Eurofighter CEO hopes export push could lead to doubled production by 2028

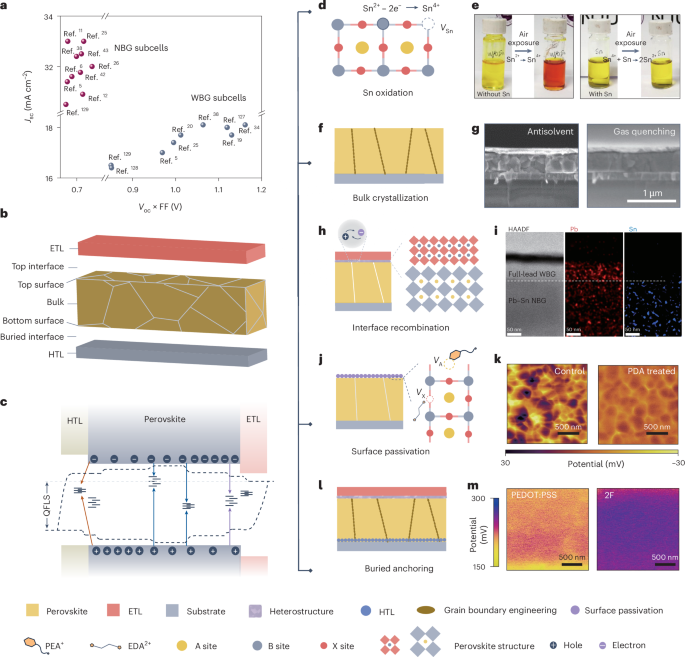

Eurofighter is chiefly targeting four export campaigns to dramatically increase production long term: Austria, Poland, Turkey and Saudi Arabia.

The Eurofighter consortium has mapped out an industrial plan to ramp up production to 30 aircraft a year, dependent on securing new export orders (Breaking Defense)

PARIS AIR SHOW — The four-country Eurofighter consortium plans to ramp up production of the Typhoon fourth generation fighter jet at a rate of 30 aircraft per year beginning in 2028, more than doubling existing output — a boost contigent on new business from customers around the world, from Europe to the Middle East.

“We are eyeing already a [production] rate of 30” aircraft, “once [new] export orders start kicking in,” Eurofighter CEO Jorge Tamarit Degenhardt told reporters at the Paris Air Show today. He shared that 14 of the combat jets are currently produced annually, with plans in motion to reach 20 units a year over the coming three years.

“We need to do it [ramp up production] fast,” said Degenhardt. “Since these deliveries are happening within the next decade or decades, we need to sustain this increase of industrial throughput, [by developing] the best new manufacturing technologies, and we need to strengthen as well, our supply chain of 400 critical suppliers.”

In addition to Eurofighter’s current order total of 729 jets, the consortium of Germany, Italy, Spain and the UK is chiefly targeting four export campaigns to dramatically increase production long term: Austria, Poland, Turkey and Saudi Arabia.

“The interesting concept is that if we start delivering jets, say, now, these jets will be fine until well into the” 2060s, added Degenhardt. “We need to accelerate and define what’s the root of capabilities enhancement for the future.

The prospect of a future deal with Austria could take a step forward once Vienna develops a procurement plan, potentially launched next year, and as proposed by a national defense report, published earlier this year, to replace ageing Eurofighter Typhoon Tranche 1 jets.

As Breaking Defense previously reported, Poland’s air dominance acquisition, which pits the Eurofighter against Boeing’s F-15EX, centers around procurement of 32 new fighter jets, though it remains to be seen when an aircraft selection decision will be made.

In the case of Turkey, the UK has made a bid to supply the aircraft to Ankara, which could result in a deal for 40 aircraft.

Additionally, BAE Systems said last year that it is in the process of collaborating with the UK government on a formal Statement of Requirements in support of prospective new deal with Saudi Arabia. Saudi Arabia already operates a fleet of 72 Eurofighters after a first sale with BAE was agreed in 2007.

Besides export business, the key to keeping the aircraft “operationally relevant” for decades more, is a yet to be defined, midlife upgrade, shared Degenhardt. At a technical level, Eurofighter is “reaching the limit” of its existing hardware architecture, while pressure relating to a “computing capacity issue” needs to be resolved long term.

Despite the ambition of the upgrade and supporting requirements clearly “articulated” by the four home Eurofighter nations, they have yet to put forward any funding for it, according to Degenhardt.

He was also clear that the Eurofighter consortium is not expecting a new order to be placed by the UK, the only nation of the four partners to publicly decide against buying additional aircraft. The recent Strategic Defence Review (SDR) instead revealed that “more F-35s will be required over the next decade,” and “could comprise a mix of F-35A and B models,” depending on requirements.

“Our leverage to influence the UK’s SDR is limited, and they are … really moving towards F-35 operations and GCAP,” said Degenhardt, referring to the trilateral Global Combat Air Programme. “We anticipate there will be knock-on effects after the SDR, which are positively affecting the Eurofighter, but not in the form of new orders.”

![The American contingent and Turkey’s autonomy goals: Paris Air Show Day 3 [Video]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/06/Wednesday-Wrap.00_00_32_21.Still001.png?#)

![A look at the jets flying high above the Paris Air Show [PHOTOS]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/06/Rafale_02-scaled-e1750268097167.jpg?#)