A level playing field for fashion brands – but at what cost to the market?

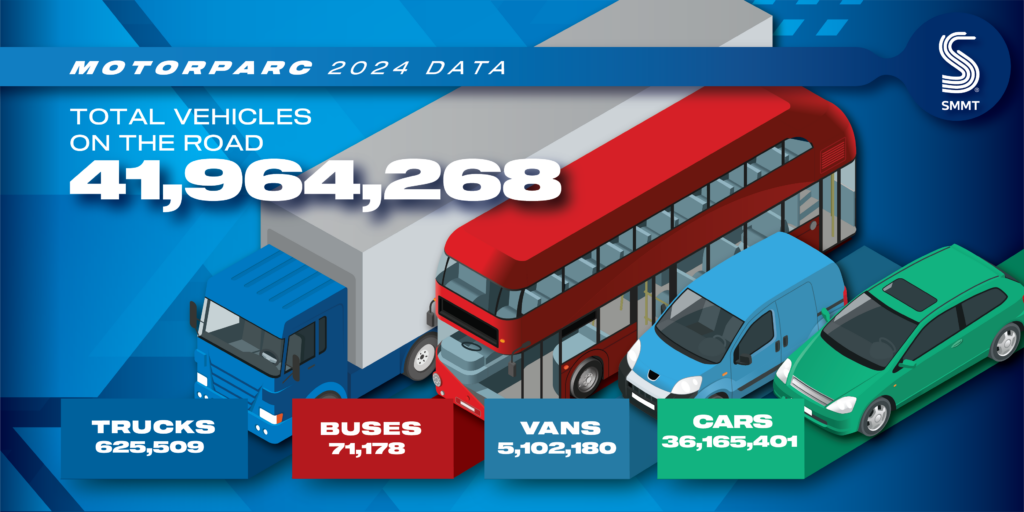

Made in USA clothing label. Credits: Dreamstime. While the U.S. government's expanded tariff regime aims to create a more level playing field for fashion brands by covering virtually all major apparel-exporting nations, the industry is grappling with a crucial question: at what cost to the market will this "fairness" be achieved? This article will analyze the potential benefits of a more uniform tariff structure against the potential costs to consumers, businesses of varying sizes, and the overall health of the U.S. fashion market. Tariff expansion and the goal of fairness The newly imposed tariffs target China (125 percent), Vietnam (10 percent), Bangladesh (10 percent), and India (10 percent), leaving no major manufacturing hub unaffected. The stated aim, according to government officials, is to prevent unfair competitive advantages and encourage long-term investment in domestic production. In theory, no single country can now significantly undercut others purely on the basis of preferential duty treatment. However, while the policy eliminates preferential treatment for specific countries, it doesn't address other inherent inequalities within the market, such as access to capital, economies of scale, and existing supply chain dependencies. Therefore, the "level playing field" may be more theoretical than practical. Industry concerns and the cost paradox Industry players, from retailers to suppliers, have expressed significant concerns, with the American Apparel & Footwear Association (AAFA) raising the alarm. "Retailers, suppliers, and consumers are all on the hook," noted AAFA in a statement. "And the U.S. lacks the infrastructure to absorb production at scale." This highlights a key tension: achieving a more uniform tariff structure may come at the expense of increased financial burden and operational disruption across the fashion ecosystem. The structural barriers to reshoring Indeed, the American apparel manufacturing sector has been hollowed out over decades. Today, only about 2 percent of apparel sold in the U.S. is domestically produced — and restarting large-scale production isn't simply a matter of policy. Domestic manufacturing faces high labor costs, a shortage of skilled textile workers, and limited capacity to scale quickly. Even in sectors where reshoring might be theoretically possible — like basic T-shirts or denim — the lead time, capital expenditure, and training needed would delay any significant shift by years, not months. This structural limitation raises serious doubts about the policy's effectiveness in achieving its stated goal of boosting domestic production in the foreseeable future. The economic trade-offs for businesses In the meantime, businesses must make difficult trade-offs, and these trade-offs represent significant costs. Some may absorb part of the tariff burden to protect market share, potentially squeezing already thin profit margins. Others may raise retail prices, risking a drop in demand and alienating cost-conscious consumers. The market is particularly sensitive: U.S. consumers already feel the pinch from inflation, and even a modest 8 percent increase in apparel prices could deter discretionary spending, leading to reduced sales volumes. According to industry estimates, a standard $90 item could now cost up to 97 dollars, with ripple effects across brand positioning and pricing tiers. Analysis of consumer spending data reveals that lower-income households, which allocate a larger proportion of their budget to apparel, are particularly vulnerable to these price hikes. Unequal impacts and market concentration While brands now face tariffs on imports from many sourcing countries, the specific rates vary considerably (for example, 125 percent for China, 10 percent for Vietnam), and the policy does not take into account the different levels of operational resilience. Larger players — like Nike or Levi’s — may be better equipped to navigate the challenge by leveraging their scale, renegotiating contracts with suppliers, or shifting logistics and sourcing strategies. Smaller and mid-size labels, particularly those dependent on tight margins and less diversified supply chains, are more vulnerable and may face existential threats. The tariffs, while uniform, could disproportionately benefit larger, financially resilient brands, potentially increasing market concentration and reducing competition from smaller players. Unintended consequences and market volatility Meanwhile, the supposed fairness of universal tariffs may not yield the intended long-term benefits. "This isn't about punishing China anymore," said one executive from a premium fashion brand, quoted in Vogue. "It's about a strategy that doesn't leave anyone with a viable option." The uncertainty surrounding tariff policies creates volatility in investment decisions, disrupts long-term planning, and can undermine consumer confidence, leading to unpredictable demand and market instability. The focus on shor

While the U.S. government's expanded tariff regime aims to create a more level playing field for fashion brands by covering virtually all major apparel-exporting nations, the industry is grappling with a crucial question: at what cost to the market will this "fairness" be achieved? This article will analyze the potential benefits of a more uniform tariff structure against the potential costs to consumers, businesses of varying sizes, and the overall health of the U.S. fashion market.

Tariff expansion and the goal of fairness

The newly imposed tariffs target China (125 percent), Vietnam (10 percent), Bangladesh (10 percent), and India (10 percent), leaving no major manufacturing hub unaffected. The stated aim, according to government officials, is to prevent unfair competitive advantages and encourage long-term investment in domestic production. In theory, no single country can now significantly undercut others purely on the basis of preferential duty treatment. However, while the policy eliminates preferential treatment for specific countries, it doesn't address other inherent inequalities within the market, such as access to capital, economies of scale, and existing supply chain dependencies. Therefore, the "level playing field" may be more theoretical than practical.

Industry concerns and the cost paradox

Industry players, from retailers to suppliers, have expressed significant concerns, with the American Apparel & Footwear Association (AAFA) raising the alarm. "Retailers, suppliers, and consumers are all on the hook," noted AAFA in a statement. "And the U.S. lacks the infrastructure to absorb production at scale." This highlights a key tension: achieving a more uniform tariff structure may come at the expense of increased financial burden and operational disruption across the fashion ecosystem.

The structural barriers to reshoring

Indeed, the American apparel manufacturing sector has been hollowed out over decades. Today, only about 2 percent of apparel sold in the U.S. is domestically produced — and restarting large-scale production isn't simply a matter of policy. Domestic manufacturing faces high labor costs, a shortage of skilled textile workers, and limited capacity to scale quickly. Even in sectors where reshoring might be theoretically possible — like basic T-shirts or denim — the lead time, capital expenditure, and training needed would delay any significant shift by years, not months. This structural limitation raises serious doubts about the policy's effectiveness in achieving its stated goal of boosting domestic production in the foreseeable future.

The economic trade-offs for businesses

In the meantime, businesses must make difficult trade-offs, and these trade-offs represent significant costs. Some may absorb part of the tariff burden to protect market share, potentially squeezing already thin profit margins. Others may raise retail prices, risking a drop in demand and alienating cost-conscious consumers. The market is particularly sensitive: U.S. consumers already feel the pinch from inflation, and even a modest 8 percent increase in apparel prices could deter discretionary spending, leading to reduced sales volumes. According to industry estimates, a standard $90 item could now cost up to 97 dollars, with ripple effects across brand positioning and pricing tiers. Analysis of consumer spending data reveals that lower-income households, which allocate a larger proportion of their budget to apparel, are particularly vulnerable to these price hikes.

Unequal impacts and market concentration

While brands now face tariffs on imports from many sourcing countries, the specific rates vary considerably (for example, 125 percent for China, 10 percent for Vietnam), and the policy does not take into account the different levels of operational resilience. Larger players — like Nike or Levi’s — may be better equipped to navigate the challenge by leveraging their scale, renegotiating contracts with suppliers, or shifting logistics and sourcing strategies. Smaller and mid-size labels, particularly those dependent on tight margins and less diversified supply chains, are more vulnerable and may face existential threats. The tariffs, while uniform, could disproportionately benefit larger, financially resilient brands, potentially increasing market concentration and reducing competition from smaller players.

Unintended consequences and market volatility

Meanwhile, the supposed fairness of universal tariffs may not yield the intended long-term benefits. "This isn't about punishing China anymore," said one executive from a premium fashion brand, quoted in Vogue. "It's about a strategy that doesn't leave anyone with a viable option." The uncertainty surrounding tariff policies creates volatility in investment decisions, disrupts long-term planning, and can undermine consumer confidence, leading to unpredictable demand and market instability. The focus on short-term survival and cost-cutting may also stifle innovation and investment in new technologies or sustainable practices within the fashion industry.

The globalized nature of fashion production

Some economists argue that the increasingly global nature of fashion production makes localized manufacturing a flawed solution. "The system isn't broken because of tariffs — it's fragile because it was never built to be self-sufficient in the U.S.," wrote a contributor to Fashion Dive. This perspective highlights the inherent complexities of the globalized fashion industry and suggests that tariffs may be an ineffective tool to address deeper structural issues.

Weighing fairness against market viability

For now, the sector is adjusting under pressure. Brands must adapt — not just to the immediate economic impact of tariffs, but to a market that is rapidly recalibrating. As the U.S. attempts to rebalance global trade, the fashion industry must weigh whether a level playing field is worth playing on if the game becomes unprofitable. While the goal of a level playing field is laudable, this analysis suggests that the current tariff regime imposes significant costs on various stakeholders. The long-term viability of the U.S. fashion market hinges on finding a trade strategy that balances fairness with affordability, stability, and the continued vitality of businesses across the spectrum.