TAI chief executive Mehmet Demiroğlu referenced rumors about an F-35 “kill switch” that would allow the United States to disable the aircraft. (The Pentagon has repeatedly stated there is no kill switch, but analysts have noted that F-35 customers are reliant on the US to support the aircraft.)

“There is a discussion in Europe about the kill switch of the F-35 and that’s creating lots of questions,” Demiroğlu told reporters on June 17. “There is availability of the F-35. Some countries can get [the] F-35 easily, some cannot. So all those things, when you add up — and the price and the maintenance and all those things — is going to play a role in the decision making process.”

In the case of the European Next Generation Helicopter Engine (ENGHE) being developed for future European rotorcraft designs, the product’s provenance is perhaps its biggest selling point.

During a June 18 ceremony at the air show, executives announced that Italian aerospace firm Avio Aero would join France’s Safran Helicopter Engines and Germany’s MTU Aero Engines to design and produce ENGHE, with marketing materials for the engine repeatedly underscoring it as “100 [percent] European.”

“This is something which we will do on a European basis, because we need to have sovereignty, and we need not to be dependent in our defense procurement on countries outside of Europe,” Michael Schreyögg, MTU Aero Engines’ chief program officer, said at the event.

Michael Marrow in Paris contributed to this report.