Leadership at C.H. Robinson celebrates a one-year milestone by posting another strong quarter

It’s been a year since a turnaround at C.H. Robinson was evident in its earnings, and the first quarter did not disappoint this year. The post Leadership at C.H. Robinson celebrates a one-year milestone by posting another strong quarter appeared first on FreightWaves.

First quarter 2025 earnings at C.H. Robinson were always going to be of outsized importance in sizing up the performance of CEO Dave Bozeman, who will hit his two-year anniversary in the top spot in late June.

A year ago, C.H. Robinson announced first quarter 2024 earnings that shocked markets. While year-over-year comparisons to 2023 were still decidedly negative, the sequential improvement over the fourth quarter of 2023 was significant, and Wall Street rewarded Bozeman’s achievements with a sharp rise in the company’s share price.

Quarterly sequential comparisons remained a key benchmark for grading Bozeman’s tenure through 2024. But with 2025 having arrived, the comps will be against that first quarter where the C.H. Robinson ship (NASDAQ: CHRW) had begun to shift, and the normal year-on-year parallels will dominate.

Virtually across the board, even in a tough market that has seen at least one venerable truckload carrier post a shocking operating loss, C.H. Robinson’s performance compared to a year ago was stronger in both revenue and profitability. A summary can be seen here. But the core message is that in a tough market, C.H. Robinson produced less revenue, but its operations reported higher profitability.

Investors liked what they heard, as after-hours trading in stock at approximately 6:30 EDT was up $4.77, a gain of 5.35%, to just under $94. The stock is up more than 25% in the last year.

Bozeman and other members of the C.H. Robinson team Wednesday, after its earnings release, held a call with analysts that was mostly positive from the Wall Street attendees, with one analyst calling the numbers “this terrific result in a tough environment.”

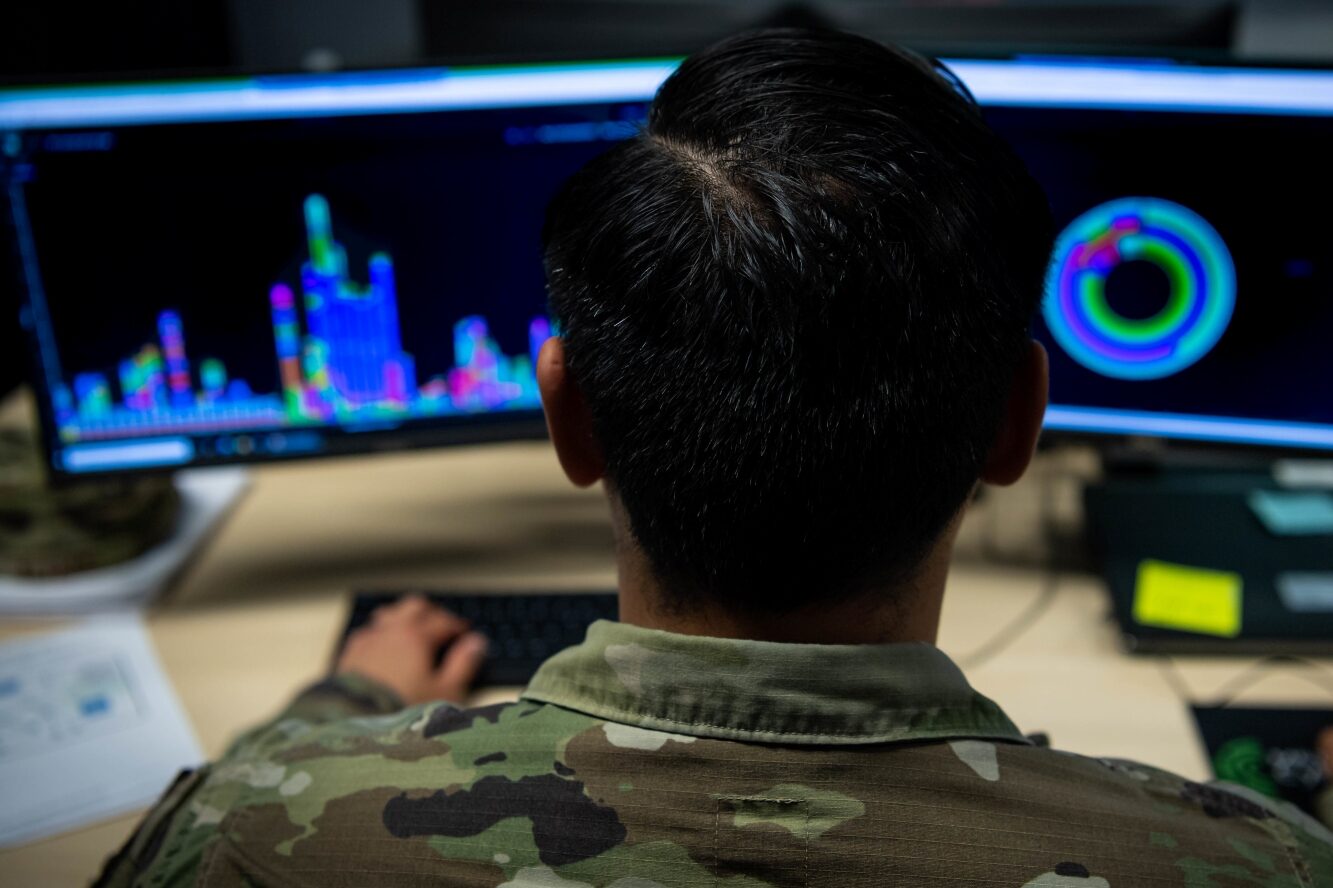

The Bozeman strategy has had several key parts to it, but technology has long been at its core. He has talked repeatedly–almost relentlessly–about using AI in C.H. Robinson’s operations.

AI at work in the millions

On the call, Arun Rajan, the company’s chief strategy and innovation officer, offered several specifics of how far it’s come at the 3PL and what it’s meant to the company’s profitability.

AI “agents” at C.H. Robinson have performed more than 3 million shipping tasks, Rajan said, which includes processing more than 1 million orders and generating more than 1 million price quotes.

While the focus of AI use at C.H. Robinson initially had been on its truckload operations, Rajan said in the first quarter, its AI capabilities handled as many transactions in its LTL activities as in truckload.

“All of these improvements are reducing the amount of time it takes us to respond to a quote or for a tender load to be accepted, thereby providing a better and more uniform customer experience,” Rajan said on the call. “Additionally, our proprietary AI is supporting our market share and margin expansion initiatives.”

Beating a benchmark

Michael Castagnetto, the president of North American Surface Transportation, which houses C.H. Robinson’s brokerage operations, said NAST volume had declined only 1% year-on-year but were up 2% sequentially. (C.H. Robinson does not break out specific volume numbers in its earnings). Truckload volumes were down 4.5% year-over-year, Castagnetto said, but were up 3.5% sequentially. LTL Volume was up 1% year over year and 1.5% sequentially.

Comparing that performance to recent reports of the widely-watched Cass Index, Castagnetto noted that “all of these key performance indicators outpaced the market indices.”

The NAST chief said that “load to truck ratios are higher than they were a year ago, and route guide depth in our managed solutions business has increased over the past year, reflecting a continued exit of capacity that has brought us closer to better balance in the market.”

The technology advances spelled out by Rajan, Castagnetto said, have been a factor in that performance. They mean the company can get, “actionable data into the hands of our freight experts faster, enabling them to make better decisions and to capture the optimal freight for us.”

Grabbing market share

In response to a question about reports C.H. Robinson is being more aggressive in pricing in the marketplace, which is leading to the higher market share that the company says it has secured, Castagnetto pivoted to the technology and operational changes at the company. (The C.H. Robinson executives on the call stayed on message for virtually every question: we’re doing better because of the processes and the systems we have implemented.)

“I think we’re being smarter in the marketplace,” Castagnetto said of the question on its aggressiveness. “I think we’re putting the tools into our people’s hands more often with better information. I think our people are making the right decisions more often, and you see that in the fact that we’re outpacing the market.”

Bozeman was more specific, saying that at C.H. Robinson’s investor day in December, “it was pretty clear that our goal was to really take market share and expand our margins. And I think leveraging our technology is part of what you’re seeing in the marketplace.”

More specifically, Rajun said “our algorithms are continuously discovering the right sweep spot to deliver.”

When analysts asked about the impact on C.H. Robinson’s business that might come out of a regime of tariffs, keeping on message dominated those answers as well. CFO Damon Lee said tariffs were “just another disruption for our customers, but we’ve had several disruptions over the years. They all show up slightly differently, but they’re all disruptions to the supply chain. That bods well for our ability to move up the value stack with a lot of our key customers.”

But in his opening remarks, Bozeman was more specific about impacts C.H. Robinson has seen so far.

“The new tariffs and fluid trade policies have created market uncertainty and a lack of clarity, making planning activities more difficult and causing many customers to adopt a wait and see approach until they understand the impact on consumer spending and global demand,” Bozeman said. Some customers have “paused or reduced” purchases from China.

More articles by John Kingston

Werner CEO Leathers confronts losses, outlines plans to bounce back

2 more charged in death of Louisiana staged truck accident witness

New decline on weak earnings delivers fresh pain to Wabash stock

The post Leadership at C.H. Robinson celebrates a one-year milestone by posting another strong quarter appeared first on FreightWaves.