The Montana Distillery files for bankruptcy

Despite award-winning spirits and community loyalty, The Montana Distillery has filed for Chapter 11, highlighting the pressures facing small producers in the American craft drinks sector. The post The Montana Distillery files for bankruptcy appeared first on The Drinks Business.

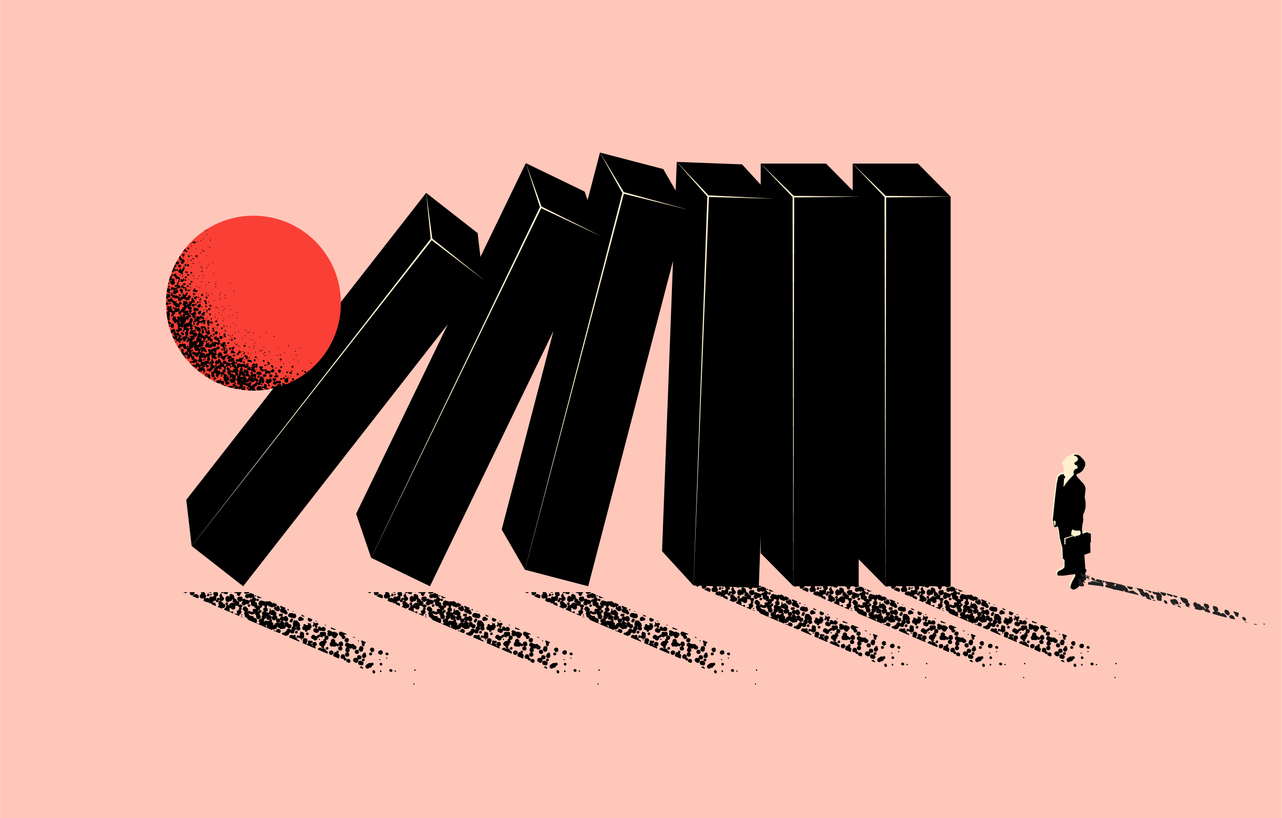

The collapse of The Montana Distillery, a much-loved producer known for its inventive vodkas and small-batch whiskey, is a poignant reminder of the volatility facing America’s craft spirits movement. Based in the small town of Stevensville, Montana, the distillery filed for Chapter 11 bankruptcy protection, revealing liabilities between US$500,000 and $1 million against assets totalling less than $50,000, according to US Bankruptcy Court filings (Case No. 24-90081).

The business had previously won the hearts of both locals and tourists through its tasting room and a range of flavoured spirits – including pepper, bacon and huckleberry vodkas – as well as a gin and a whiskey known as Careless Creek Red Sheep. Despite being voted Best Distillery in Montana by readers of Distinctly Montana Magazine in early 2024, the owners, Mark Hlebichuk and Sharie McDonald, cited a series of crushing financial and regulatory pressures that ultimately made operations unsustainable.

A distillery born from revival and relocation

The couple acquired the original business in 2011, when it was operating as Flathead Distillery, and reopened it in Missoula in 2014 as The Montana Distillery. As costs escalated in downtown Missoula, particularly with soaring property taxes (the building’s assessed value reportedly rose from $795,000 to $1.26 million in a single year), the owners relocated to Stevensville in 2020 in what they described as a "move or go out of business" scenario (KPAX-TV, Jul 2020).

The pandemic intensified their challenges. Like many hospitality-focused producers, they suffered a dramatic drop in on-site sales and tourism-related income. Hlebichuk and McDonald leaned heavily on government support, including a US$523,421 loan from the Small Business Administration (SBA) and $161,342 in outstanding taxes to the Internal Revenue Service, both of which appeared in the bankruptcy documents.

Cost spikes, regulation and a shrinking market

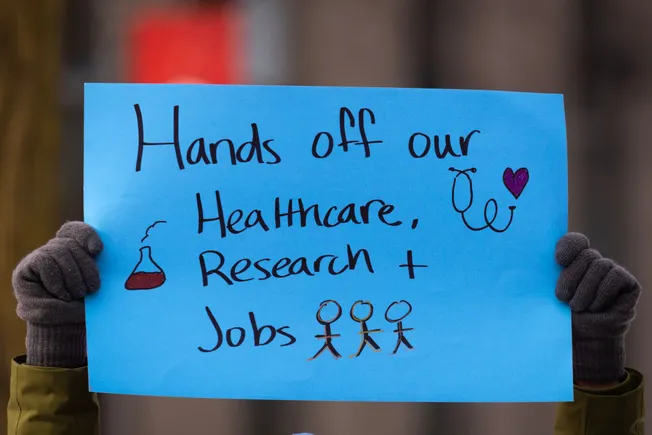

The owners attributed their downfall not to a lack of demand but to what Hlebichuk described as an "oppressive regulatory" climate and unsustainable cost increases. Montana law, for instance, limits distillery tasting rooms to serving just 2 ounces of liquor per customer per day – a cap that throttled on-premise sales, even as their spirits gained a following (Bitterroot Star, 12 Mar 2025).

This local struggle is mirrored in national trends. According to Whisky Advocate and the American Craft Spirits Association, craft spirits sales in the US declined by 3.6% in 2023, the first contraction in the category’s modern history. Industry observers have warned of an oversaturated market and a consumer base increasingly drawn to large, familiar brands or looking for budget-friendly options amid inflation.

Noel Burns, co-founder of Alamo Distilling Co in Texas, which also filed for Chapter 11 in 2024, described the post-pandemic operating environment for craft producers as "catastrophic", citing a tripling of operational costs and increasingly tight margins. "It’s the small businesses that collapse under that load," he told the San Antonio Business Journal (14 Nov 2024).

The steep price of community and quality

The Montana Distillery’s Stevensville tasting room was as much a social centre as a spirits outlet. Staff member John Rudow reflected that customers would miss "a lot of what the Montana Distillery has brought to the valley," even noting that the distillery dog who greeted guests had become a local fixture.

For Hlebichuk, the decision to file for bankruptcy was not a reflection of consumer demand but of structural limitations. In the final week of business in March 2025, the distillery offered steep discounts on merchandise and spirits to clear stock and thank patrons. He said he remained hopeful that someone might buy the business and revive its operations, hinting he would be open to consulting with any new owners.

Lessons from the still

While the Chapter 11 filing allows for potential reorganisation, the closure of the tasting room and the sell-off of assets suggest this particular chapter may be closing for good. For distributors and suppliers, the loss of Montana Distillery means unsettled debts and the disappearance of a niche but respected niche brand from shelves. For consumers, it signals the fragility of even the most celebrated small producers.

Ultimately, Montana Distillery’s story is emblematic of a broader challenge. As costs mount, regulations persist, and consumer preferences evolve, many craft producers are finding the post-pandemic terrain treacherous. Despite quality products and community goodwill, survival now depends as much on financial engineering and scale as on artistry.

the drinks business has reached out to The Montana Distillery for further comment.

The collapse of The Montana Distillery, a much-loved producer known for its inventive vodkas and small-batch whiskey, is a poignant reminder of the volatility facing America’s craft spirits movement. Based in the small town of Stevensville, Montana, the distillery filed for Chapter 11 bankruptcy protection, revealing liabilities between US$500,000 and $1 million against assets totalling less than $50,000, according to US Bankruptcy Court filings (Case No. 24-90081).

The business had previously won the hearts of both locals and tourists through its tasting room and a range of flavoured spirits – including pepper, bacon and huckleberry vodkas – as well as a gin and a whiskey known as Careless Creek Red Sheep. Despite being voted Best Distillery in Montana by readers of Distinctly Montana Magazine in early 2024, the owners, Mark Hlebichuk and Sharie McDonald, cited a series of crushing financial and regulatory pressures that ultimately made operations unsustainable.

A distillery born from revival and relocation

The couple acquired the original business in 2011, when it was operating as Flathead Distillery, and reopened it in Missoula in 2014 as The Montana Distillery. As costs escalated in downtown Missoula, particularly with soaring property taxes (the building’s assessed value reportedly rose from $795,000 to $1.26 million in a single year), the owners relocated to Stevensville in 2020 in what they described as a "move or go out of business" scenario (KPAX-TV, Jul 2020).

The pandemic intensified their challenges. Like many hospitality-focused producers, they suffered a dramatic drop in on-site sales and tourism-related income. Hlebichuk and McDonald leaned heavily on government support, including a US$523,421 loan from the Small Business Administration (SBA) and $161,342 in outstanding taxes to the Internal Revenue Service, both of which appeared in the bankruptcy documents.

Cost spikes, regulation and a shrinking market

The owners attributed their downfall not to a lack of demand but to what Hlebichuk described as an "oppressive regulatory" climate and unsustainable cost increases. Montana law, for instance, limits distillery tasting rooms to serving just 2 ounces of liquor per customer per day – a cap that throttled on-premise sales, even as their spirits gained a following (Bitterroot Star, 12 Mar 2025).

This local struggle is mirrored in national trends. According to Whisky Advocate and the American Craft Spirits Association, craft spirits sales in the US declined by 3.6% in 2023, the first contraction in the category’s modern history. Industry observers have warned of an oversaturated market and a consumer base increasingly drawn to large, familiar brands or looking for budget-friendly options amid inflation.

Noel Burns, co-founder of Alamo Distilling Co in Texas, which also filed for Chapter 11 in 2024, described the post-pandemic operating environment for craft producers as "catastrophic", citing a tripling of operational costs and increasingly tight margins. "It’s the small businesses that collapse under that load," he told the San Antonio Business Journal (14 Nov 2024).

The steep price of community and quality

The Montana Distillery’s Stevensville tasting room was as much a social centre as a spirits outlet. Staff member John Rudow reflected that customers would miss "a lot of what the Montana Distillery has brought to the valley," even noting that the distillery dog who greeted guests had become a local fixture.

For Hlebichuk, the decision to file for bankruptcy was not a reflection of consumer demand but of structural limitations. In the final week of business in March 2025, the distillery offered steep discounts on merchandise and spirits to clear stock and thank patrons. He said he remained hopeful that someone might buy the business and revive its operations, hinting he would be open to consulting with any new owners.

Lessons from the still

While the Chapter 11 filing allows for potential reorganisation, the closure of the tasting room and the sell-off of assets suggest this particular chapter may be closing for good. For distributors and suppliers, the loss of Montana Distillery means unsettled debts and the disappearance of a niche but respected niche brand from shelves. For consumers, it signals the fragility of even the most celebrated small producers.

Ultimately, Montana Distillery’s story is emblematic of a broader challenge. As costs mount, regulations persist, and consumer preferences evolve, many craft producers are finding the post-pandemic terrain treacherous. Despite quality products and community goodwill, survival now depends as much on financial engineering and scale as on artistry.

the drinks business has reached out to The Montana Distillery for further comment.

![F/A-XX hints, icebreaker ambitions and previewing day two of Sea Air Space [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/04/250407_SAS_2025_indopac_WELCH-scaled-e1744076170241.jpg?#)