Tariff Tsunami Hits U.S. Healthcare: Double-Digit Penalties Spark Cost Surge and Supply Chain Crisis, Black Book Warns

Black Book's ad hoc survey of 200 healthcare executives reveals real-time disruptions, cost inflation, and stalled innovation as Trump-era tariffs expand across key healthcare imports. The post Tariff Tsunami Hits U.S. Healthcare: Double-Digit Penalties Spark Cost Surge and Supply Chain Crisis, Black Book Warns appeared first on MedTech Intelligence.

Press Release: MTI Staff was not involved in writing this content

The updated survey-conducted March 6 through April 2-builds upon Black Book’s original February study and reflects the real-time ripple effect of the expanded trade penalties. A total of 200 leaders across hospitals, health systems, pharmaceutical and medical equipment manufacturers, payers, and health IT vendors participated in the research.

“The second wave of tariffs is no longer a theoretical threat-it’s a full-blown disruption with immediate consequences,” said Doug Brown, Founder of Black Book Research. “Healthcare organizations are shifting budgets, freezing projects, and forming crisis response teams to manage this economic shock.”

Updated Key Findings from the April 2025 Survey

As tariff impacts shift from forecast to reality, Black Book’s follow-up April survey reveals the precise ways in which providers, payers, and vendors are adapting under pressure. Key findings include:

1. How are healthcare organizations reacting to the expanded March & April tariffs?

83% of respondents say they are in emergency budget recalibration mode, adjusting Q2 and Q3 forecasts due to the anticipated cost spikes in equipment and pharmaceuticals.

45% have called executive task forces or crisis response teams to address the escalating economic impact on operations and care delivery.

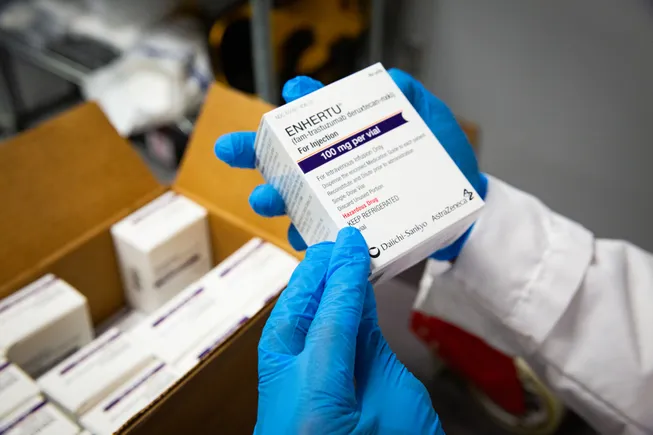

2. What’s the projected impact on medical equipment and pharmaceutical costs?

88% of executives forecast a minimum 18% spike in medical equipment costs by Q4 2025, with 94% expecting 33% or more for critical devices affected by China and EU import penalties.

97% now anticipate a 15+% increase in pharmaceutical expenses, worsened by new tariffs on Indian APIs and a lack of viable substitutes.

3. How are supply chains being disrupted-and how fast?

21% of supply chain leaders report that procurement timelines have already slipped within the first week of the new tariffs-especially for surgical kits, diagnostic components, and imaging devices.

12% cite “unprecedented volatility” in contract renegotiations with international suppliers, leading to missed shipments and inventory backlogs.

4. What financial countermeasures are hospitals and practices planning?

75% of provider CFOs are implementing short-term cost shifting to payers and patients.

29% are considering staff restructuring or wage freezes to manage the mounting fiscal pressure.

94% confirm they are delaying IT modernization projects and clinical technology upgrades until tariff-driven volatility subsides.

5. How are payers preparing for downstream impacts on affordability?

95% of payer executives anticipate claims cost inflation will drive double-digit premium hikes for individual and group plans in 2026.

92% are conducting internal reviews of value-based care contracts and drug formularies to explore ways to control patient costs.

6. Are alternative sourcing strategies viable in this environment?

33% of organizations are accelerating evaluations of domestic and allied-nation suppliers.

However, 94% caution that regulatory hurdles and timeline risks may delay any meaningful supplier transitions.

Just 12% of respondents believe their organizations could fully shift supply chains by end of 2025 without significant disruptions.

7. What fallout are IT and digital health vendors bracing for?

17% of IT leaders say key infrastructure purchases are now on hold due to rising component costs.

100% expect delays in digital transformation roadmaps, with cybersecurity and interoperability projects among the most affected.

Industry Response & Strategic Outlook

The healthcare industry is rapidly mobilizing to adapt to the economic turbulence. Finance leaders are reshaping 2025 budgets, supply chain officers are revisiting vendor relationships, and payer organizations are recalculating the long-term affordability of care.

Black Book Research will continue tracking and analyzing the downstream impacts of these tariffs through real-time pulse surveys, quarterly updates, and custom industry insights.

“This is a multi-front disruption-straining operations, freezing capital plans, destabilizing sourcing, and threatening patient affordability all at once,” said Brown. “With 94% of provider IT leaders delaying digital transformation and 91% of payers anticipating double-digit premium hikes, the coming months will test not only the agility of U.S. healthcare systems, but their ability to absorb systemic economic shock without compromising care delivery.”

Survey Methodology and Respondent Profile

Survey Timeline: March 6 – April 2, 2025

Total Respondents: 200 senior healthcare professionals

Confidence Level: 95%

Margin of Error: ±6.7%

All responses were anonymized and statistically weighted to ensure balance across organization size and geographic regions. Participants were verified through Black Book’s proprietary panels, LinkedIn authentication, and survey history. The survey drew responses from:

| Stakeholder Category | Example Roles | # of Respondents |

|---|---|---|

| Hospital Finance & Supply Chain Executives | CFOs, COOs, VPs of Finance, Directors of Supply Chain & Strategic Sourcing | 81 |

| Pharmaceutical & Medical Equipment Executives | Heads of Regulatory, Product Supply, Manufacturing, and Distribution | 28 |

| Payers & Health Plan Executives | Chief Managed Care Officers, VPs of Claims & Network Contracting | 43 |

| Healthcare IT & Digital Health Leaders | CIOs, CTOs, Digital Transformation Executives, IT Infrastructure Leaders | 20 |

| Physicians & Ancillary Practice Administrators | CMOs, Clinical Department Heads, Ambulatory Services Directors | 28 |

| Total | 200 |

Appendix: Participant Role Alignment

Respondents were selected based on their direct involvement in organizational decision-making and operational planning in response to economic shocks. Key contributors included:

Finance & Executive Strategy: CFOs, COOs, CEOs, Health System Administrators

Procurement & Pharmacy: Chief Procurement and Pharmacy Officers, Materials Managers

Supply Chain & Operations: Supply Chain Officers, Sourcing Directors, Clinical Engineering

Payer Contracting & Affordability: Managed Care Executives, Population Health Leaders

IT & Digital Health: CIOs, CTOs, Digital Transformation Leads, IT Infrastructure Directors

About Black Book Research

Black Book Research is the healthcare industry’s trusted source for independent market intelligence, competitive benchmarking, and real-time polling. For over two decades, Black Book has delivered in-depth research and strategic insight to support healthcare organizations navigating disruption, innovation, and regulatory change. Leveraging advanced surveying technologies and a vetted panel of professionals across the provider, payer, vendor, and investor landscape, Black Book produces high-impact reports and client experience studies that inform critical decision-making. Our comprehensive database tracks emerging healthcare trends, procurement priorities, and customer satisfaction benchmarks across every corner of the industry. Black Book’s mission is to empower healthcare leaders with unbiased, data-rich intelligence to thrive in an increasingly complex, competitive, and fast-moving environment.

The post Tariff Tsunami Hits U.S. Healthcare: Double-Digit Penalties Spark Cost Surge and Supply Chain Crisis, Black Book Warns appeared first on MedTech Intelligence.