Brewers are choosing to import New Zealand hops over US varieties to meet the European Union’s new strict organic certifications.

The trend, which has already started to be classed as a win for New Zealand, has seen US hops like Citra, Mosaic and Cascade being swapped for NZ varieties of Nelson Sauvin, Moutere and Nectaron. With predictions around this switch meaning that beer fans could be seeing an increase in NZ pales, ambers and New World brews on more taps across Europe very soon.

Declining craft beer sales have recently led to places like

Oregon in the US seeing a nearly 20% drop in its 2024 hop harvest, according to statistics from the Oregon Beverage Alliance.

The

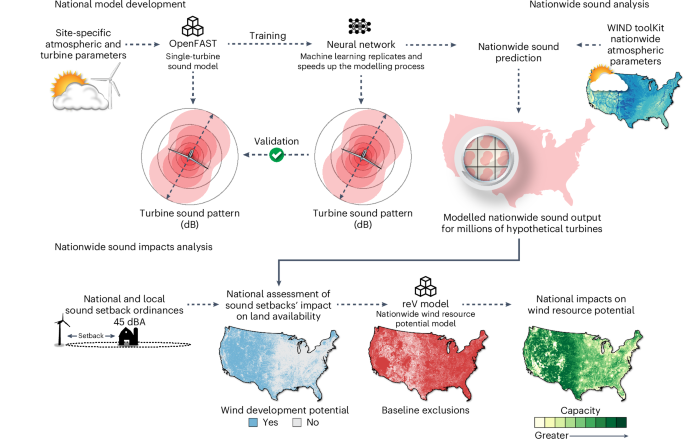

impact of climate on hop growing is now being assessed in new research undertaken following brewers' concerns about the critical impact of climate change on their supply chains.

Additionally, European aroma hops are facing continued challenges. In a study from the Czech Academy of Sciences, researchers warned that, unless swift adaptations are developed, European hops will be increasingly difficult to grow due to climate change affecting yields and alpha acid content. This means that

Europe will experience a drop of 4-18% in traditional aroma hops yields by 2050, plus a 20-31% fall in alpha acids, giving New Zealand a reason and the means to step up.

New Zealand’s south Island hop farmers have alreadt started to see success moving a surplus of hops over to EU brewers in recent export deals, picking up the opportunities where US hops have not met the grade.

According to radio station RNZ, Hinetai Hops has 64 canopy hectares, some certified organic, at its Tapawera garden south of Motueka and supplies hops to the grower-owned cooperative NZ Hops along with 24 other shareholder-suppliers found mostly around the Tasman district.

As one of just a few certified organic hop producers in New Zealand, Hinetai Hops owner and co-op director Dean Palmer explained how some US hop exports had failed to meet the European Union's strict organic certifications recently and noted that this is where New Zealand stepped up to meet demand.

Palmer admitted: "We've had a bit of a win in that a lot of the US organics [hops] couldn't make the European market requirements, they breached [maximum residue levels] MRLs for spray drift from neighbouring conventional hops, so we've seen a massive surge in demand just over the past couple of months due to that."

Hop farmers from all of the world have had a surplus of crop Palmer explained and pointed out that this was a lot to do with trends for New World hops spiking and then waning across wider trends in craft beer, cost pressures among brewers and also beer consumption overall being down globally.

Palmer revealed: "There's quite an oversupply of hops worldwide, and also particularly from New Zealand there's the oversupply, given the massive production increase over the last six years or so. And then also with a few economic headwinds and some changes in beer consumption and styles, the demand has dropped back a bit too."

Despite the challenges, Palmer insured that his company has had "a good run" thanks to the increased popularity of craft beer in recent years, even though business has been "very volatile".

He lamented that “the hop market is currently in a bit of a down” and pointed out that the volume of NZ hops being sold domestically was minimal compared to those being exported to other parts of the world, but reminded that there were higher costs attached to exporting.

Tasman-based collective NZ Hops currently represents around 25 shareholder-suppliers across 27 farms, and has a large coolstore for growers' hops to retain them at the highest quality. However, Palmer explained that there were more than a handful of independent hop farmers in New Zealand too and they are well-aware of the opportunities in the EU. As such, hop gardens have been buzzing with activity this month as harvest started.

With 15% of the hop crop bound for the domestic market, around 85% exported to markets, but, as Palmer stated: “We're a long way from market” and described the export costs as “considerable”.

“The cost getting to market is quite high compared to our competitors” Palmer said and admitted that this means which “takes considerable effort to grow our market share”.

To assist with these challenges and to pick up more business, Palmer said Hinetai recently hosted around 100 brewers from Australia, the US, Poland, Latvia and the UK to generate new business.

But, despite the hurdles, and what Palmer suggested would be "a long road" back to the hot hop market of recent years - New Zealand’s growers are now seeing special varieties like trademarked Nelson Sauvin, Moutere or registered Nectaron offering an advantage.

He added: "We've got a really awesome offering and we've got additional value with things like organics and spray free that the rest of the world can't do. And we also have really good varieties down here that are unique. We're in it for the long-term and we believe this is a really good value proposition.”

The trend, which has already started to be classed as a win for New Zealand, has seen US hops like Citra, Mosaic and Cascade being swapped for NZ varieties of Nelson Sauvin, Moutere and Nectaron. With predictions around this switch meaning that beer fans could be seeing an increase in NZ pales, ambers and New World brews on more taps across Europe very soon.

Declining craft beer sales have recently led to places like Oregon in the US seeing a nearly 20% drop in its 2024 hop harvest, according to statistics from the Oregon Beverage Alliance.

The impact of climate on hop growing is now being assessed in new research undertaken following brewers' concerns about the critical impact of climate change on their supply chains.

Additionally, European aroma hops are facing continued challenges. In a study from the Czech Academy of Sciences, researchers warned that, unless swift adaptations are developed, European hops will be increasingly difficult to grow due to climate change affecting yields and alpha acid content. This means that Europe will experience a drop of 4-18% in traditional aroma hops yields by 2050, plus a 20-31% fall in alpha acids, giving New Zealand a reason and the means to step up.

New Zealand’s south Island hop farmers have alreadt started to see success moving a surplus of hops over to EU brewers in recent export deals, picking up the opportunities where US hops have not met the grade.

According to radio station RNZ, Hinetai Hops has 64 canopy hectares, some certified organic, at its Tapawera garden south of Motueka and supplies hops to the grower-owned cooperative NZ Hops along with 24 other shareholder-suppliers found mostly around the Tasman district.

As one of just a few certified organic hop producers in New Zealand, Hinetai Hops owner and co-op director Dean Palmer explained how some US hop exports had failed to meet the European Union's strict organic certifications recently and noted that this is where New Zealand stepped up to meet demand.

Palmer admitted: "We've had a bit of a win in that a lot of the US organics [hops] couldn't make the European market requirements, they breached [maximum residue levels] MRLs for spray drift from neighbouring conventional hops, so we've seen a massive surge in demand just over the past couple of months due to that."

Hop farmers from all of the world have had a surplus of crop Palmer explained and pointed out that this was a lot to do with trends for New World hops spiking and then waning across wider trends in craft beer, cost pressures among brewers and also beer consumption overall being down globally.

Palmer revealed: "There's quite an oversupply of hops worldwide, and also particularly from New Zealand there's the oversupply, given the massive production increase over the last six years or so. And then also with a few economic headwinds and some changes in beer consumption and styles, the demand has dropped back a bit too."

Despite the challenges, Palmer insured that his company has had "a good run" thanks to the increased popularity of craft beer in recent years, even though business has been "very volatile".

He lamented that “the hop market is currently in a bit of a down” and pointed out that the volume of NZ hops being sold domestically was minimal compared to those being exported to other parts of the world, but reminded that there were higher costs attached to exporting.

Tasman-based collective NZ Hops currently represents around 25 shareholder-suppliers across 27 farms, and has a large coolstore for growers' hops to retain them at the highest quality. However, Palmer explained that there were more than a handful of independent hop farmers in New Zealand too and they are well-aware of the opportunities in the EU. As such, hop gardens have been buzzing with activity this month as harvest started.

With 15% of the hop crop bound for the domestic market, around 85% exported to markets, but, as Palmer stated: “We're a long way from market” and described the export costs as “considerable”.

“The cost getting to market is quite high compared to our competitors” Palmer said and admitted that this means which “takes considerable effort to grow our market share”.

To assist with these challenges and to pick up more business, Palmer said Hinetai recently hosted around 100 brewers from Australia, the US, Poland, Latvia and the UK to generate new business.

But, despite the hurdles, and what Palmer suggested would be "a long road" back to the hot hop market of recent years - New Zealand’s growers are now seeing special varieties like trademarked Nelson Sauvin, Moutere or registered Nectaron offering an advantage.

He added: "We've got a really awesome offering and we've got additional value with things like organics and spray free that the rest of the world can't do. And we also have really good varieties down here that are unique. We're in it for the long-term and we believe this is a really good value proposition.”

The trend, which has already started to be classed as a win for New Zealand, has seen US hops like Citra, Mosaic and Cascade being swapped for NZ varieties of Nelson Sauvin, Moutere and Nectaron. With predictions around this switch meaning that beer fans could be seeing an increase in NZ pales, ambers and New World brews on more taps across Europe very soon.

Declining craft beer sales have recently led to places like Oregon in the US seeing a nearly 20% drop in its 2024 hop harvest, according to statistics from the Oregon Beverage Alliance.

The impact of climate on hop growing is now being assessed in new research undertaken following brewers' concerns about the critical impact of climate change on their supply chains.

Additionally, European aroma hops are facing continued challenges. In a study from the Czech Academy of Sciences, researchers warned that, unless swift adaptations are developed, European hops will be increasingly difficult to grow due to climate change affecting yields and alpha acid content. This means that Europe will experience a drop of 4-18% in traditional aroma hops yields by 2050, plus a 20-31% fall in alpha acids, giving New Zealand a reason and the means to step up.

New Zealand’s south Island hop farmers have alreadt started to see success moving a surplus of hops over to EU brewers in recent export deals, picking up the opportunities where US hops have not met the grade.

According to radio station RNZ, Hinetai Hops has 64 canopy hectares, some certified organic, at its Tapawera garden south of Motueka and supplies hops to the grower-owned cooperative NZ Hops along with 24 other shareholder-suppliers found mostly around the Tasman district.

As one of just a few certified organic hop producers in New Zealand, Hinetai Hops owner and co-op director Dean Palmer explained how some US hop exports had failed to meet the European Union's strict organic certifications recently and noted that this is where New Zealand stepped up to meet demand.

Palmer admitted: "We've had a bit of a win in that a lot of the US organics [hops] couldn't make the European market requirements, they breached [maximum residue levels] MRLs for spray drift from neighbouring conventional hops, so we've seen a massive surge in demand just over the past couple of months due to that."

Hop farmers from all of the world have had a surplus of crop Palmer explained and pointed out that this was a lot to do with trends for New World hops spiking and then waning across wider trends in craft beer, cost pressures among brewers and also beer consumption overall being down globally.

Palmer revealed: "There's quite an oversupply of hops worldwide, and also particularly from New Zealand there's the oversupply, given the massive production increase over the last six years or so. And then also with a few economic headwinds and some changes in beer consumption and styles, the demand has dropped back a bit too."

Despite the challenges, Palmer insured that his company has had "a good run" thanks to the increased popularity of craft beer in recent years, even though business has been "very volatile".

He lamented that “the hop market is currently in a bit of a down” and pointed out that the volume of NZ hops being sold domestically was minimal compared to those being exported to other parts of the world, but reminded that there were higher costs attached to exporting.

Tasman-based collective NZ Hops currently represents around 25 shareholder-suppliers across 27 farms, and has a large coolstore for growers' hops to retain them at the highest quality. However, Palmer explained that there were more than a handful of independent hop farmers in New Zealand too and they are well-aware of the opportunities in the EU. As such, hop gardens have been buzzing with activity this month as harvest started.

With 15% of the hop crop bound for the domestic market, around 85% exported to markets, but, as Palmer stated: “We're a long way from market” and described the export costs as “considerable”.

“The cost getting to market is quite high compared to our competitors” Palmer said and admitted that this means which “takes considerable effort to grow our market share”.

To assist with these challenges and to pick up more business, Palmer said Hinetai recently hosted around 100 brewers from Australia, the US, Poland, Latvia and the UK to generate new business.

But, despite the hurdles, and what Palmer suggested would be "a long road" back to the hot hop market of recent years - New Zealand’s growers are now seeing special varieties like trademarked Nelson Sauvin, Moutere or registered Nectaron offering an advantage.

He added: "We've got a really awesome offering and we've got additional value with things like organics and spray free that the rest of the world can't do. And we also have really good varieties down here that are unique. We're in it for the long-term and we believe this is a really good value proposition.”