Opening Statement at Investor Advisory Committee Panel on Pass-Through Voting and Other Ways to Reach the Ultimate Beneficial Owner

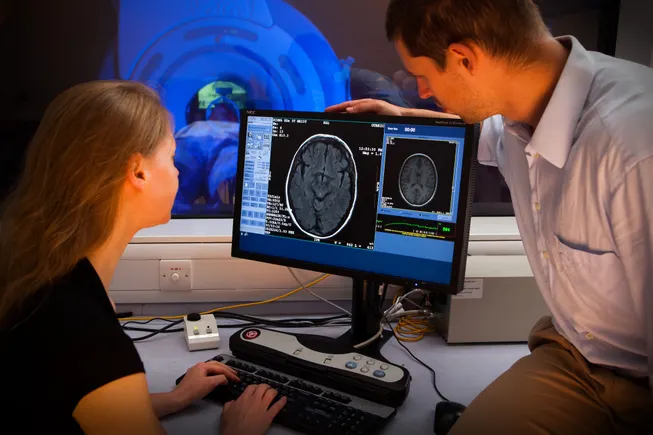

In June 2025, I participated in a panel hosted by the U.S. Securities and Exchange Commission’s Investor Advisory Committee to discuss the growing momentum behind pass-through voting and what it means for investor empowerment. The conversation brought together experts from across the governance ecosystem, including Vanguard, EQ Shareowner Services, the Society for Corporate Governance, and […]

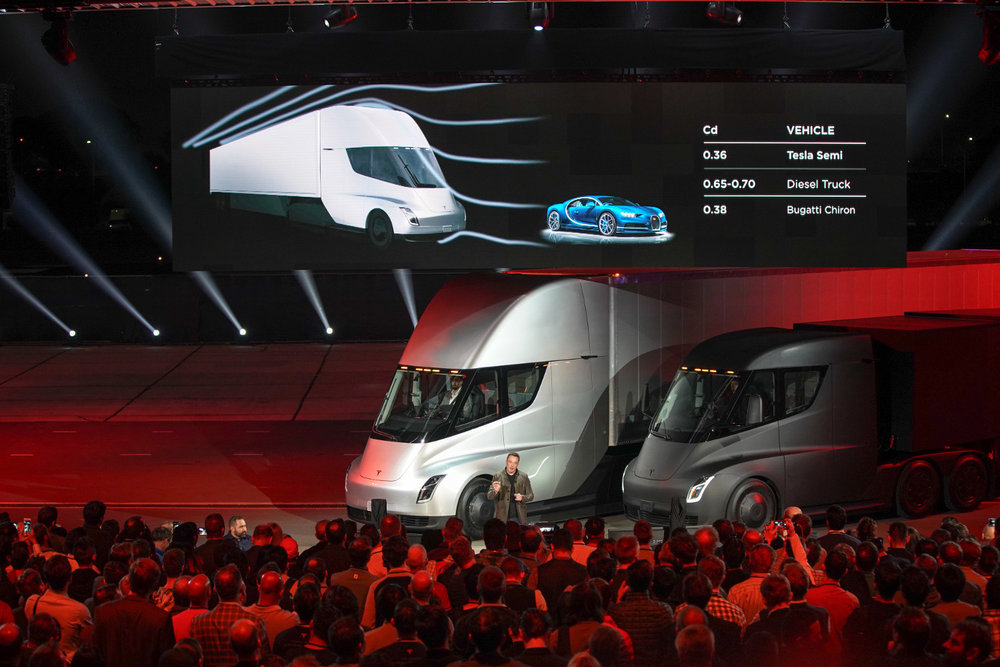

![]() In June 2025, I participated in a panel hosted by the U.S. Securities and Exchange Commission’s Investor Advisory Committee to discuss the growing momentum behind pass-through voting and what it means for investor empowerment.

In June 2025, I participated in a panel hosted by the U.S. Securities and Exchange Commission’s Investor Advisory Committee to discuss the growing momentum behind pass-through voting and what it means for investor empowerment.

The conversation brought together experts from across the governance ecosystem, including Vanguard, EQ Shareowner Services, the Society for Corporate Governance, and a renowned academic from the University of Pennsylvania. Each of us explored how the proxy voting system is evolving, and why giving clients a direct say in corporate governance is no longer a fringe idea, but a fiduciary necessity.

Why investor choice matters

More than 50% of U.S. households own pooled investment vehicles — mutual funds, ETFs, or closed-end funds.(1) That’s around 74 million households or approximately 130 million individual investors.

If we believe corporate governance plays a critical role in how companies operate today, then we must also believe that clients should have a say in how that governance is executed.

The current state of proxy voting

Traditional flow: (more…)