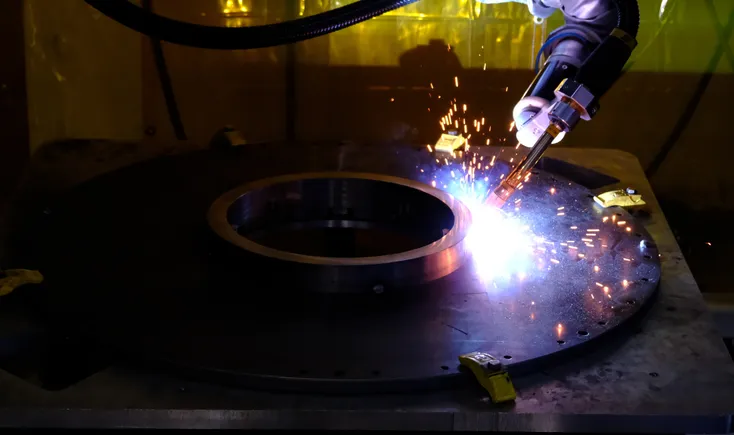

Klarna pauses IPO plans amid tariffs uncertainty

Credits: Klarna Buy-now, pay-later platform Klarna has reportedly pressed pause on its plans for an initial public offering (IPO) amid ongoing uncertainty surrounding global tariffs. People familiar with the matter had told The Wall Street Journal (TWSJ) that Klarna was halting its pursuit of a US listing, which had initially been scheduled to take place this week. Sources for Reuters, however, suggested that Klarna could reassess its plans if market conditions stabilise. Klarna declined FashionUnited’s request to comment. Klarna had announced it had filed IPO documents proposing to list on the New York Stock Exchange back in March, with Goldman Sachs & Co, JP Morgan and Morgan Stanley onboarded as joint book-running managers. TWSJ had previously reported that the company was targeting a valuation of 15 billion dollars and thus a raise of one billion dollars. Its step back comes at a volatile time for the US’ stock market, which took a hit for the second session in a row last week upon the announcement of sweeping global tariffs by President Donald Trump. Klarna’s pursuit of a listing had initially been pitted as an encouraging sign for the local IPO market, fueling hopes that recovery was imminent.

Buy-now, pay-later platform Klarna has reportedly pressed pause on its plans for an initial public offering (IPO) amid ongoing uncertainty surrounding global tariffs.

People familiar with the matter had told The Wall Street Journal (TWSJ) that Klarna was halting its pursuit of a US listing, which had initially been scheduled to take place this week.

Sources for Reuters, however, suggested that Klarna could reassess its plans if market conditions stabilise. Klarna declined FashionUnited’s request to comment.

Klarna had announced it had filed IPO documents proposing to list on the New York Stock Exchange back in March, with Goldman Sachs & Co, JP Morgan and Morgan Stanley onboarded as joint book-running managers.

TWSJ had previously reported that the company was targeting a valuation of 15 billion dollars and thus a raise of one billion dollars.

Its step back comes at a volatile time for the US’ stock market, which took a hit for the second session in a row last week upon the announcement of sweeping global tariffs by President Donald Trump.

Klarna’s pursuit of a listing had initially been pitted as an encouraging sign for the local IPO market, fueling hopes that recovery was imminent.

![What you need to know before you go to Sea Air Space 2025 [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2024/05/Screen-Shot-2024-05-14-at-12.19.19-PM.png?#)

.jpg)