Tender Rejections: The Freight Market’s Crystal Ball

The entire market shifts when carriers start saying “no” to contracted freight. Rising tender rejection rates signal tightening capacity and often precede spot rate hikes, while falling rates point to softening demand. The post Tender Rejections: The Freight Market’s Crystal Ball appeared first on FreightWaves.

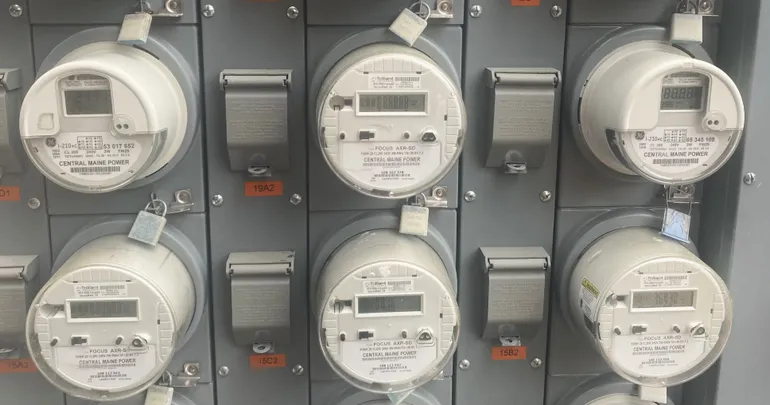

What’s a tender rejection rate? Few indicators are as telling in the dance of freight logistics as the tender rejection rate. This metric, often underappreciated outside logistics circles, offers a window into the balance of supply and demand, signaling shifts in market dynamics before they fully materialize.

Tender rejections occur when carriers decline loads offered under contract by shippers. A rising rejection rate typically indicates tightening capacity, as carriers opt for more lucrative spot market opportunities. Conversely, a declining rate suggests ample capacity and potentially softer spot rates.

Current Trends

As of May 2025, the national Outbound Tender Rejection Index (OTRI) stands at 6.69%, reflecting a slight increase from previous weeks. This uptick suggests a modest tightening in capacity, though rates remain relatively stable.

Regionally, there are disparities. The Southeast has seen rejection rates surpass 10% for the first time since 2022, indicating a significant tightening in that area. In contrast, the West Coast, particularly Southern California, continues to experience low rejection rates, reflecting abundant capacity.

Implications for Fleets

Understanding tender rejection trends is strategic planning. In regions with rising rejection rates, carriers may find opportunities to negotiate higher rates or prioritize spot market loads. Conversely, maintaining strong relationships with shippers and focusing on efficiency becomes paramount in areas with declining rates.

While current trends suggest a gradual tightening in certain regions, the overall market remains balanced. Carriers and owner-operators should monitor rejection rates as they offer early signals of market shifts. This helps make proactive adjustments to operations and strategy.

Tender rejection rates are an indicator of the freight market’s health. By staying attuned to these metrics, carriers and owner-operators can make better decisions, understanding the industry’s complexities and how they will affect the near- and long-term future of trucking.

The post Tender Rejections: The Freight Market’s Crystal Ball appeared first on FreightWaves.