Carter's Q1 sales and earnings decline

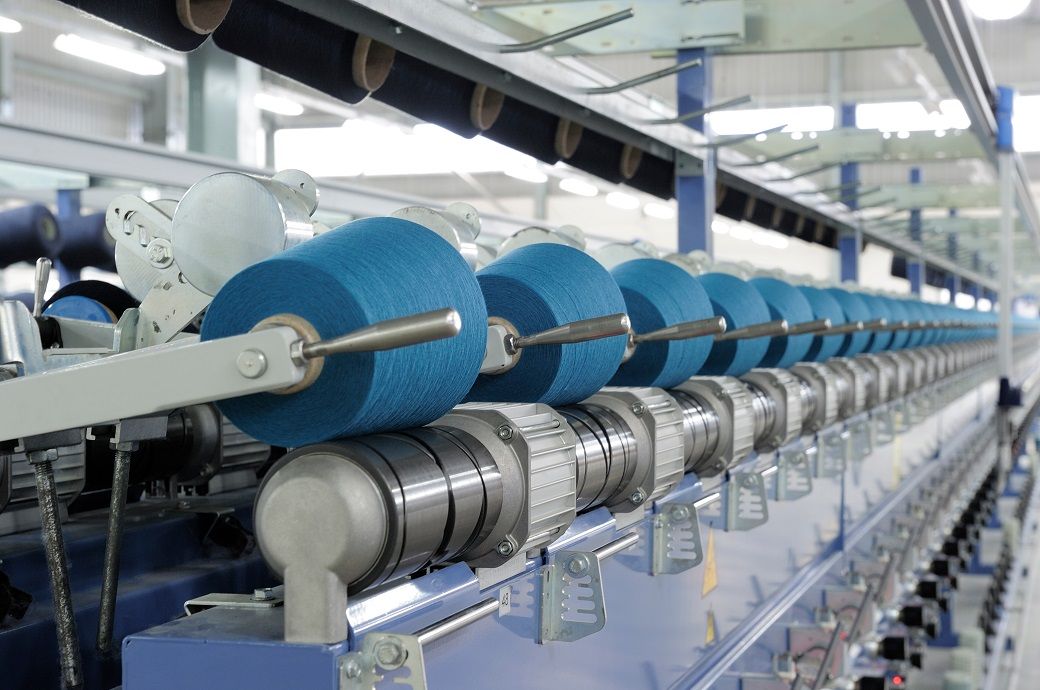

Carter's Credits: Facebook/Carter's Carter's, a prominent children's wear retailer, disclosed its financial performance for the first quarter of fiscal year 2025, revealing a reduction in key financial indicators compared to the corresponding period last year, indicating a difficult start to the fiscal year for the company. The company's consolidated net sales for the first quarter reached 630 million dollars, marking a 4.8 percent decrease. Furthermore, the adjusted diluted earnings per share (EPS) declined to 66 cents, compared to the 1.04 dollars reported in the same quarter of the previous year. Despite the overall financial downturn, Carter's management highlighted specific areas of resilience within the company's operations. Douglas Palladini, the newly appointed CEO and president of Carter's said, “Our U.S. Retail business achieved its sales and earnings plans in the quarter. Trends in March, the most significant month of the quarter, improved meaningfully from performance in January and February driven by the effectiveness of our product and promotional strategies. In March, we saw improved traffic, conversion, and comparable sales trends while continuing to add new customers and improve customer retention.” Examining individual segments, the company’s US wholesale segment experienced a 5.3 percent decrease, the US retail segment saw a 4.3 percent reduction, and the international segment also reported a 4.9 percent drop in net sales. Despite the decline in sales and earnings, Carter's distributed 29 million dollars to shareholders through dividend payments, with a cash dividend of 80 cents per common share. In light of the recent change in leadership and the considerable uncertainty surrounding potential new tariffs, Carter's has made the decision to suspend its forward financial guidance for the time being.

Carter's, a prominent children's wear retailer, disclosed its financial performance for the first quarter of fiscal year 2025, revealing a reduction in key financial indicators compared to the corresponding period last year, indicating a difficult start to the fiscal year for the company.

The company's consolidated net sales for the first quarter reached 630 million dollars, marking a 4.8 percent decrease. Furthermore, the adjusted diluted earnings per share (EPS) declined to 66 cents, compared to the 1.04 dollars reported in the same quarter of the previous year.

Despite the overall financial downturn, Carter's management highlighted specific areas of resilience within the company's operations.

Douglas Palladini, the newly appointed CEO and president of Carter's said, “Our U.S. Retail business achieved its sales and earnings plans in the quarter. Trends in March, the most significant month of the quarter, improved meaningfully from performance in January and February driven by the effectiveness of our product and promotional strategies. In March, we saw improved traffic, conversion, and comparable sales trends while continuing to add new customers and improve customer retention.”

Examining individual segments, the company’s US wholesale segment experienced a 5.3 percent decrease, the US retail segment saw a 4.3 percent reduction, and the international segment also reported a 4.9 percent drop in net sales.

Despite the decline in sales and earnings, Carter's distributed 29 million dollars to shareholders through dividend payments, with a cash dividend of 80 cents per common share.

In light of the recent change in leadership and the considerable uncertainty surrounding potential new tariffs, Carter's has made the decision to suspend its forward financial guidance for the time being.

![Five-Star Basketball Prospect Severely Injured In Fiery Tesla Cybertruck Crash [Update]](https://www.jalopnik.com/img/gallery/five-star-basketball-prospect-severely-injured-in-fiery-tesla-cybertruck-crash/l-intro-1745597808.jpg?#)