Capacity, courtrooms and caution – what’s really driving the market this week

California Court Stirs the Pot on Lease-On Model If you’re leased on under someone else’s authority and operating in or around California — or even just watching the legal landscape — pay attention. A ruling from the 9th U.S. Circuit Court of Appeals just gave California’s AB5 law a major boost, making it even harder […] The post Capacity, courtrooms and caution – what’s really driving the market this week appeared first on FreightWaves.

California Court Stirs the Pot on Lease-On Model

If you’re leased on under someone else’s authority and operating in or around California — or even just watching the legal landscape — pay attention.

A ruling from the 9th U.S. Circuit Court of Appeals just gave California’s AB5 law a major boost, making it even harder for trucking companies to classify drivers as independent contractors. The court sided with the state, saying there’s nothing illegal about enforcing the law across the trucking industry — even though it directly conflicts with how the lease-on model has worked for decades.

Why this matters:

AB5 uses what’s called the “ABC Test” to decide if a worker is truly independent. And most leased-on owner-operators don’t pass the test — especially the part that says the worker must do something outside the core business of the company. (Hauling freight is the core business.) That means, in California, leased-on drivers might be forced to become employees — or risk being deemed “misclassified.”

This ruling could put serious heat on carriers that rely on lease-on contractors in California. And while this specific case was about one company, the court’s message was loud and clear: Enforcement is fair game, and state labor laws can override how the trucking model is traditionally operated.

What happens next?

The Owner-Operator Independent Drivers Association might push this to the Supreme Court, but so far, no green light. If this stands, it opens the door for stricter enforcement, back-pay lawsuits and fines for companies not in line with AB5.

What small carriers and leased-on O/O’s need to do right now:

- If you’re leased on: Start looking at your options. Running under your own authority may offer more protection long term if AB5-style rules spread to other states.

- If you run a small fleet using leased on drivers: Talk to a compliance attorney. Make sure you understand how this law could impact your operation — especially if you’re doing business in California.

- Watch for ripple effects: Other states could follow suit, especially New Jersey, New York and Illinois — all of which have flirted with similar rules.

This potentially isn’t just a California issue anymore. This could reshape how independent trucking operates across the country.

Trade Court Tariff Ruling Put on Hold — But It’s Far from Over

On Wednesday, the U.S. Court of International Trade ruled that President Donald Trump’s sweeping import tariffs overstepped constitutional boundaries, briefly delivering a hard stop to one of the most aggressive trade maneuvers in decades. But the legal drama was just getting started. On Thursday, a federal appeals court stayed the trade court ruling temporarily. Depending on the final legal outcome, we could see the beginning of a major shift in the freight economy.

So what happened?

The trade court decided that the White House can’t use emergency powers to impose broad tariffs without congressional approval — specifically targeting the Trump-era global import tax that hit nearly every U.S. trading partner. The ruling also blocked a set of retaliatory tariffs aimed at China, Mexico and Canada.

But then the U.S. Court of Appeals for the Federal Circuit weighed in, staying the trade court order, and many legal experts agree the case is heading to the Supreme Court. If the high court ultimately sides with the trade court rather than the appeals court, thousands of small importers could be in line for massive refunds — plus interest.

Now, what does that mean for the freight market?

If the tariffs are pulled back permanently or suspended during appeals, expect to see some key effects:

- More imports, more volume. Lower duties mean more goods flowing through ports, intermodal hubs and distribution centers. That spells opportunity for carriers running out of the ports or pulling freight from warehouse zones like Savannah, LA/Long Beach, New York/New Jersey, and Chicago.

- Spot market momentum. If manufacturing and retail sectors get tariff relief, shippers may surge back into the market to replenish inventory or accelerate imports. This could temporarily boost available loads on high-traffic lanes.

- Fuel for a potential rate lift. Increased freight demand — paired with rising tender rejection rates we’ve seen in recent weeks — could finally start to tip the rate scales in favor of carriers, especially if capacity continues to tighten.

Here’s what to watch:

- Legal delays. The appeals process will drag out. If this reaches the Supreme Court, a final decision could be months away — so don’t expect immediate change.

- Border ops. For now, U.S. Customs is still collecting tariffs until told otherwise. But brokers and importers are already adjusting contract terms in anticipation of future refunds or reversals.

- Shipper sentiment. Some shippers are already reevaluating their long-term pricing and sourcing strategies. If they believe these tariffs won’t stick, they’ll start planning freight moves more aggressively — and that means load boards could heat up faster than usual.

Bottom line:

This isn’t just a courtroom technicality — it’s a potential freight catalyst. Small carriers should pay attention to trade headlines, because this could lead to more volume, more stability and stronger lanes. But until the final gavel falls, stay cautious. Legal moves this big don’t play out overnight.

Where the Numbers Are Pointing Now

Despite the noise suggesting a turnaround, the real data tells us we’re still stuck in a holding pattern. Volume and rates may have seen temporary bumps, but capacity just isn’t leaving the market fast enough to tip the scales. Instead of the large-scale exits that would tighten supply and drive up pricing power, we’re seeing a trickle of new entrants still flowing in — and that’s keeping competition stiff for small carriers trying to survive.

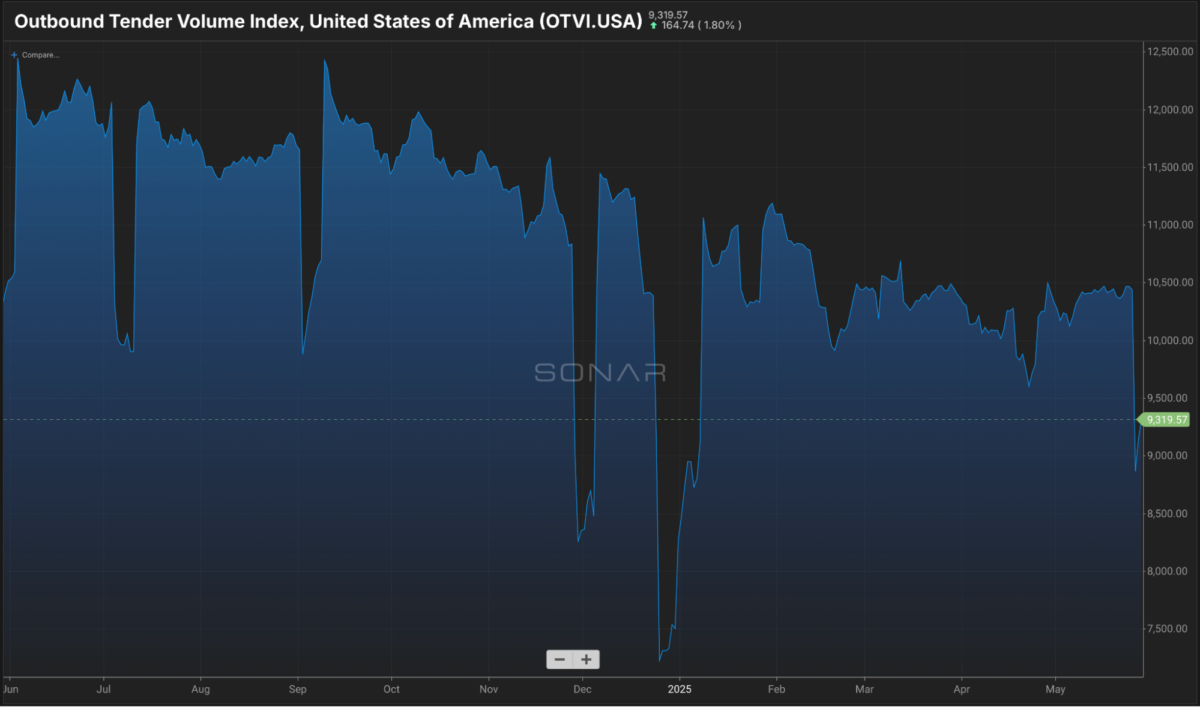

So what does that mean? It means we’re in a “grind-it-out” season. No magic flip, no clean recovery. Just tactical execution and watching the data like a hawk. Let’s unpack what the latest SONAR charts are showing us — and why they might be the first signs of a market shift worth preparing for:

We saw a meaningful 1.8% bump in tender volumes this week. That’s notable. But it needs context. Tender volumes are still down compared to seasonal expectations, and even with this increase, we’re not yet in peak season mode. The spike could reflect a mix of delayed Memorial Day freight, rebalancing or just a short-term burst of demand. Either way, it’s movement — and movement matters.

For small carriers, this is where you need to be watching your lane activity. Look for trends in your region — are tenders climbing? Are brokers calling you instead of the other way around? This volume bump means some areas are seeing freight flow again, and you need to be first to spot it.

Tender rejections are creeping back up — and that matters more than most folks realize. A rate near 7% isn’t what we’d call a tight market just yet, but it’s a strong signal that carriers are beginning to say “no thanks” to low-paying, inconvenient freight. The higher this number climbs, the more leverage shifts back toward the truck.

This is the highest rejection rate we’ve seen in several weeks, and it’s not happening in isolation. It’s part of a broader trend of tightening in key regions — especially the Southeast, Mid-Atlantic and Texas. That tells us capacity is starting to push back, even if it’s not dropping off in droves.

Takeaway for small carriers: If you’re still taking whatever a broker throws your way, it’s time to reconsider. Use this as an opportunity to start building rate discipline. If you’re hauling into one of the tightening regions, ask for more. Use language like, “Look, rejections are up in this lane. I can take it, but not at that number.” Keep it firm, not combative. Remember, the market is shifting — and when it does, early movers make the most of it.

You may not be able to flip every rate, but if you don’t start flexing your pricing muscle now, you’ll be left behind when momentum really starts to turn.

After a brief rally earlier this month, national linehaul rates are easing back down to $2.31 per mile on the seven-day average, according to the SONAR National Truckload Index. We saw a nice post-Memorial Day lift — likely driven by tighter holiday windows and carriers that sat out International Roadcheck — but it didn’t stick. The dip we’re seeing now tells a clear story: Spot shippers were willing to bump up rates temporarily, but in the long run, they’re still in the driver’s seat when it comes to negotiating power. The broader market hasn’t tightened enough to create lasting upward pressure just yet.

What does that mean for small carriers? It’s a reminder that we’re still operating in a shipper-favored environment. You might get lucky on a few loads, especially if you’re running into hotter regions, but don’t treat these bumps as the new norm. Protect your margins by doubling down on the controllables — accessorials like detention time, layover pay, TONU (Truck Order Not Used) and fuel surcharges can make the difference between profit and breakeven on tighter runs. Start tracking your weekly averages across core lanes and be aggressive with follow-up negotiations. Every penny matters right now.

This is the one to keep your eye on — not because it’s explosive, but because it’s telling a deeper story that most folks will miss. At a glance, a net positive gain in carrier authorities might feel like a good sign. But in reality, it’s a red flag when we’re trying to signal a capacity correction. A healthy recovery for small carriers means less competition, not more. And what we’re seeing here is that new entrants are still trickling into the market — even in the middle of a freight recession.

This isn’t a flood like we saw in 2021 or early 2022, but it’s enough to stall meaningful upward rate pressure. If carriers aren’t leaving and new ones are still popping up, then pricing power stays diluted. More trucks fighting over the same — or even fewer — loads.

This is where we need to start thinking about supply and demand, not just in terms of freight volume, but in terms of how many competitors are left in the room. Every new MC that goes active adds noise to the rate negotiation process, keeps the load board crowded and makes it harder to get consistency. This is the bottleneck that’s holding rates back from a true rebound.

Takeaway for small carriers: Waiting for the market to tighten is no longer a strategy — it’s a liability. Capacity isn’t leaving fast enough to do the hard work for you. So the move now is to get sharper: Build out shipper/broker relationships, refine your value proposition, and focus on making your truck stand out when it counts. That means improving service levels, delivering on time, investing in communication tools, and showing brokers and customers that you’re a reliable partner when others flake.

You have to outlast — but more importantly, you have to outsmart. This isn’t a game of patience. It’s a game of precision, and the ones who thrive are the ones who stop waiting for the economy to save them and start engineering their own edge.

Used Truck Prices Just Jumped — But Here’s the Full Story

If you’re in the market for a used truck, or even thinking about unloading one, now’s the time to pay attention.

Auction prices for sleeper tractors surged in April — especially for newer, low-mileage models. According to the latest data, 2023 model trucks went for nearly $97,000, up over 20% from just last month. Even older 4-to-6-year-old models saw a 30% price jump compared to this time last year. That’s not noise — that’s movement.

Why It Matters to You

This tells us two things:

- Fleets are buying again, especially when they can grab trucks with less than 300,000 miles. These buyers aren’t waiting around for the next EPA mandate or another rate spike.

- Inventory may be tightening, which means if you’re holding on to a clean truck with reasonable miles, you have leverage. Dealers and auction houses are seeing stronger bidding and more competition — which wasn’t the case even a few months ago.

And if you’re still using a higher-mileage unit that’s eating you alive on maintenance? That temporary pause on tariffs from China might help stabilize some parts costs, but new truck uncertainty still looms with 2027 emission rules in limbo.

Average Hammer Price (3-to-6-Year-Old Sleepers):

Prices spiked hard in April — especially on 3-year-olds. This wasn’t a one-month blip. When you zoom out, you’ll notice prices are still well above 2019 levels. If you have a late-model truck, its value might be higher than you think.

Auction Volume of Used Sleepers (3-7 Years Old):

While prices jumped, the number of trucks sold fell. That’s classic supply and demand. More buyers, fewer good trucks to sell = stronger pricing. But don’t be fooled — this isn’t a long-term guarantee. If rates cool or macro demand weakens, pricing could level.

Bottom Line for Owner-Ops and Small Fleets:

- Don’t panic-buy, but do start comparing pricing if you’re planning to scale or replace this summer.

- If your truck is clean, low-mileage and well-specced, you might get top dollar right now if you need to sell or trade.

- Keep in mind — 2027 model pricing is already inflated due to emissions prep. Used might remain a smart move for the near future.

Let’s keep it real: Higher prices at auction don’t mean the market is “back” — but they do show signs of life. And in a freight cycle like this, every signal counts.

Adam sat down with Avante Jackson — known across social media as CDL Shorty — a seasoned CDL instructor and trucking mentor who’s built a massive following by calling out the real issues behind the so-called “driver shortage.”

In this episode, Avante breaks down what’s really going on behind the curtain — from CDL mill scams to carriers hiring undertrained drivers just to keep wheels turning. We also dig into how the system sets up new drivers to fail and what needs to change if we want safety and skill to actually matter again.

If you care about raising the bar in this industry — whether you’re a fleet owner, dispatcher or new driver — this one’s required listening.

Tesla Semi Delays Again — But Here’s What It Really Means for Small Carriers

Another quarter, another delay. Tesla’s long-promised electric Semi has once again been pushed back, with no firm date on when wider production will begin. According to an article by Thomas Wasson, only limited deliveries are expected this year, and most of those are earmarked for internal use by Tesla and hand-picked test customers.

For most small carriers and owner-ops, this headline probably feels like a rerun. And in many ways, it is. Tesla made waves back in 2017 when it first unveiled the Semi, promising 500-mile range, rapid charging and a bold new vision for trucking. But seven years later, most fleets still haven’t touched one — and may not for a while.

So what does this delay actually mean?

Here’s the takeaway:

- EV adoption in heavy trucking is still crawling, especially outside of short-haul and drayage work. The infrastructure simply isn’t there yet for most small carriers to switch without major disruption.

- The headlines outpace the reality. There’s a lot of noise about electric trucks, but the diesel rig in your yard still has more real-world uptime, easier access to fueling and a stronger repair network than any EV on the market.

- If you’re running a smaller fleet, this is not your signal to pivot to electric. It’s your reminder to stay focused on what you can control: fuel efficiency, preventative maintenance and managing your cost per mile.

Tesla isn’t alone in missing timelines. Even legacy OEMs with decades of fleet relationships (like Peterbilt and Volvo) have seen rollout delays due to battery sourcing, grid challenges and high production costs. And with the EPA’s 2027 emissions standards still looming in limbo, the truth is the diesel-to-EV transition for heavy trucks is going to stretch well into the next decade.

Bottom line?

Keep an eye on the tech — but don’t let it distract you from building a strong, resilient business now. There’s opportunity for small carriers in this gap while the big guys play catch-up.

Final Word – Windows Don’t Stay Open Forever

This week wasn’t filled with fireworks, but it carried real freight for the sharp carriers paying attention. A court ruling that could reshape the leased-on model. Another delay in Tesla’s long-promised Semi. Spot rates creeping upward while volume sputters and capacity refuses to exit stage left.

These aren’t random headlines. They’re signals.

We’re not in a boom. But we’re not in freefall either. This is what the freight middle looks like — and the ones who thrive here are the ones who know how to work it.

Maybe your margins are still tight. Maybe the load board still feels like a war zone. But if you’ve been watching the charts, reading the tea leaves and positioning yourself in the regions where freight is heating up — you’re already ahead.

So here’s your charge this week:

Don’t wait for a recovery. Operate like the recovery is already testing you. Every mile matters. Every rate negotiation counts. Every move should be strategic.

Until next time — stay focused, stay dangerous and keep your wheels turning.

The post Capacity, courtrooms and caution – what’s really driving the market this week appeared first on FreightWaves.