US ranks low among international postal services on financial flexibility

The U.S. Postal Service’s limited ability to operate as a pure private business makes it more difficult to turn a profit. Other postal operators have more management flexibility, a new report shows. The post US ranks low among international postal services on financial flexibility appeared first on FreightWaves.

The U.S. Postal Service has less flexibility to address financial shortfalls than mail systems in other countries because of its obligation to provide universal service, the size of population served and regulatory limits on competing with the private sector outside its core postal business, according to the agency’s independent watchdog.

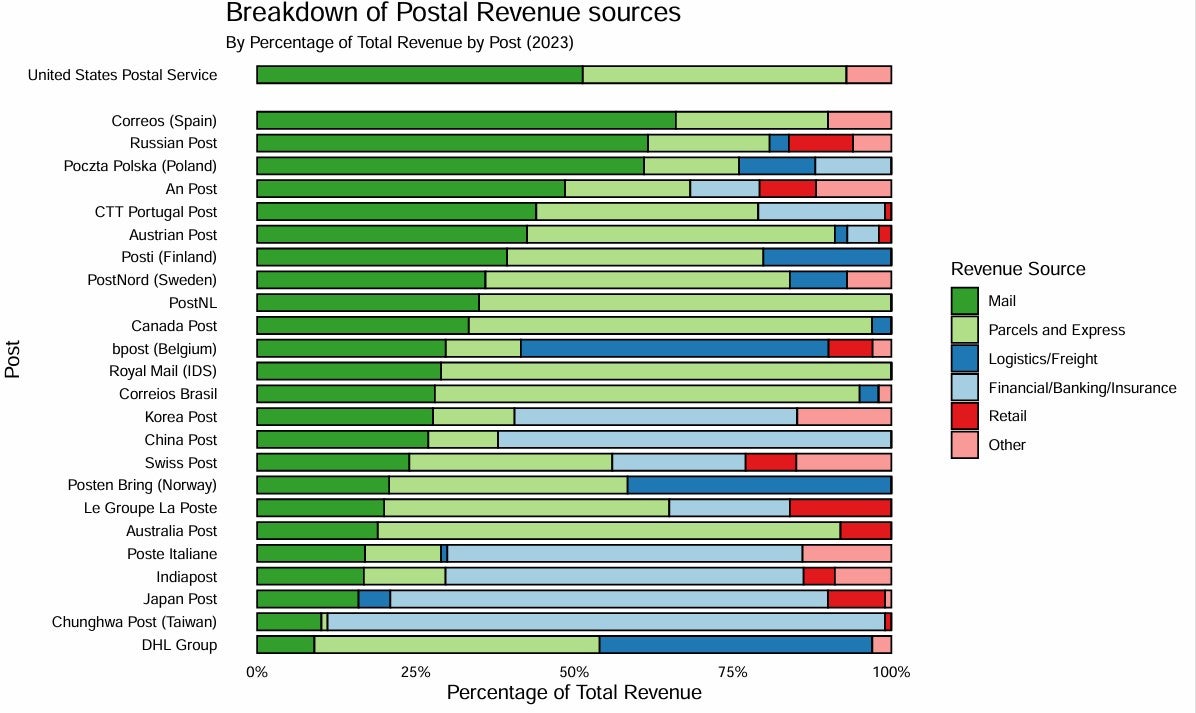

The Postal Service’s business model is largely restricted to postal products, making it one of the least diversified posts in the world, the Office of Inspector General said in a white paper published on Monday. Many foreign counterparts enjoy greater freedom in pursuing financial stability, with more relaxed delivery schedules, multiple revenue streams and government funding to support universal service obligations.

In 2023, the Postal Service delivered about 49% of the world’s 227 billion mailpieces, far surpassing the volumes managed by any other national postal operator.

The report compared the postal models of 25 other national postal operators, including Japan, Portugal and China, with the United States. Most posts are fully or partially owned by the government, with very few fully privatized.

“Posts that have diversified, either within the parcel and logistics sector or in other business areas, tend to be more profitable as they can offset the declining or negative profitability of mail,” the OIG study said. The long-term viability of postal services depends largely on their ability, with government support, to adapt business models to evolving market conditions and societal needs, it concluded.

A post’s legal structure is important to how it operates. Fifteen of the other 25 posts surveyed operate as private corporations. The U.S. Postal Service and other counterparts are state-owned corporations, which are limited to varying degrees from certain self-help measures. The U.S. Postal Service, Canada Post and Swiss Post, for example, are subject to debt caps that may restrain capital expenditures.

U.S. law gives the Postal Service more room than many international posts to set service standards, but the agency is more constrained by the obligation to serve all addresses than many other postal operators, including a wider scope of universal services, stricter pricing regulations and a six-day delivery requirement instead of five-, three- or every-other-day frequencies elsewhere.

Most countries require government approval to raise letter mail prices, but the Postal Service is subject to stricter pricing regulations, with 100% of its mail volume falling under a price cap. Also, parcel pricing is generally less regulated for foreign posts than in the United States, where price adjustments for retail and commercial parcel prices require approval.

At the same time, the U.S. Postal Service faces more business restrictions than most counterparts, especially when it comes to borrowing funds, managing pension obligations and expanding into other lines of business.

Most posts have more flexibility than the Postal Service in managing pension funds, including the ability to determine how to diversify investments of retiree assets and propose changes to the rules governing pension funds.

About half of the sampled foreign postal services lost money in 2023.

The U.S. Postal Service finished fiscal year 2023 with a $6.5 billion net loss. DeJoy’s agency overhaul over four years has brought the agency close to breakeven. In the first quarter of fiscal year 2025, the Postal Service said it generated about $150 million in profit versus a $2 billion loss for the same period in the prior year. DeJoy has repeatedly asked Congress and the Postal Regulatory Commission to relax restrictions on how it can pursue cost-cutting and raising revenue.

In nine countries, governments provide funding – up to 8% of the posts’ annual revenue – to support nationwide universal delivery obligations or other public service missions. The U.S. Postal Service is almost entirely self-funded.

Postal services that operate as private entities generally have greater commercial freedom than government-owned ones to streamline costs, optimize workforce size and composition, and manage capital investments, the OIG report said. Most posts, for example, have more flexibility than the Postal Service in managing employment-based postal pension funds and determining how to diversify investments of retiree assets.

Posts that have diversified, either within the parcel and logistics sector or in other business areas, tend to be more profitable because they can offset the declines in mail volume and revenue, according to the study.

DeJoy this week proposed that the U.S. Postal Service could serve as a third-party logistics provider for other federal agencies, which would pay to use its vast freight transportation and warehousing infrastructure to move material. By better utilizing existing capacity, the Postal Service could better offset overhead costs, he suggested.

It’s worth noting that profitability isn’t the only indicator of a postal service’s value. Posts play a crucial role in broader economic development and connecting rural and urban areas, facilitating social cohesion and feelings of national belonging that go beyond the desire for profitability.

Faced with declining mail volumes and increasing competition in parcel delivery, postal operators are trying to streamline operations, expand into markets related to postal services and seek legislative reforms to alleviate regulatory and financial burdens.

The European Union, United Kingdom, Australia and Canada, for example, are requesting that lawmakers relax their universal service obligations or provide more government funding.

Under DeJoy, the U.S. Postal Service has embarked on a 10-year transformation plan, called Delivering for America, to put the quasipublic agency on a path toward financial sustainability and improved service delivery. It is reducing billions of dollars in costs by adjusting the logistics network to integrate delivery of mail and package categories and shift more air transportation to ground, and it has created new products, adjusted rates and persuaded Congress to repeal a requirement that the Postal Service prepay health plans for retirees.

The postmaster general has previously asked Congress to change the way Civil Service Retirement System liabilities are calculated, allow the use of market-based investments for retiree funds and increase the agency’s debt limit of $15 billion. Last week he engaged Elon Musk’s efficiency team to help speed up the retiree fixes.

The second-phase of the Delivering for America plan lacks specific timelines for implementing key reforms and details on their expected impact on finances, leaving uncertainty about the Postal Service’s long-term financial sustainability, the OIG said.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED READING:

Postal Service weighs serving as logistics partner for federal agencies

The post US ranks low among international postal services on financial flexibility appeared first on FreightWaves.