Liberation Day triggers panic mode for manufacturers

The difficulty in comparing “hard” versus “soft” data is that sentiment influences decisions that will eventually bear out in the hard data. The post Liberation Day triggers panic mode for manufacturers appeared first on FreightWaves.

Despite solid fundamentals, sentiment in the U.S. manufacturing sector has mostly been informed by buzzy anxieties over economic growth.

Take durable goods, for example: After a surprising beat on new orders in January, analysts expected a correction in February. Instead, new orders for durable goods grew 0.9% month over month (m/m) against consensus expectations of a 1% m/m drop, while January’s growth was revised up to 3.3% m/m.

To learn more about SONAR, click here.

Growth in February’s headline number came despite a 5% m/m drop in orders for nondefense aircraft – beleaguered aircraft manufacturer Boeing reported only 13 orders in February, down from 36 per month previously.

Excepting transportation orders, core durable goods orders were up 0.7% m/m: the category’s largest monthly jump since March 2022. And though new orders of core capital goods – a category used to calculate equipment investment for GDP – were down 0.3% m/m, shipments were up 0.9% m/m.

Similarly, factory orders, which reflect upstream demand for manufactured goods, were up 0.6% m/m in February, narrowly beating consensus expectations for 0.5% m/m growth. New orders from durable goods industries were even stronger, rising 1% m/m. According to the latest hard data, then, the U.S. manufacturing sector is in a good place.

Producers still captive to tariff fears

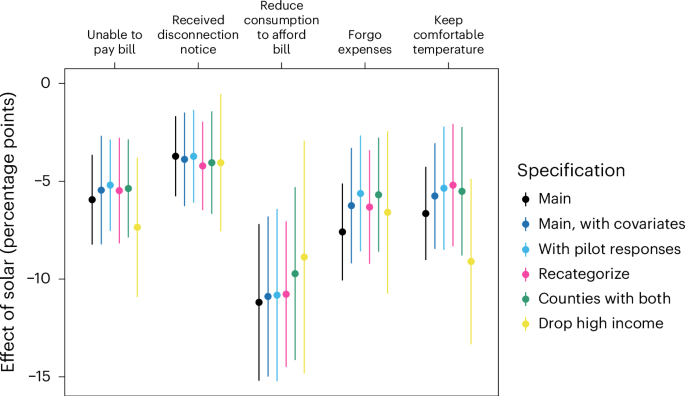

Even so, tariffs are top of mind for U.S. manufacturers, as can be seen in the two most important sentiment indexes for the sector.

The S&P Global US Manufacturing Purchasing Managers’ Index suffered a notable decline in March, dropping to 50.2 from February’s 52.7. Although any reading above 50 does indicate expansion, the production subindex fell into contraction for the first time since December — potentially signaling an unwelcome inflection point in the sector’s nascent recovery.

“A combination of improved optimism surrounding the new administration and the need to front-run tariffs had buoyed the goods-producing sector in the first two months of the year,” wrote Chris Williamson, chief business economist at S&P Global Market Intelligence, “but cracks are now starting to appear.”

The difficulty in comparing so-called “hard” versus “soft” data is that sentiment influences decisions that will eventually bear out in the hard data.

“A key concern among manufacturers,” Williamson continued, “is the degree to which heightened uncertainty resulting from government policy changes, notably in relation to tariffs, causes customers to cancel or delay spending, and the extent to which costs are rising and supply chains deteriorating in this environment.

“Supply chains are suffering to a degree not seen since October 2022 as delivery delays become more widespread.”

In a market unprepared for such shocks, Williamson’s last point concerning a crisis in manufacturing supply chains would ordinarily be a lucrative opportunity for carriers.

To learn more about SONAR, click here.

But shippers have been acting with extreme caution since the historic disruptions brought about by the pandemic, as can be seen in the pre-tariff wave of imports depicted above. These imports have not fed truckload demand (at least, not yet) as shippers have instead elected to slow-walk them on the rails or keep them in coastal warehouses for the time being.

The sector’s other major sentiment index, the Institute for Supply Management’s Manufacturing PMI, was even more negative. The headline PMI fell into contraction at 49 in March, down from February’s reading of 50.3 and below the consensus of 49.5.

To learn more about SONAR, click here.

The index’s key metrics all declined: The New Orders Index tumbled deeper into contraction from 48.6 to 45.2, the Production Index flipped out of expansion from 50.7 to 48.3, and the Backlog of Orders Index slid from 46.8 to 44.5.

On the flip side, the metrics for which expansion is not a good omen saw growth. The Inventories Index jumped 3.5 points m/m to 53.4, while the Prices Index (which tracks input costs) surged 7 points m/m to 69.4.

Comments from anonymous survey respondents all pointed to tariffs as the main driver of weakening sentiment. “Business condition is [sic] deteriorating at a fast pace,” wrote one machinery producer. “Tariffs and economic uncertainty are making the current business environment challenging.”

Running out of steam

Tellingly, a producer of petroleum and coal products noted that “worldwide economic instability has really begun to impact our oil and gas business. Aside from the change in the U.S. administration, the economies of China, India and Europe are drivers in what we believe is the next cyclical trough.”

The oil and gas industry perhaps best exemplifies the current tension between fundamentals and sentiment.

In theory, U.S. oil supply is threatened by sanctions on Iranian and Venezuelan crude, while usable supply in the market will be limited by the U.S. Department of Energy’s intention to refill the Strategic Petroleum Reserve.

But negative sentiment has kept domestic oil prices pegged to $70 per barrel, a price below which oil producers claim capital expenditures and output will suffer. According to the latest Dallas Fed Energy Survey, $65 per barrel is the absolute breakeven point after accounting for inflating input and operational costs.

“Oil prices have decreased while operating costs have continued to increase,” said one exploration and production firm in the Dallas Fed Energy Survey. “To stimulate new activity, oil prices need to be in the $75-$80 per barrel range.”

“The administration’s chaos is a disaster for the commodity markets,” was the blunt judgment of another firm. “‘Drill, baby, drill’ is nothing short of a myth and populist rallying cry. Tariff policy is impossible for us to predict and doesn’t have a clear goal. We want more stability.”

Whether sentiment will rise to meet solid fundamentals or – as seems more likely – whether fundamentals will weaken to justify depressed sentiment will be decided in the coming months.

For more insights on trucking industry dynamics and economic outlooks, subscribe to FreightWaves’ newsletters and stay updated with the latest trends and analyses.

The post Liberation Day triggers panic mode for manufacturers appeared first on FreightWaves.

![A vibe check on the Sea Air Space conference, plus key points from SecNav’s speech [VIDEO]](https://breakingdefense.com/wp-content/uploads/sites/3/2025/04/phelan-shaking-scaled-e1744233372839.jpg?#)