Disappointing Q1 for TFI International as U.S. LTL drags down results

TFI’s earnings release late Wednesday didn’t have much good news for its U.S. LTL operations. The post Disappointing Q1 for TFI International as U.S. LTL drags down results appeared first on FreightWaves.

The stock of TFI International took a significant downturn in post-close trading Wednesday after earnings that once again can only be described as disappointing.

At approximately 5:30 p.m., TFI International stock was down about 2% to $76.85. It had been down by more immediately after the close. TFI stock had weakened by the end of the regular trading day, falling 0.19% at the close to $78.43. It is down about 42% in the past three months.

According to SeekingAlpha, non-GAAP earnings of 76 cents a share at TFI fell short of forecasts by 18 cents, while revenue of $1.96 billion missed analyst forecasts by $100 million.

The fate of the trucking conglomerate has increasingly been tied to the operations of its U.S. LTL operations, which contains the legacy business of UPS Freight and operates as TForce Freight.

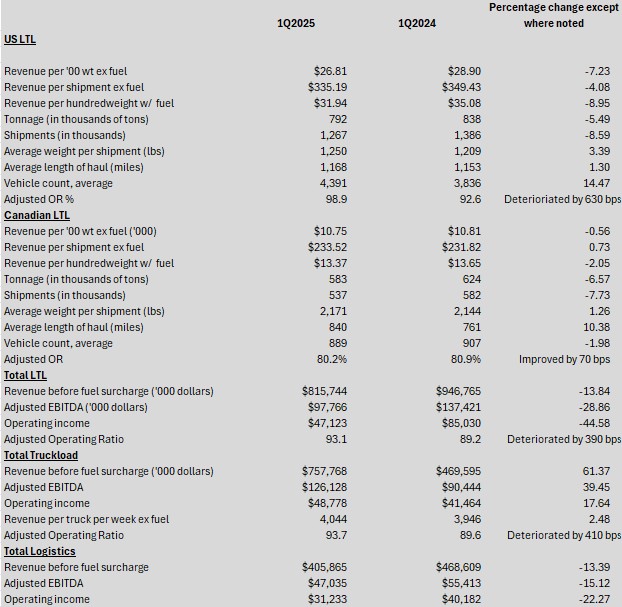

However, revenue in its truckload group excluding fuel was up sharply from a year ago as a result of acquisitions, increasing to $662.9 million from $397.7 million. Meanwhile, total LTL operations excluding fuel had revenue of $679.9 million, down from $783.5 million a year ago.

Various operating metrics for the U.S. LTL group were all negative. Revenue per hundredweight excluding fuel was down 7.23% from the corresponding quarter in 2024. Revenue per shipment excluding fuel dropped a little more than 4%. Adjusted operating ratio was down 630 basis points to 98.9% from 92.6%.

In earnings calls with analysts, CEO Alain Bedard has compared the U.S. LTL operations unfavorably to its Canadian operations. The Canadian LTL division had an OR of 80.2% in the quarter, an improvement from 80.9%. Revenue per shipment excluding fuel rose slightly, but revenue per hundredweight with or without fuel declined for the Canadian LTL operations.

Truckload’s operating income rose to $48.8 million from $41.5 million, though that 17.5% increase paled compared to the more than 66% increase in revenue. Meanwhile, operating income in LTL was $47.1 million on revenue before fuel of $679 million. The corresponding numbers from a year ago were operating income of $85 million on $783.5 million in revenue.

In the company’s earnings release, Bedard did not focus on any operating metrics. “TFI International continues to navigate industrywide freight demand weakness by following long held core operating principles, including an overarching focus on robust free cash flow as evidenced by a 40% year-over-year increase during the first quarter,” he said.

He also said the company is on “strong financial footing” that enables TFI to “take a strategic approach to cyclicality, making targeted investments while our hardworking team drives operational excellence across the organization.” He touted the cash returned to shareholders via dividends or buybacks as well.

Bedard’s call with analysts is at 9 a.m. EDT Thursday. Unlike most CEOs in the logistics sector, Bedard is always the only company executive on the call.

More articles by John Kingston

TFI acknowledges US LTL ‘disaster’ and difficult Daseke integration in Q4

UPS hit with SEC fine over its internal valuation of UPS Freight before TFI sale

TFI’s Bedard: Buying UPS’ LTL operations was not a mistake

The post Disappointing Q1 for TFI International as U.S. LTL drags down results appeared first on FreightWaves.

![Five-Star Basketball Prospect Severely Injured In Fiery Tesla Cybertruck Crash [Update]](https://www.jalopnik.com/img/gallery/five-star-basketball-prospect-severely-injured-in-fiery-tesla-cybertruck-crash/l-intro-1745597808.jpg?#)