Is ESG Making the Job Market More Polarized?

Recent debates over corporate social responsibility reveal deepening divides in how companies engage with environmental, social, and governance (ESG) issues. Public discourse around corporate responsibility has intensified, with the U.S. emerging as a focal point following the 2024 presidential election. Several large firms have publicly reduced their ESG commitments; for example, Google recently eliminated its […]

Thomas Rauter is an Associate Professor of Accounting at The University of Chicago Booth School of Business. This post is based on a recent paper by Professor Rauter, Professor Emanuele Colonnelli, Professor Timothy McQuade, Gabriel Ramos, and Olivia Xiong.

Recent debates over corporate social responsibility reveal deepening divides in how companies engage with environmental, social, and governance (ESG) issues. Public discourse around corporate responsibility has intensified, with the U.S. emerging as a focal point following the 2024 presidential election. Several large firms have publicly reduced their ESG commitments; for example, Google recently eliminated its hiring goals for historically underrepresented groups and signaled a reassessment of its diversity, equity, and inclusion (DEI) programs. Conversely, other major corporations, such as Costco and Microsoft, among others, have reaffirmed their ESG commitments. These divergent strategies highlight the increasingly polarized landscape of corporate social responsibility, where strategic engagement with ESG practices plays a growing role in defining corporate identity.

This evolving landscape raises critical questions about the impacts of firms’ engagement with ESG on job-seeker preferences and broader labor dynamics. Do corporate ESG practices matter for job-seekers? Are job-seekers uniformly responsive to ESG practices, or do meaningful differences in preferences exist across sociodemographic lines? What are the broader implications of ESG on talent allocation, wage inequality, and labor market efficiency?

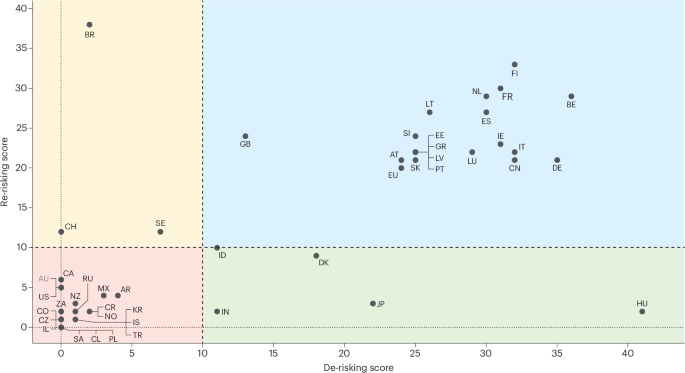

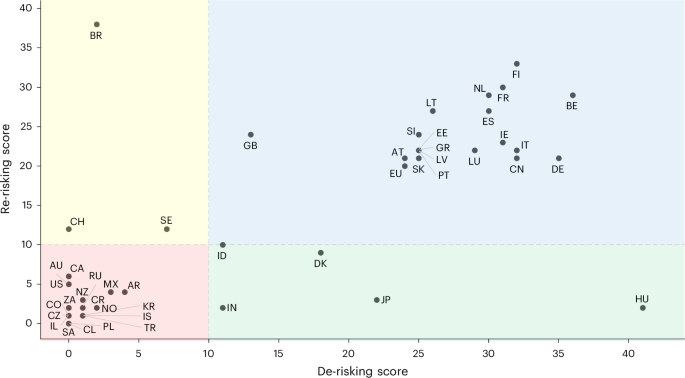

In Colonnelli et al. (2025a), we explore the implications of ESG practices in the context of Brazil, one of the world’s largest emerging economies. While public discourse on ESG has largely centered on the U.S. and Europe, emerging markets provide a unique and understudied context to examine these questions.